Recently Ravendex is thrilled to inform the $RAVE community that their long-awaited staking platform will soon be available, allowing token holders to stake their tokens and earn $RAVE incentives via a simple web interface.

Introduction

Ravendex is the first non-custodial Decentralized Exchange on the Cardano Blockchain, enabling rapid and near-instant asset and liquidity transfers between native Cardano tokens and ADA. It is a cross-chain exchange on the Cardano Blockchain that runs on the EUTXO model, well-known for its unique features, such as splitting shared liquidity among many assets on the Cardano Ecosystem.

Additionally, this is one of the first projects on The Cardano Ecosystem to conceptualize the idea of a crypto asset lending & borrowing platform using the released recently Alonzo Hard Fork update, which enables smart contracts to deposit assets and collect interest according to a pre-defined set of rules.

When launched, the APY rates were lower than those of other lending platforms on different blockchains, such as AAVE on the Ethereum network. Still, the utilization of borrowed funds and total returns to investors at the end of the lending period were significantly higher and more efficient than those of other networks, owing to the Cardano Blockchain’s speed and low transaction fees.

Features

Multi-function liquidity pool

These four pools are what RavenDex is doing.

- Constant-product pool

- Stable pool

- Multi-asset pool

- Dynamic pool

RavenDex – Cross-Chain Swap Protocol

A decentralized automated market maker system, RavenDex, will allow users to trade native Cardano native tokens without risk. In other words, a cross-chain swap will enable you to trade tokens between blockchains without using a third party (like an exchange).

As part of its decentralized asset exchange, RavenDex uses the HTLC protocol. As long as everyone agrees, the protocol assures the exchange. Contrarily, if any participants choose not to complete the procedure, they should be refunded.

NAP Protocol

The yore nightly extension allows users to link their wallets and earn interest securely.

ERC-20 Cardano Converter

A few clicks and your project’s ERC-20 tokens will be transferred to Cardano’s minimal transaction fee.

P2P (Peer to Pool) Lending Protocol

It will be able to decentralize lending and crypto loans by allowing users to borrow pooled assets and pay them back later.

In other words, you may utilize the RavenDex lending protocol to trade your deposited Cardano assets for another asset. It also allows you to pay back your debts/loans with collateral.

Staking Platform

In accordance with providing the users with unrestricted access to $RAVE staking rewards, they take the next step by bringing the community a simple procedure for reaping rich passive income in $RAVE via the staking platform.

Using a simple web app, $RAVE holders can stake their tokens to earn rewards in $RAVE, as Ravendex announced to the community. Ravendex will unveil the much-anticipated staking platform.

Be sure to join the Telegram group to stay updated on the platform’s public testing schedule.

When it comes to making Ravendex a more profitable platform for the early adopters.

A Non-Fungible Token Staking Protocol is also in the works to allow Ravers to earn reward points for staking their rare digital collectibles.

For more detail of the staking platform, please click here

Tokenomics

Token Detail:

Ticker: $RAVE

Total Supply: 1,000,000,000 Rave

Token Distribution:

Public Sale – 50%

Team – 12%

Staking / Yield Farming & Governance – 35%

Locked Ecosystem Reserve – 3%

Use Cases

WHEN LAUNCHED, $RAVE token holders can utilize the staking platform to up to 25% additional return on staked assets.

The amount of $RAVE allocated determines the size of the stake, with providing and rewards are paid out after each cycle.

- Liquidity Mining Program

When holding $RAVE, you can choose to provide liquidity to projects on the DEX and receive a percentage of the liquidity fees. A solution much like staking.

