The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

A few days ago, one of the largest Bitcoin mining pools, Poolin, suspended withdrawals from their wallet service, PoolinWallet, in an effort to stabilize assets and preserve liquidity. This is significant because 1) Poolin is a China-based mining pool service, operating in China after the mining ban, and 2) the pool was estimated to have roughly 10% of the hash rate before withdrawals were suspended.

Fortunately, there is a simple response for Bitcoin miners worried about PoolinWallet withdrawals and using their mining pool service: switch to another mining pool, a process that takes seconds (as just one example, miners can instantly switch to Slush Pool and set up auto withdrawals). Switching to another pool won’t unfreeze withdrawals from Poolin but it does provide the hash rate market a mechanism to vote with their ASICs in real time and choose a more competitive global pool.

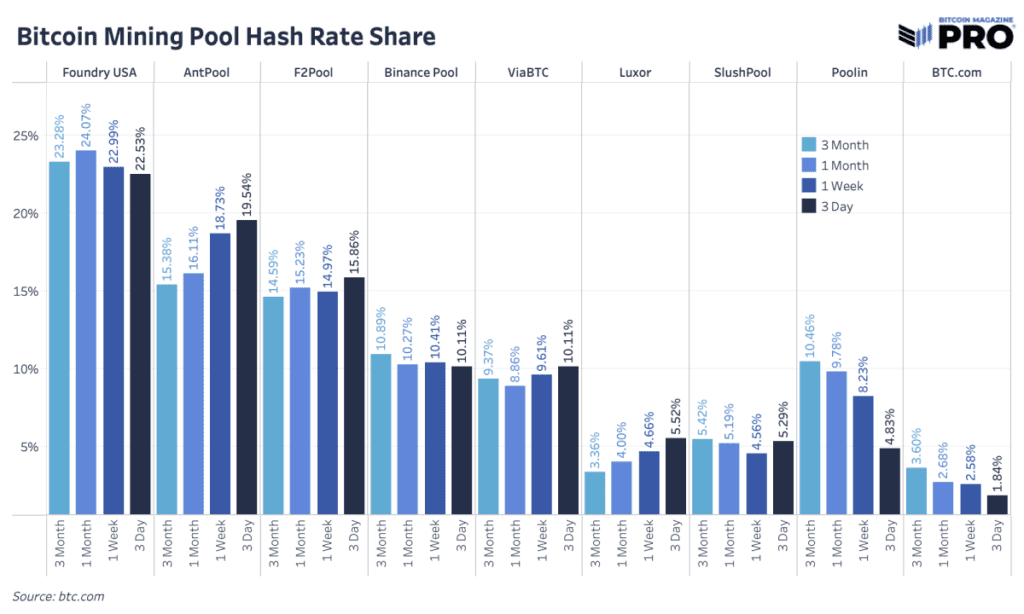

So far, that’s exactly what we’ve seen over the last few days. A three-month pool distribution view shows Poolin to have had 10.5% of hash rate. The latest three-day view shows that hash rate share has fallen by over half, to 4.83%. A three-day view doesn’t always capture the data with perfect accuracy, but the estimations show a clear trend: hash rate is leaving Poolin at a good clip.

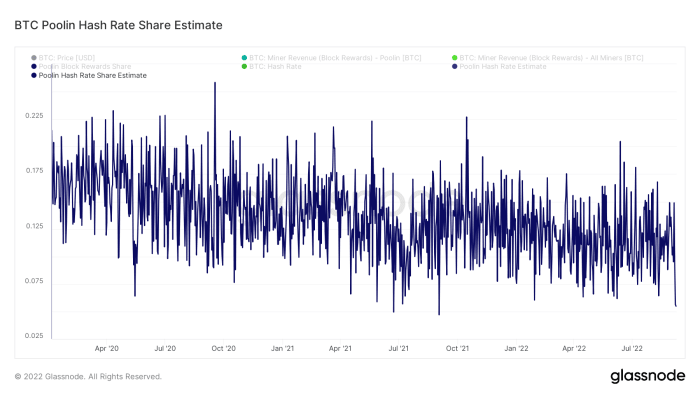

Using Glassnode data, we can take the share of Poolin’s Bitcoin block rewards relative to the total market and estimate their share of hash rate on a daily basis, which is a similar method to the above data. Although volatile, we can see Wednesday’s daily hash rate share fall to 5.48%, which is the lowest value since the China mining bad period in 2021.

Poolin’s estimated daily hash rate share fell to its lowest value since the China mining bad period in 2021.

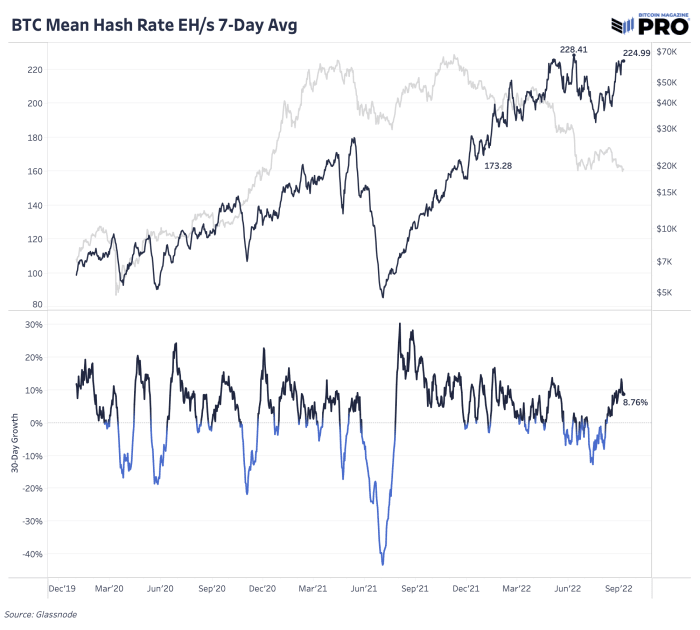

Total hash rate, using the seven-day moving average, hasn’t moved much at all over the last few days so one assumption is that the hash rate that left Poolin found a new home fairly quickly and stayed online.

Total hash rate, using the seven-day moving average, hasn’t moved much at all over the last few days.

One interesting note is that Poolin announced its partnership with Three Arrows Capital back in June of 2020.

Three Arrows Capital & Poolin Wallet Strategic Partnership

While the cause of Poolin’s “liquidity issues,” is not exactly known, if the two firms were still financially interlinked during the fall of Three Arrows Capital amid the crypto industry contagion, that event could certainly have played a factor.

Read: Bitcoin Magazine PRO Contagion Report