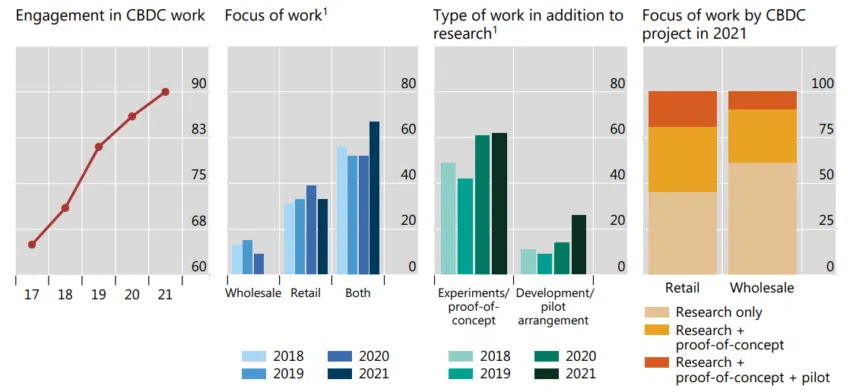

Over 90% of central banks are working on some form of digital currency, a survey has revealed.

The Bank for International Settlements (BIS) surveyed 81 central banks and responses showed that 60% are working on proofs-of-concept, while 26% are running pilots. And the number of banks announcing a review of CBDCs has almost doubled in 2022 alone.

The focus of these CBDCs is both wholesale and retail, and a majority of banks are keen to involve the private sector. This two-tiered model is one of the more popular architectures among central banks currently.

As for a more concrete prediction on how CBDCs might turn out, more than half of the banks believe there is a good possibility that they would release one.

Central banks explore impact of stablecoins

Stablecoins also feature in the report, with about 70% of banks saying that they were examining the potential impact of stablecoins on financial stability, a figure that has actually gone down over the years.

The expanded interest in and rapid development of CBDCs has come about in the last 18 months, partly because of the growth in stablecoins and DeFi.

The latter two have caught the attention of regulators, and one fear is that they may take some influence out of national currencies and existing financial systems.

Governments and central banks have also begun to acknowledge the potential of blockchain-based currencies, namely faster transaction times, cheaper costs, and greater security.

China is the largest economy to have launched a pilot, but that does not mean other countries will mirror it – Japan has said that it will model its CBDC on Sweden.

Mexico is the latest country to announce an update on its CBDC, with the central bank’s governor saying that it would launch by 2025. India, meanwhile, expects to launch a trial of the digital rupee later this year.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.