There were three altcoins swimming against the tide: Stellar, XRP, and Terra. Over the last 24 hours, as Bitcoin retraced on its chart, most of the industry’s altcoins followed suit. However, XLM, XRP, and LUNA continued to display bullish sentiments. Today’s global cryptocurrency market cap was at $2.25 Trillion, after noting a decline of 3.1% over the last day.

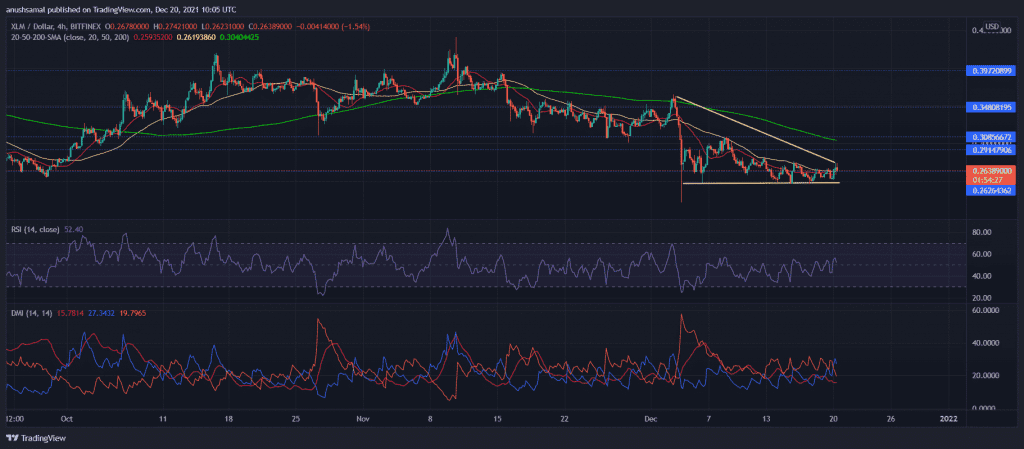

Stellar/USD Four-Hour Chart

Stellar was priced at $0.263 after it rose by 3.7% over the last 24 hours. XLM’s price had been on an uprise ever since the beginning of December. However, the coin had formed a descending triangle in the last couple of weeks. The coin was seen above the 20-SMA line, indicating a decrease in selling pressure. However, near-term technicals haven’t ruled out the chances of a price reversal.

Immediate resistance for the coin stood at $0.291, and the local support was $0.262. Stellar has witnessed periods of massive sell-offs. However, the Relative Strength Index was seen above the midline at the time of writing.

RSI will dip below the midline in the immediate trading sessions if the bullish momentum loses its force. The Directional Movement Index chose the bulls. However, a downtick was noted, signifying a possible downturn of XLM’s prices.

XRP/USD Four Hour Chart

The fear index suggested that the market was still quite apprehensive about investments. Despite that, XRP moved up its chart by 3.3%. At press time, the coin was trading at $o.85. The altcoin’s downward channel was met by an ascending triangle that was formed over the last couple of weeks. In the last week also, XRP was mainly consolidating with brief recovery periods thrown in between. The trading range remained between $0.91 and $0.74.

In the last week, XRP appreciated over 3%, which has been reflected in the Relative Strength Index. The indicator displayed bullishness as XRP touched the overbought zone for the first time in over a month and a half. At press time, however, there was a dip in buying pressure.

On Balance, Volume highlighted an increase in buying pressure in the market. Chaikin Money Flow suggested that capital inflows dipped shortly after it appreciated. A fall in prices would cause XRP to trade near $0.74.

Terra/USD Four Hour Chart

The double top that LUNA had formed had confirmed that the coin would soon retrace. However, at press time, Terra logged a 3.1% gain. LUNA was now trading within an ascending price channel that signifies an uptrend.

Exchanging hands at $76.91, the next target for LUNA’s prices was $80. A fall below the current price level meant that Terra would be priced at $76.49 and then $66.65.

Today, among the top gainers was LUNA; the coin displayed highly overbought conditions as reflected in the Relative Strength Index reading.

Capital inflows steadily moved upwards in the past few days, although there was a slight downtick on the Chaikin Money Flow. MACD remained quite bullish after a bullish crossover, and it emanated green histograms at the time of writing.