Key Takeaways

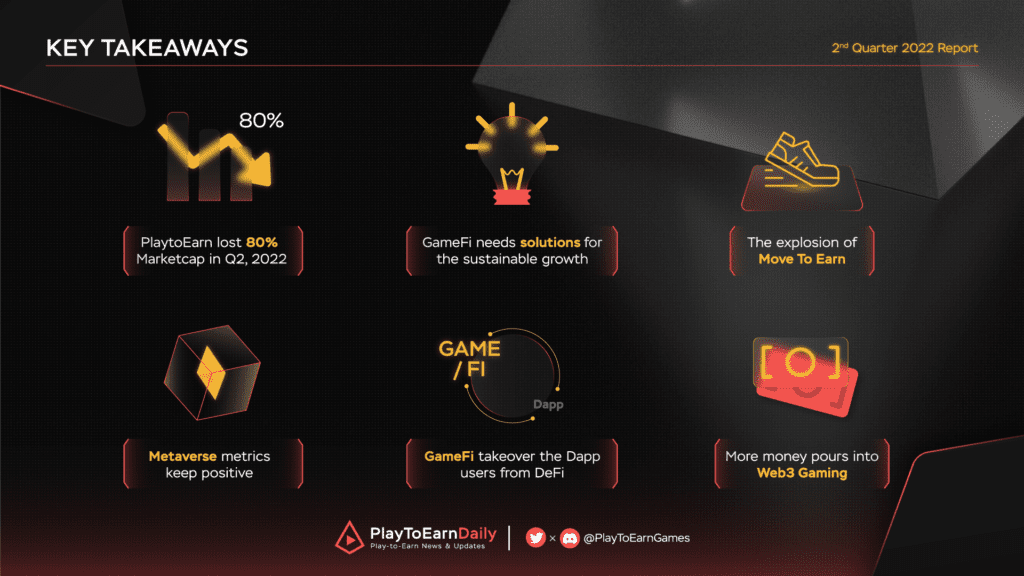

- The crypto market fell sharply, wiping out 80% market capitalization (MC) of PlaytoEarn in a single quarter.

- GameFi is facing a sustainable growth problem without adequate solutions.

- Move To Earn exploded as a leading trend and soon disappeared with the market flow.

- Metaverse metrics keep positive in the bear market.

- GameFi took over the Dapp users from DeFi.

- Web3 Gaming and NFTs are attracting over a third of the total investment value into cryptocurrency for the first half of 2022.

Introduction

Play to Earn (P2E) or GameFi has a fantastic growth rate in the second half of 2021 with the expectation of changing the gaming industry. However, the problems of instability, as well as bad impacts from the financial market, are increasing and impact negatively on this category.

Over the months, Play to Earn projects are experiencing the same issue of inflation, the “Earn” element is no longer meaningful and is only for the early stages of the game. Nevertheless, the figures on UAW (Unique Active Wallet) as well as Fundraising are showing that Play To Earn will be a long-term development.

2nd quarter also changed the mindset of new projects participating in P2E, projects that do not have a long-term vision are gradually being eliminated (Change from PlaytoEarn to PlayandEarn). This promotes a new generation of P2E with higher quality (Graphic, Gameplay, ..) and persistent development direction (Tokenomics, Mechanism, ..).

Market and Bitcoin correlation

BTC had a significant drop to the $20K price zone (at press time) from the $45K price zone (at the start of Q2) With a 55% drop, this is considered a big impact on the overall cryptocurrency market (BTC represent 40% of crypto MC).

According to on-chain data from Footprint, while the Market Capitalization of BTC dropped from nearly $900B to $400B (55% decrease), the GameFi Market Cap dropped from $19B to approximately $4B, a decrease of nearly 80%.

Meanwhile, projects with large market capitalization such as $AXS, $MANA, $SAND also experienced a fall, although not as much as compared to the overall decrease of the whole P2E (79%). This shows that P2E is still heavily dependent on BTC price and even has higher volatility (CoinMarketCap).

Network Activity

Regarding on-chain data, P2E experienced a decrease in the number of participants, from 1.2M users to about 800K users (30% decrease) (Source: Footprint). Daily trading volume also dropped sharply from $5-7B at the beginning of Q2 to just $1-2B at the end of the quarter (Coinmarketcap).

Besides, users had the tendency to withdraw out of GameFi, so the amount of withdrawal is also larger than the deposit. That is a negative signal for P2E, which lasted from the beginning of the first days of Q2.

Many Metaverse-based Land tokens plummeted across the board. Among the hardest hit were Axie and Mobox which suffered a 90% and 95% reduction (Dappradar). However, there are positive signs for Metaverse in both Trading Volume and Sales Count in the 2nd Quarter.

Ignoring the general downtrend of cryptocurrency, Metaverse is considered one of the brightest sectors driving GameFi growth in Q2/2022 (Representative: Otherside, The Sandbox, Decentraland, Illuvium, ..)

GameFi Issue

Dual-Token was effectively adopted from Axie Infinity and created a standard for GameFi development. However, the mechanism encountered inflation problems (instability) and created a barrier to new players. The innovation costs this game the decline in many metrics, close to forgetting until the new Origin version.

Axie has been in a downward spiral since January and has taken another hit this quarter. It lost 40% of its user base, which was aggravated by the Ronin bridge hack ($600 million stolen). However, Axie intends to overhaul the system with Axie: Origins update completely. This direction is to reborn Axie in a new appearance and mechanism while keeping the best features from the previous Axie Infinity version.

Move To Earn

Recently, a project expected to create innovation for GameFi, STEPN with a dual token model, is facing the same problem. When trying to separate the utility from $GMT and $GST, the project did not realize the hypergrowth demand and then slowly lost the users by high upfront costs (lack of stability in utility and supply).

Successfully solving work that brings real value to players (here health), Move To Earn experienced hypergrowth and soon fell down after the LUNA crash. The combination of running and earning from STEPN attracted great attention from the community and made Move To Earn a hot trend at that moment (led by STEPN).

During this time, $GMT and $GST, the tokens of the STEPN project, have had an impressive performance and huge transaction volumes lasting for months. $GMT was IEO on Binance Launchpad at $0.01 in early March 2022. In just under 2 months, this token had reached ATH at $ 4.1 as of April 28, incredibly performing 41,000% ROI while the world was in the fear of the Ukraine War. Thanks to STEPN, many projects have come into Move to Earn, it quickly became a gold mine at that time with hype on social media.

However, the rapid development has led to many consequences of uncontrolled inflation, with the LUNA event, Move To Earn decreased tremendously and is raising questions about its sustainability.

Fundraising

The highlight with Play to Earn in the last quarter came from the fact that a lot of money was continuously poured into Web3 Gaming. In addition, the development of Web3 Gaming is now long-distance oriented with a more diversified allocation of capital to sub-categories.

Epic Games was funded $2 billion to actually build its friendly metaverse. Through Unreal Engine, Epic Games Store, and Epic Online Services, Epic provides an end-to-end digital ecosystem for developers and creators to build, distribute, and operate games and other content. In the $2 Billion funding round, they also said they are “open” to blockchain games, which were banned by Steam recently.

Tim Sweeney, CEO and founder of Epic, said in [their announcement](https://www.forbesindia.com/article/crypto-made-easy/fortnite-developer-epic-games-raises-2-billion-to-build-for-the-metaverse/75301/1#:~:text=Tim Sweeney%2C CEO and founder,build a community and thrive”.) that the investment would “accelerate our work to build the metaverse and create spaces where players can have fun with friends, brands can build creative and immersive experiences and creators can build a community and thrive.”

Also, Non-fungible token (NFT) scaling platform Immutable launched a $500 million venture fund focusing on Web 3 games and NFT projects. Immutable said that the fund would collaborate with crypto and gaming investors including BITKRAFT, Animoca, Arrington Capital, Double Peak, Airtree, King River Capital and GameStop.

Venture capital firm, Andreessen Horowitz (a16z) has also launched a $600 million fund dedicated to gaming startups with a focus on Web3 saying they believes “games infrastructure and technologies will be key building blocks of the Metaverse.”

The move by a16z brought the total investment in the Web3 gaming and metaverse space in a month to $3 billion, committed by venture funds and gaming industry giants.

Comparison

In an objective view, we will compare P2E with DeFi, the origin of Dapp and expected to become the main utility of cryptocurrency. Defi’s TVL had a deep decline from $215B to $67B, more than 70%, and is currently lower than the figure at the beginning of Q1 2021

Based on on-chain data, crypto users mainly use GameFi Dapps, which can be seen through Users per Category and Transaction (txt) per Category as shown.

Regarding Users, at the beginning of Q2, there were 9.7M users in P2E and 4.3M users in DeFi, then at the end of the Quarter, these numbers were 2.7M and 1.1M, respectively. Admittedly, these two categories suffered the same loss in terms of the number of users, but there is another story when considering the total transaction.

P2E operation maintained 145.6M txt at the beginning of Q2 and fell to 74.4M at the end of the quarter. In contrast, DeFi experienced a sharp decline from 16.2M to only 4.2M ( P2E only reduced by 50% while DeFi lost 75% txt compared to the beginning figure)

According to statistics from Crunchbase, in 2021, Defi Investment accounted for 30% of the total value of crypto venture deals, but at the moment this figure is only about 15% and most recently in May is 9%.

In contrast, Web3 Gaming and NFTs are attracting 30-40% of the total investment value.

Projections

It is undeniable that, at the present time, many of the GameFi projects are quite similar to a Ponzi scheme where latecomers often have little chance of earning. In addition, in-game inflation has never been effectively addressed by any project, the new model is required.

With the impact of the global financial market, the Cryptocurrency market will highly suffer another drop (The correlation ratio between BTC and the S&P 500 is positively high). This will have a big impact on Web3 Gaming while this is still a relatively new and nascent segment in cryptocurrency. Also, pioneering projects still have a lot of problems to solve, so it will be tough for Web3 Gaming in the short term.

However, with a large amount of money flowing into Web3 Gaming, this will no longer be a temporary trend but will develop sustainably with the crypto market in the future. Besides, investment in recent days is not only in Games but also a lot of Infrastructure for Web3 Gaming. Based on that, when the right time, AAA projects hit the market, innovations in tokenomics, models, support of sufficient infrastructures and more will change the gaming industry.

Disclaimer – #DYOR

The information provided in this report does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the report’s content as such.

PlaytoEarn Daily does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligent research and consult your financial advisor before making any investment decisions.