- RCMP informs exchanges to cease 34 crypto addresses of Freedom Convoy protesters.

- Banks also received letters to restrict accounts of people connected with the protests.

- Financial institutions must also send transaction details of these identified protesters.

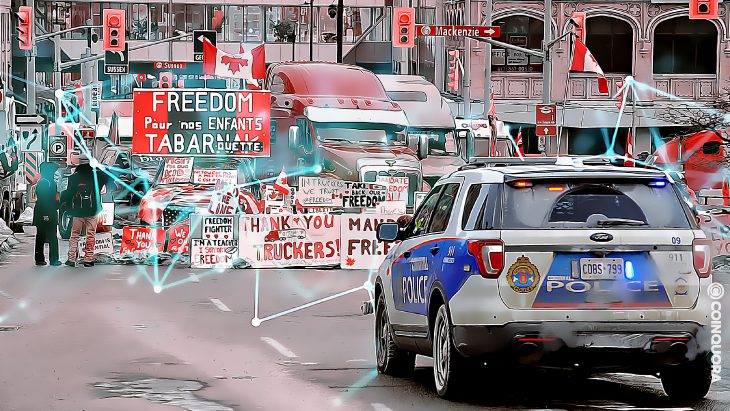

Canada is heating up quickly as new developments keep springing up amid the recent unrest in the country. New reports reveal that Canada’s national police force — the Royal Canadian Mounted Police (RCMP) has taken stringent action against protesters.

In detail, RCMP ordered crypto exchanges to cease facilitating transactions of 34 crypto addresses linked to Freedom Convoy protests. To many, this is another strategy by the government to destabilize the Freedom Convoy Protests, also known as Trucker Protests.

Canadian police have asked #crypto exchanges to cease facilitating transactions pertaining to 34 crypto addresses. #cryptocurrency #bitcoin #FreedomConvoy #CanadaTruckers https://t.co/mvbVoYOS37

— Bitcoin News (@BTCTN) February 18, 2022

The latest step from the government against the protesters comes on the heels of the recently passed Emergencies Act. Moreover, the RCMP has sent letters to crypto exchanges listing a total of 34 crypto wallets tied to the protests.

The letter reads,

The Ontario Provincial Police and Royal Canadian Mounted Police are currently investigating cryptocurrency donations being collected in relation to illegal acts falling under the scope of the Emergency Measures Act.

The RCMP, in its letter, further added that any information about transactions or proposed transactions by these addresses must be disclosed immediately to the Commissioner. Of note, among the 34 crypto wallets, 29 are Bitcoin accounts while two are Ethereum accounts. Then, the remaining three are Monero, Cardano, and Litecoin accounts.

Not only that, but banks also received letters about designated people connected with the protests. The police sent names of at least 20 people identified as participants in the Freedom Convoy protests.

To add, RCMP also announced that the financial institutions must disclose the identified customers’ banking details to them or the Canadian Security Intelligence Service.