- Paying For Platform Fees

- Governance

- Staking & Yield Farming

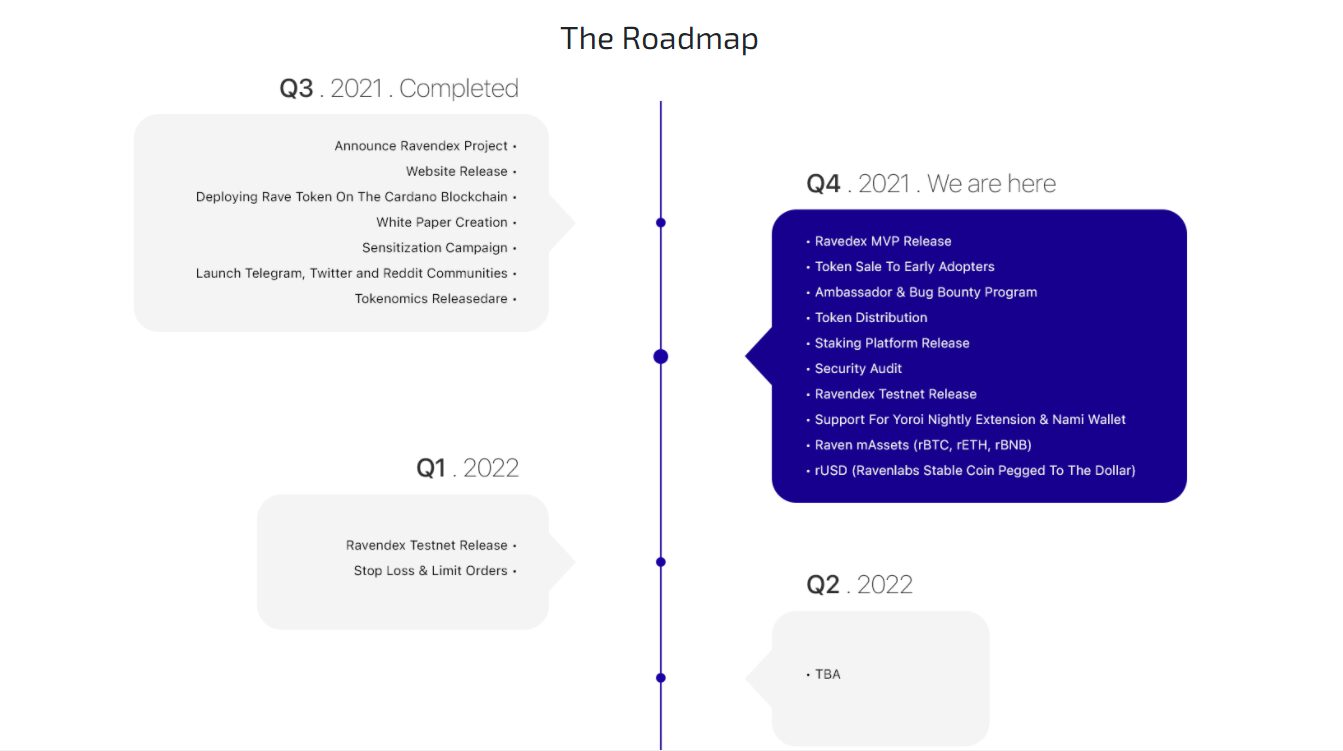

Roadmap

Q3-2021

- Announce RavenDex Project

- Website Release

- Whitepaper Creation

- Launch Telegram, Twitter and Reddit Community

- Sensitization Campaign

- Tokenomics Released

- Deploying Rave Token On The Cardano Blockchain

Q4-2021

- RaveDex MVP Release

- Token Sale To Early Adopters

- Ambassador & Bug Bounty Program

- Token Distribution

- Staking Platform Release

- Security Audit

- Raven Dex Testnet Release

- Support For Yoroi Nightly Extension & Nami Wallet

- Raven mAssets (rBTC, rETH, rBNB)

- AUSD (Ravenlabs Stable Coin Pegged To The Dollar)

Q1 2022

- Direct Token Swaps

- Stop Loss & Limit Orders

Q2 2022

Learn More

Website: https://ravendex.io/

Twitter: https://twitter.com/Ravendexlabs

Telegram: https://t.me/ravendexlabs

Medium: https://ravendex.medium.com/

Github: https://github.com/Ravendexlabs/