The U.S. SEC’s rejection of the VanEck Spot Bitcoin ETF dampened the hopes of many traders who were hoping to gain exposure to the king coin. One might even wonder, do crypto investors care so much about Bitcoin ETFs? Arcane Research took a closer look at the ProShares BITO ETF and its much hyped “first-mover advantage.”

Are you winning, son?

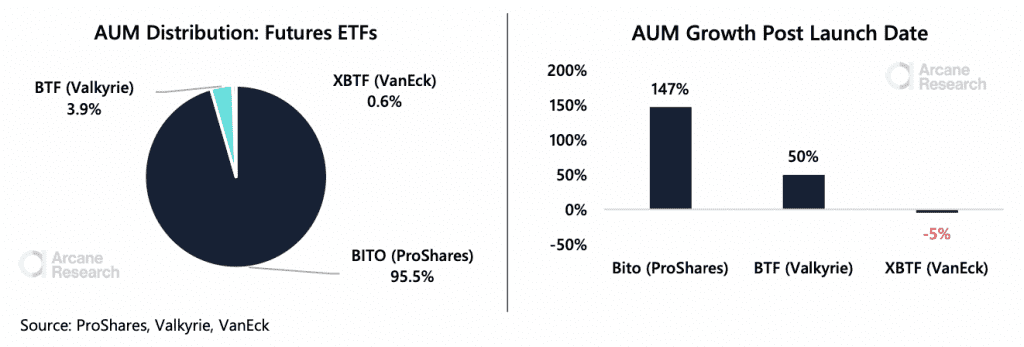

ProShares’ BITO was a clear winner when considering both the growth and distribution of Futures ETFs’ Assets Under Management [AUM].

Source: Arcane Research

Adding on to that, CoinShares data revealed that ProShares’ inflows for the week ending 19 November were $107.7 million. CoinShares further reported,

“The recently launched ETFs in the US saw over 90% of inflows into Bitcoin.”

Coming to the “first-mover advantage,” Arcane Research’s report explained,

“ProShares BITO ETF has become a very popular instrument, still gaining traction. Since Nov 10th, the ETF has seen a 12% growth in shares outstanding, increasing their exposure from 4177 CME contracts to 4840 CME contracts. Since the launch date, the ETF has seen its AUM grow 147%, illustrating the high demand for bitcoin exposure through this ETF.”

And then there were none? No

VanEck might have gotten out in the first round, but it rejoined the game with a Bitcoin Futures ETF [XBTF]. However, Arcane Research noted,

“This ETF has yet to gain any traction, it holds 30 November contracts, and their holdings has remained unchanged since launch.”

Coming to Valkyrie’s Bitcoin ETF, Arcane Research’s report noted the reduction in activity and said,

“Since the launch, the fund’s AUM has grown by 50%, but the fund only holds 3.9% of the AUM of the futures-based bitcoin ETFs. Since Nov 1st, the fund has increased its CME contract exposure from 163 contracts to 197.”

However, a number of other applications are still pending regulatory review. In short, it might be premature to declare ProShares’ BITO the king of all ETFs.

Source: Arcane Research

Bitcoin in battle

At press time, the king coin was on its throne at $56,442.40 – a far cry from its ATHs earlier in the month. Understandably, the market is feeling quite nervous, which the Bitcoin Fear and Greed Index recorded at a value of 42, signalling fear.

However, not all is lost. Data from Glassnode revealed that the number of Bitcoin addresses with more than 0 BTC has hit its new ATH of 38.76 million.

The number of #Bitcoin addresses with a non-zero balance has reached a new all-time high of 38.76 million addresses.

The previous high of 38.7 million was set seven months ago on April 23rd, taking 213 days to fully recover.

Live chart: https://t.co/jbyYVmnwcH pic.twitter.com/Fxa9MMwhaW

— glassnode (@glassnode) November 23, 2021