PolyCub, the next generation of DeFi yield optimization has made a grand entry into the crypto space.

PolyCUB is a long-term, deflationary, and self-sustainable DeFi ecosystem that maximizes yield generation for user assets. It seeks to create the ideal scenario for yield optimization on the Polygon Network, by combining the infrastructures of successful projects while running thousands of Monte Carlo simulations.

The launch of the project marks incredible success for its team as it has outperformed many other projects with its achievements. It has apparently shown the LeoFinance Community and the DeFi industry how much can be achieved through proper research with the goal of creating long-term value and opportunities for their community.

PolyCub’s Tokenomics

The design of the POLYCUB token will allow it to go up in weight in perpetuity in a similar way as the scarcity dynamics and utility of Bitcoin do for the world’s largest cryptocurrency. The PolyCub token is based on three core features that reflect a self-reliance theory which helps it generate an incredible value for the community token holders. This has triggered the increasing interest to join the ecosystem as xPOLYCUB stakers.

- The incentive of staking the PolyCub token leverages hyper-deflationary token emissions to LPs in exchange for an extremely high APY. This helps to ensure that the supply will never grow beyond that emissions rate.

- It features a self-sustainability theory as staking the native token PolyCub into xPolyCub gives the holder a share of the generated value through the TVL in the protocol, while offering an exponential value proposition in relation to the native token value. As such, the PolyCub/xPolyCub ratio will always go up.

- The PolyCub kingdoms serve as a safe option for the token holders as it offer the highest yields on the entire Polygon network by leveraging Cross-Composable Yield Optimizing Vaults that operate with management fees which are held by the treasury as Protocol Owned Liquidity (PoL) and ultimately buyback POLYCUB thereby creating endless demand and permanent liquidity.

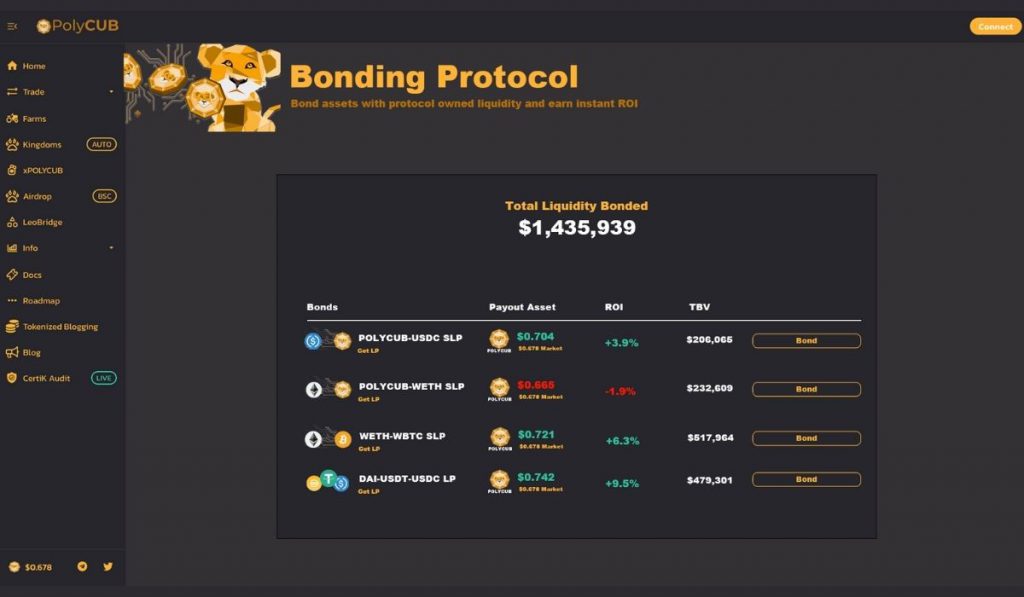

The team is aiming to further provide permanent liquidity to the protocol via POLYCUB-USDC and POLYCUB-WETH bonds. It seeks to allow other bonds in the form of WBTC-WETH, stablecoins, and other Kingdoms LP assets. Thus, giving users the opportunity to bond external assets and earn greater returns on POLYCUB. These bonds are then held by the Protocol Liquidity and used to buy back POLYCUB and distribute long-term xPOLYCUB LP Incentives.

The targeted development will enable the Protocol Liquidity to begin to buy back PolyCub tokens from the market once the emissions rate of PolyCub is seen dropping to almost zero. Thus, it will continuously add demand to the token in perpetuity. Then, the protocol will distribute the market-bought PolyCub amongst the Liquidity Pools that will no longer be earning from the emission rate.