Veteran investor Jim Rogers, who co-founded the Quantum Fund with billionaire investor George Soros, has warned that more bear markets are coming and the next one will be “the worst” in his lifetime. Noting that many stocks will go down 90%, he stressed that investors will lose a lot of money.

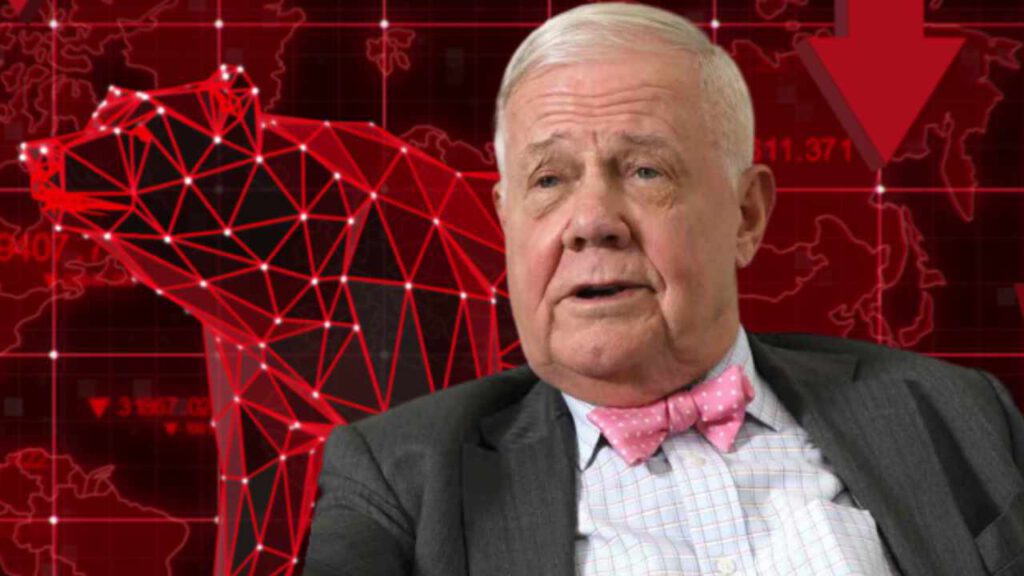

Jim Rogers Says ‘the Worst’ Bear Market in His Lifetime Is Coming Next

Famed investor Jim Rogers warned about an incoming bear market that will be “the worst” in his lifetime in an interview with Kitco News, published last week. Rogers is George Soros’ former business partner who co-founded the Quantum Fund and Soros Fund Management.

Citing that we are somewhat in a bear market right now, he predicted that the worst has yet to come, warning:

More bear markets are coming … The next one is going to be the worst in my lifetime.

While explaining that in 2008, “we had a problem with too much debt,” he stressed that the debt has skyrocketed since then.

“The debt, oh my God, look out the window, the debt has skyrocketed everywhere, so the next bear market has to be horrible,” he opined. “How can it not be a horrible bear market … I mean, the U.S. has increased its debt by several times since 2009. Japan, oh my God, they can’t even count the debt in Japan. In many countries in the world, the debt just goes higher and higher and higher … 2008 was because of too much debt, it’s much worse now.”

Rogers elaborated:

Many stocks are going to go down 70%, 80%, 90%. Of course, that’s going to happen. I just don’t know when.

“It’s been 13 years since we’ve had big problems and that’s the longest in American history,” he noted, adding that “it’s already overdue on a historic basis.”

He further detailed: “We have very high valuations, we have staggering debt, we have a lot of new investors coming in. It’s not my first rodeo. I’ve seen this movie. I know how it works. They’re all going to lose a lot of money. I hope I’m not one of them.”

Jim Rogers on the U.S. Dollar Losing Its Dominance

Rogers also reiterated his view that the U.S. dollar will lose its dominance, stating that “The Russia-Ukraine war has accelerated it.”

The veteran investor described: “The world’s international medium of exchange is supposed to be neutral — anybody can do anything with it they want to. But, unfortunately, Washington is changing those rules. Washington says well if they don’t like you, you cannot use the U.S. dollar, and people say ‘wait a minute an international medium of exchange is supposed to be neutral. That’s not the way it’s supposed to work.’”

He asserted that the U.S. government has shown that it will “take your money away from you” if it does not like you. “Many people have had their assets seized by the U.S. because they don’t like them,” Rogers emphasized, elaborating:

Many countries, even our allies, are now looking for something to compete [with the U.S. dollar] because it could happen to them, you know, all of a sudden Washington could say you are finished.

Rogers also commented on bitcoin, confirming that he has not bought any BTC. He reiterated his view that if the cryptocurrency succeeds as a currency, governments will outlaw it because they do not like competition.

What do you think about Jim Rogers’ warnings? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer