According to a financial report for the quarter, PayPal growth has slowed across various metrics in Q4 2021. One major contributing factor was supply chain challenges.

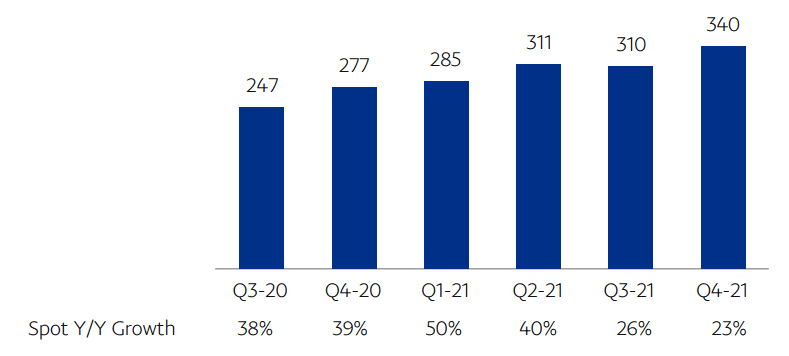

Financial technology company PayPal has posted its financial results for Q4 2021, with growth slowing after strong preceding quarters. Among the highlights of the report are total payment volume (TPV), reaching $1.25 trillion in 2021, a growth of 23% in Q$ TPV, and 49 million net new active accounts.

PayPal called performance in 2021 a strong one, despite the slowdown in growth. Last year’s numbers were better than 2020, which itself was a record year for the company.

Total revenue generated in 2021 was $25.4 billion, representing a 29% year-on-year growth. Active merchant accounts also grew by 13% to 426 million.

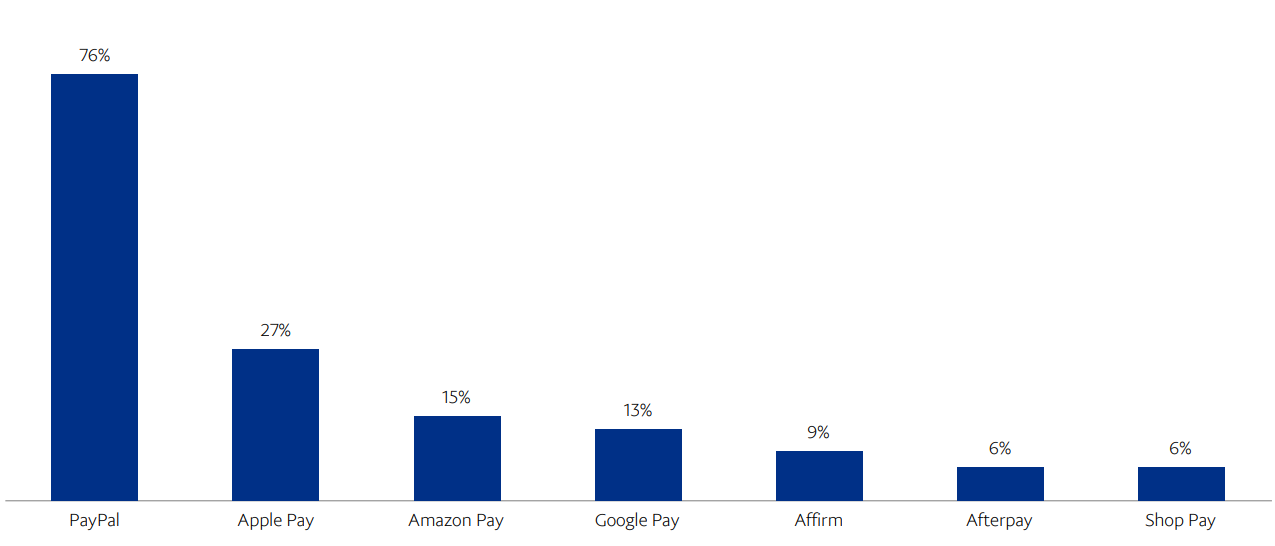

With respect to its crypto services, PayPal touted its digital wallet as having early signs of success. PayPal released its digital wallet for crypto and other services last year, with first-time crypto users increasing by 40%. Another interesting fact, which may have a bearing as crypto adoption grows, is the fact that PayPal digital wallet had a 76% acceptance among the 1,500 largest online retailers across North America and Europe.

Chief Financial Officer John Rainey said in the conference call cited supply chain difficulties played a part in the slowdown,

“We had a slower-than-expected finish of the year…the more muted end of the year for e-commerce growth, driven by both supply-chain challenges as well as pull-back in spending by lower-income consumers.”

PayPal’s fairly strong crypto services in 2021 could foreshadow 2022

PayPal made a lot of progress with respect to its crypto services that were rolled out in 2021. Revenue continually increased in 2021 as it was expanding its crypto offerings. It allowed customers in the U.K. to buy and sell crypto, even as the country was clamping down on the crypto market.

Along with Visa and others, it invested in Blockchain Capital’s $300 million fund. PayPal’s CEO has said that the financial system will change more in five years than in the past 20, which suggests the company’s focus for the future.

PayPal will likely double down its crypto services going into 2022. More countries are allowing crypto to function within limits, and PayPal will want to be the top platform for crypto buying and trading.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.