In this article, BeInCrypto analyzes various on-chain indicators for Bitcoin (BTC) including realized profits, losses, and net realized profit/loss values.

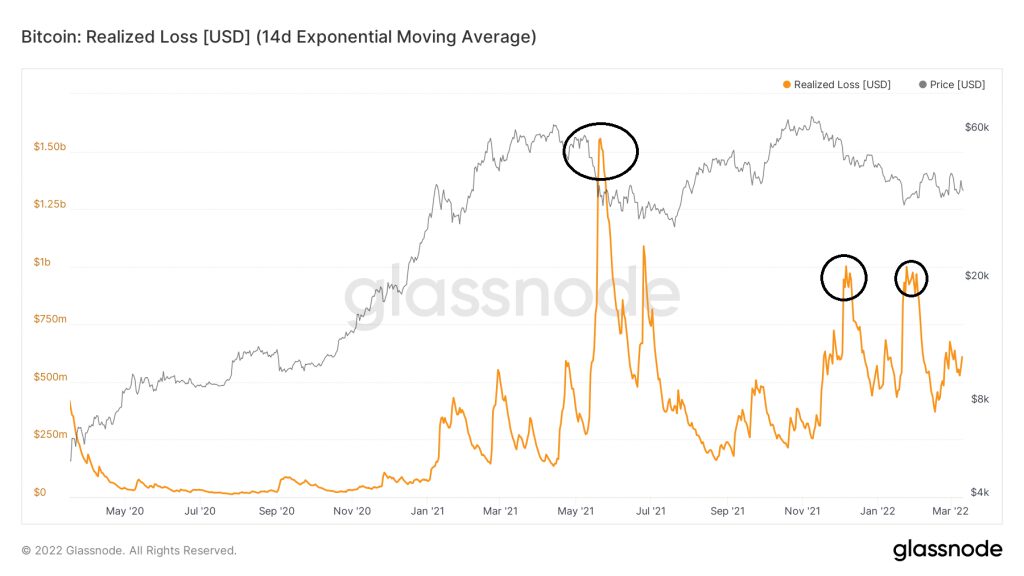

Realized losses show the total USD loss of all the bitcoins that were sold at a loss. The indicator peaked in May 2022 at a high of more than $1.5B (red circle) when BTC was trading at $34,000. The losses were likely caused by sellers who had bought near the then all-time high price of $63,000 in April.

Despite the BTC price going lower, realized losses reached a slightly lower high of $1.05B. These sellers were either those that bought the previous dip, or all-time high holders who were finally capitulating.

Realized losses then peaked twice (black circles) in December 2021 and January 2022. These two realized loss peaks were very similar to what was seen in July 2021.

Interestingly, the values have been hovering around $600M since, despite the BTC price moving lower.

This suggests that either all the all-time high buyers have capitulated, or that they have become holders.

BTC realized profits

Realized profits peaked above $3B in January 2021 (black circle), at a then all-time high price of $40,400. Following this, realized profits bottomed at $230M in July 2021, very close to the local BTC price bottom (red circle).

Currently, realized loss values have been hovering around $600M, similar to realized losses.

Net realized profit/loss

Finally, the Net Realized Profit/Loss indicator shows that with the exception of the Jan. 24 bottom (black circle), profits/losses have been close to 0.

This means that the majority of BTC being transacted have been bought very close to the current price.

The realized profit/loss indicator, which simply takes the ratio between the two, is also currently at one. This means that realized profits are roughly equal to realized losses.

Interestingly, the indicator dropped to 0.54 in January 2022. This was the same value that was reached in March 2020.

Furthermore, the two previous times that the indicator dropped below 1 (black circles) marked temporary BTC price bottoms.

It remains to be seen if the same will occur this time around.

BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.