On Thursday, Polygon’s largest decentralized exchange QuickSwap voted in favor of doing a token split to make QUICK – the DEX’s native governance and utility token – more appealing. Today, QUICK token holders began part two of their governance vote to determine whether to redenominate QUICK at a 1:100 or 1:1000 ratio. A few hours after the vote began, and at the time of this writing, the 1:1000 ratio had taken an early lead with 76.96% of voters in favor of the larger split.

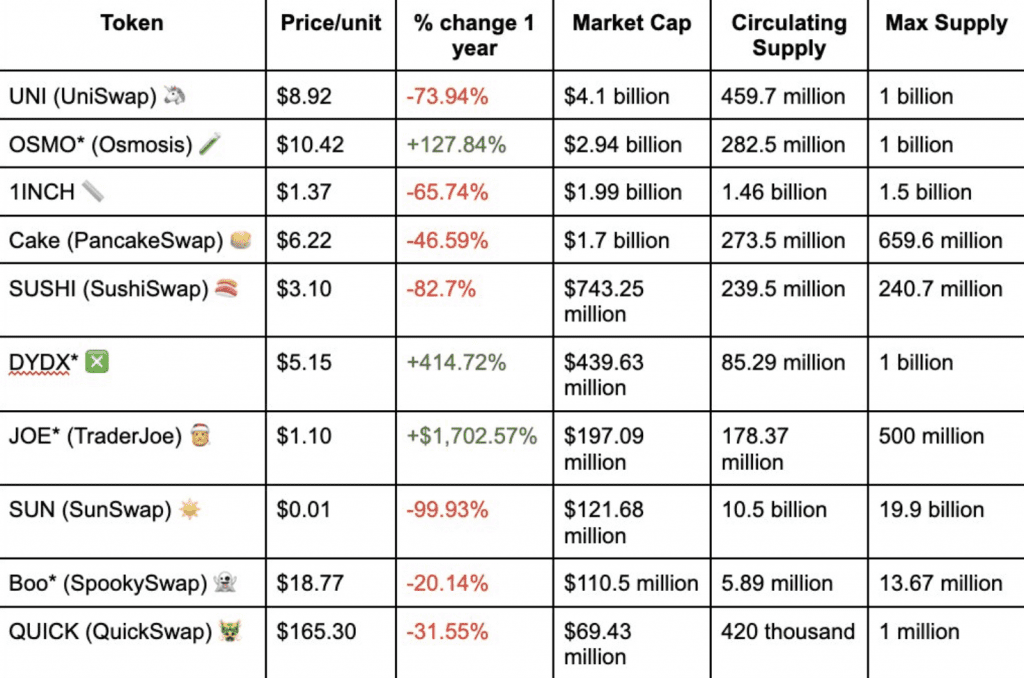

This token split will bring QUICK’s price more in line with the price of other DEX tokens making the asset more appealing to investors who are impacted by unit bias. As one member of the DEX’s senior staff explains, “QUICK’s price per unit is significantly higher than other DEX tokens, while its market cap pales in comparison.”

QUICK’s meager $69.43 million market cap (as of March 1st, 2022) is not an accurate reflection of the token’s adoption or utility. When comparing QUICK to other DEX tokens like UNI, SUSHI, OSMO, and CAKE, the discrepancy becomes very clear. QUICK’s low market cap may be related to its short supply.

Despite compelling evidence that suggested this was the case, some QUICK holders still opposed the split, claiming that redenominating the asset wouldn’t improve the token’s poor price performance. In the little over 24 hours since the decision to split was made final, the naysayers appear to have been wrong. QUICK’s price is up over 6% in 24 hours and over 15% in 7 days. This marks the asset’s largest percent gain since December 2021 when it rapidly increased by over 56% in a single day following StrongNode’s announcement that they would launch a syrup pool on QuickSwap where holders could stake QUICK to earn SNE.

With a market cap of $59.39 million and a 24-hour trading volume of $11.21 million (according to crypto.com), QUICK is outperforming the market for the first time in a long time. The asset’s sharp upwards spike began on March 13th, approximately one day after the DEX’s governance vote had begun. While it is still possible that this recent upwards trend is unrelated to the decision to split, the timing of this increase aligns with stock market trends. When Tesla announced a 5:1 stock split in August 2020, shares rose 81% before the split happened and another 42% in the following months.

If Tesla is any indicator of what could come next for QUICK, the sky’s the limit. Assets with low market cap like QUICK’s can appreciate in mere moments with large market buys. Of course, there’s no guarantee that QUICK will perform like Tesla, but time will tell.