- Polygon-Bebop partnership to improve the DEX trading efficiency through “one-to-many” and “many-to-one” token swap tools.

- Can improved token trading and swap efficiency on Polygon shore up MATIC’s value?

Polygon (MATIC) continued its high-profile partnerships in November. Following deals with Reddit, Robinhood, Uniswap, Starbucks, Meta, and JP Morgan, Bebop is the latest. Polygon’s speed and solid proof-of-stake (PoS) model attracted previous partnerships.

However, Bebop aims to scale Polygon’s decentralized trading efficiency. The benefits will include lower transaction fees and reduced slippage charges.

Bebop allows users to exchange one token for another or an entire portfolio in a single transaction. It is a DEX token trading platform backed by liquidity provider Wintermute.

🪙 @bebop_dex launches a unique ‘One-To-Many’ ‘Many-To-One’ token trading platform #onPolygon!

This new platform, incubated by DeFi powerhouse @wintermute_t, chose #Polygon to enable low fees and a best-in-class user experience. pic.twitter.com/Cacb5pZcci— Polygon – MATIC 💜 (@0xPolygon) November 8, 2022

For a fast-moving crypto market, that’s a plus. For example, the current bank run on FTX could easily allow Bepop users to enter or exit multiple positions in a single transaction. This allows investors to balance and rebalance their portfolios in one go.

In this regard, Katia Banina, head of product at Bebop, reiterated that, “It’s trivial to exit multiple positions and consolidate funds in a single asset.”

Such advanced swap token trading tools offer benefits beyond cost and speed. According to CSIRO Data61, a blockchain architecture and analytics platform, token swaps can increase user liquidity and improve interoperability between chains.

But it also has drawbacks – inflexibility and lack of privacy, since token swap transactions are public.

Nonetheless, Polygon (MATIC) investors can reap benefits linked to network growth. A look at key on-chain metrics provides better insight into the potential impact of the partnership.

MATIC holders are cashing in on recent network growth

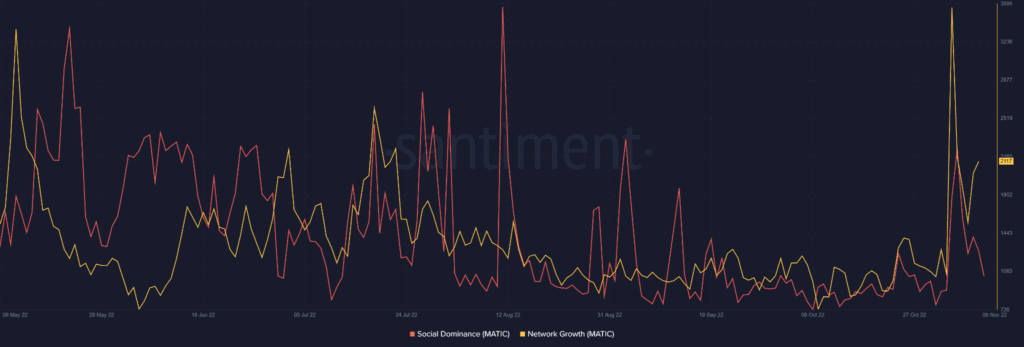

According to Santiment, social activity declined slightly, likely due to FTX contagion.

However, Polygon (MATIC) saw an increase in network growth. The network growth score increased from 2006 on 7 November to 2117 on 8 November. It is noteworthy that network growth correlates positively with MATIC price, as shown.

Short-term MATIC holders were, therefore, able to book gains, as shown by the 30-day MVRV, which was in positive territory, at press time.

Long-term holders are still at a loss

On the other hand, long-term MATIC holders, however, are yet to post any significant gains. The 365-day MVRV was briefly in positive territory before being knocked out by the FTX contagion.

At press time, MATIC’s daily chart was bearish, although buyers had leverage. Chaikin Money Flow (CMF) was above the zero mark, indicating that the bulls are slightly in control. The price action was also above the EMA band, further reinforcing bulls’ leverage.

But the Relative Strength Index (RSI) showed that buyers exhausted themselves and fell to the equilibrium level. This showed that sellers were gaining momentum, at press time. Interestingly, MATIC was back in an ascending channel after a violent, bullish breakout last week.

With reduced trading volume, as shown by On Balance Volume (OBV), MATIC seems to be losing buying pressure. If the trend continues, the price could fall to $0.8710 or plummet further to $0.7721. However, if buyers take control after absorbing the current shocks, the next target could be $1.26.

The partnership between Polygon and Bepob can benefit Polygon users and investors. The impact could be felt in the long run, considering the current negative sentiment in the crypto market after the FTX contagion.