Addressing recent speculation that Russian oligarchs have used cryptocurrency to avoid sanctions, blockchain analysis firm Chainalysis released their latest report which may come at a surprise to many.

The report, published on Wednesday, relied upon a 2017 study by the National Economic Bureau, which estimated that Russian oligarchs hold nearly $800 billion in offshore funds. The study measured three different metrics for calculating liquidity across crypto markets.

‘Free Float’ model

The first model, known as ‘free float,’ measures the total value of a particular crypto asset held by liquid individuals or exchanges for purposes of liquidity in cryptocurrency markets.

According to the report, Chainalysis found that after looking at 19 different exchanges, it would be near impossible to move that much amount of money without crashing the price of Bitcoin. Specifically, Bitcoin’s price would decrease by 10% after the sale of $1.5 billion in Bitcoin.

Combined, the free float of Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), who have the largest market cap by total supply, was around $296 billion – significantly less than the $800 billion held by the Russian elite in and outside of Russia.

“Any attempt to liquidate $800 billion or even $100 billion worth of crypto would likely cause major price crashes, making large-scale Russian sanctions evasion with cryptocurrency infeasible,” said Chainalysis.

Is the Ukraine crisis a remedy to sanctions evasion?

Over the past two months, western governments have responded to Russia’s invasion of Ukraine with severe sanctions against billionaire businessmen, thought to be members of President Vladimir Putin’s inner circle. Assets including football clubs, stocks, and palatial overseas properties have now been seized.

For those that have yet to be confiscated, owners are reportedly scrambling to hold on to their assets amidst what some people consider to be the most comprehensive economic sanctions imposed in modern history.

For example, Chelsea Football Club owner, Roman Abramovich (estimated net worth $12.4 billion), mining and telecoms magnate Alisher Usmanov ($17.6 billion), and aluminium tycoon Oleg Derispaka ($3 billion).

But are concerns of the ongoing crisis a remedy for those seeking to evade sanctions?

Unlikely.

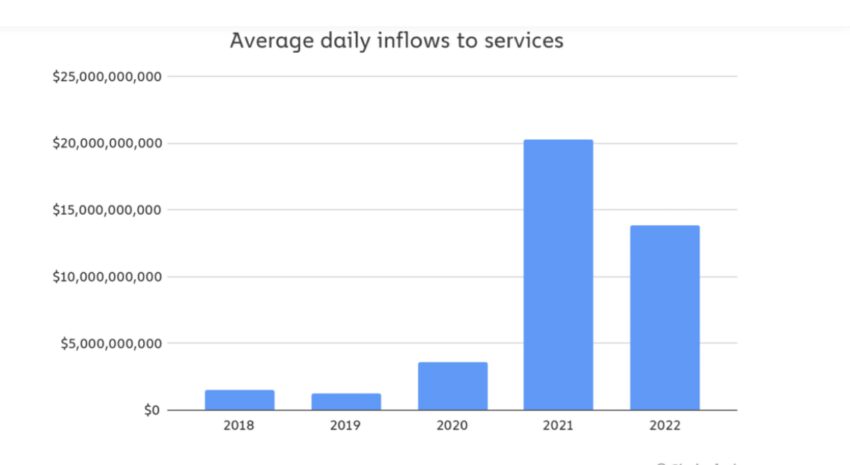

Measuring daily inflows to services

Another model Chainalysis used for measurement involves examining data on crypto asset inflows to services such as exchanges.

As of April, a total of $14 billion in crypto has flowed into the industry per day – down from $20 billion in 2021. In May of 2021, that figure peaked at $80 billion. At this rate, it would take up to 10 days of inflows for sanctioned Russian billionaires to move bitcoin equivalent to their wealth to an exchange where it could be liquidated.

“That would raise red flags not just for those services’ compliance teams, but for law enforcement and the cryptocurrency community at large,” detailed the report.

Mixing services

Chainalysis said the use of mixing services that obfuscate the destination of funds would also not work, because of low crypto inflows, which averaged $30 million per day for the whole of last year. Mixers, for the uninitiated, are services used by criminals to obfuscate their activities.

The figure reached a high of $160 million on Dec. 5, 2021.

“Even if Russian oligarchs sent $160 million worth of cryptocurrency per day to mixers – amounts that would likely render the mixers ineffective – it would take 5,000 days to move their $800 billion,” the report continued.

“By nearly any measure, cryptocurrency markets don’t have the liquidity to support Russian sanctions evasion en masse. The assets of sanctioned actors far exceed what one could hope to sell without either crashing the prices of crypto assets or drawing the attention of blockchain observers.”

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.