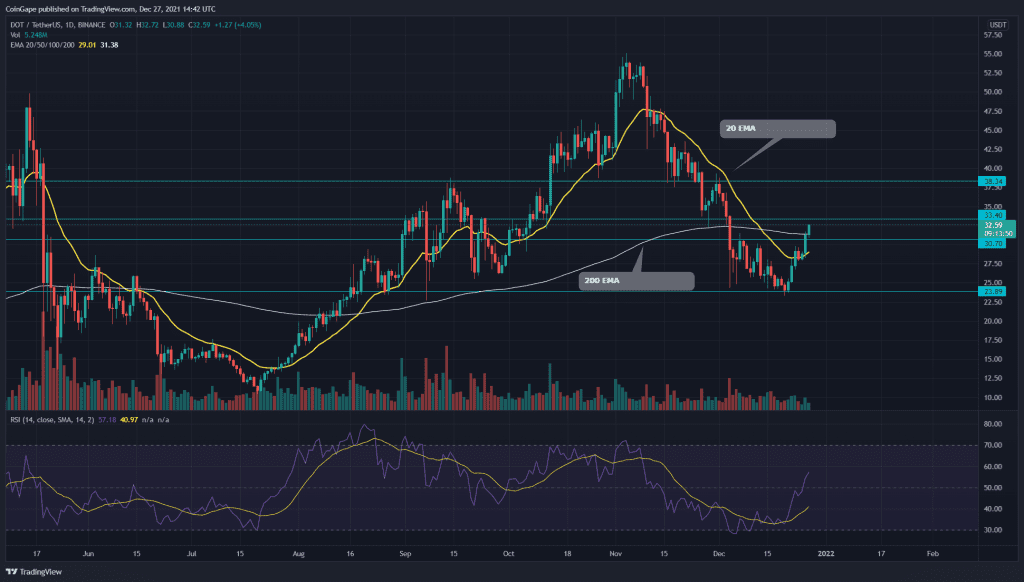

The correction phase started from the later part of November, plunged the Polkadot price to the $23.5 mark. The buyers showed strong interest in this discounted price, resulting in quick recovery in this coin. Currently, the pair is climbing higher resistance levels one after another, initiating a new rally.

Polkadot Key technical points:

- The DOT bulls trying to reclaim the 200-day EMA

- The daily RSI line has crossover above the neutral line(50)

- The 24-hour trading volume in the Polkadot coin is $1.09 Billion, indicating a 29.96% gain.

Source-Tradingview

The Last time when we covered an article on Polkadot, the pair was trying to reverse from the $26.3 support with a morning star candle pattern. However, the strong resistance from the $30 mark rejected the coin and dropped it to the lower support of $23.5.

The pair retested this bottom support on December 20th, and the intense demand pressure brought a sudden recovery from the very next day. The coin has gained 40% in one week and breached a resistance level of $30.5.

The DOT coin has recently crossed above the 200 EMA line, providing an excellent edge for the long trader if the price sustains above it.

The daily Relative Strength Index (57) showed significant recovery from the oversold territory. Moreover, the RSI line has entered the bullish zone and is moving high above the 14-EMA.

DOT/USD 4-hour time frame chart

Source- Tradingview

On December 26th, the DOT coin price gave a bullish breakout from the $30.5 resistance level. After offering a decent retest phase, the coin shows a strong follow-up candle, displaying a 3% intraday gain. Anyhow, the next resistance level is quite near to the price, i.e., $33.3.

The crypto traders should look out for this resistance level, which can provide another long entry opportunity after a proper breakout.

The Moving average convergence divergence indicator shows MACD and the signal line moving above the neutral line projects a bullish momentum. Moreover, its chart also indicates a buy signal for the traders with a bullish crossover of these lines.