Partnerships and collaborations in the crypto-space have often acted in favor of assets’ prices. Last year saw a number of high-profile partnerships between cryptocurrency platforms and major sports leagues, teams, as well as players amid the NFT fever. This, in turn, pumped certain altcoins’ prices.

One of the most recent instances of the same was the rise in the price of tokenized sports exchange platform’s token – Chiliz (CHZ).

Chiliz has gained by close to 110% since the end of October after launching live in-game NFTs for fan token holders as institutional interest in the altcoin’s ecosystem grew. While one would think such dramatic growth can pump mid-cap or low-cap alts, sports partnerships also seemed to pump the price of the third-ranked BNB recently.

On 5 November, Binance announced a multi-year partnership with Football Club Porto, becoming the team’s Official Fan Token Partner. On the same day, BNB rallied and the alt soared by over 20% in the following days.

In fact, for Chiliz, the growth over the last few days has been pretty good. However, taking a look at the bigger picture helps gauge the sentiment for the altcoin better.

The bigger picture

CHZ’s latest rally was triggered by the roll-out of the platform’s first live, in-game NFT drop which took place in a match between A.C. Milan and A.S. Roma. The alt has been around since 2018 and is already in partnership with big football teams like AC Milan, Juventus, and FC Barcelona.

While the altcoin looks primed for growth, the current rally lacks retail euphoria. Notably, in the first quarter, the platform saw more partnerships and in tandem, more retail crowds flocked to the network.

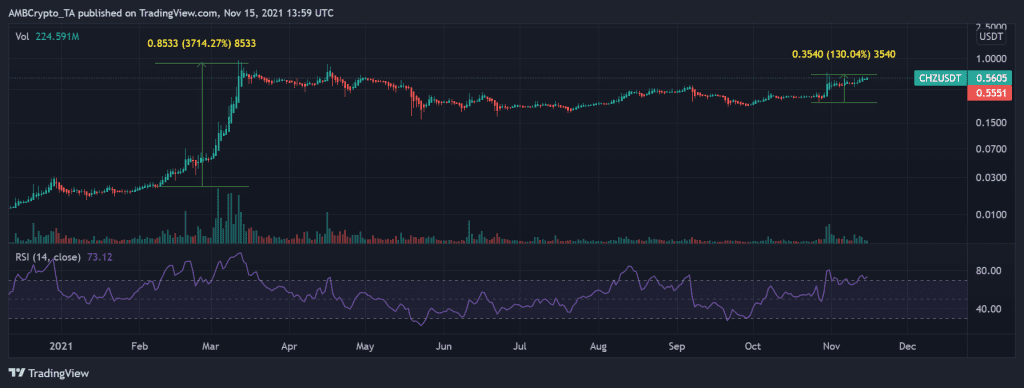

From February to March, the altcoin hit a new ATH of $0.94, charting over 3700% gains. Nonetheless, metrics and recent network strength made a good case for CHZ’s growth this time too.

Strengthening network

Driven by the rapidly expanding ecosystem, the network has over 80 strong sports partnerships. This could also be credited to the growth of Socios, the fan engagement platform owned by Chiliz.

Apart from that, the number of holders saw a remarkable increase over time as CHZ’s value appreciated by 26x YTD. This was significant and representative of the growing HODLer base for the alt.

Furthermore, growing institutional adoption was also seen as the average transaction size grew and showed that CHZ was not only being bought by small players.

Following the 29 September dip, the average transaction for Chiliz increased from $4,654 to a six-month high of over $107k on 13 November.

Source: IntoTheBlock

Finally, short-term interest in the altcoin has also been rekindling. Recent updates and partnerships could be credited for the same. Notably, the number of addresses holding CHZ is now at its highest point since April 2021.

In fact, as the number of traders increased, the volume also spiked. As of 14 November, the number of Chiliz holders had reached a new ATH of 150.5k addresses, up to 7.14x YTD.

Source: IntoTheBlock

While reasons for CHZ’s price growth are aplenty, the alt’s momentum, at the time of writing, had somewhat slowed down. Nonetheless, with strong fundamentals and a growing user base, CHZ could hit its ATH soon.