While there were hopes of Bitcoin reaching $98,000 in November before rolling on to $100,000, reality saw the king coin tumbling below $50,000. The “first miss” of Plan B’s floor model sent shockwaves through the crypto community. Now, many investors might be wondering if buying Bitcoin during COVID-19 was a good idea at all.

But according to one research report, there’s a definitive answer to this question.

COVID-19 got you on “hedge?”

In a newly released research report, Arcane Research concluded that Bitcoin has been an “excellent” inflation hedge during the pandemic. The report stated,

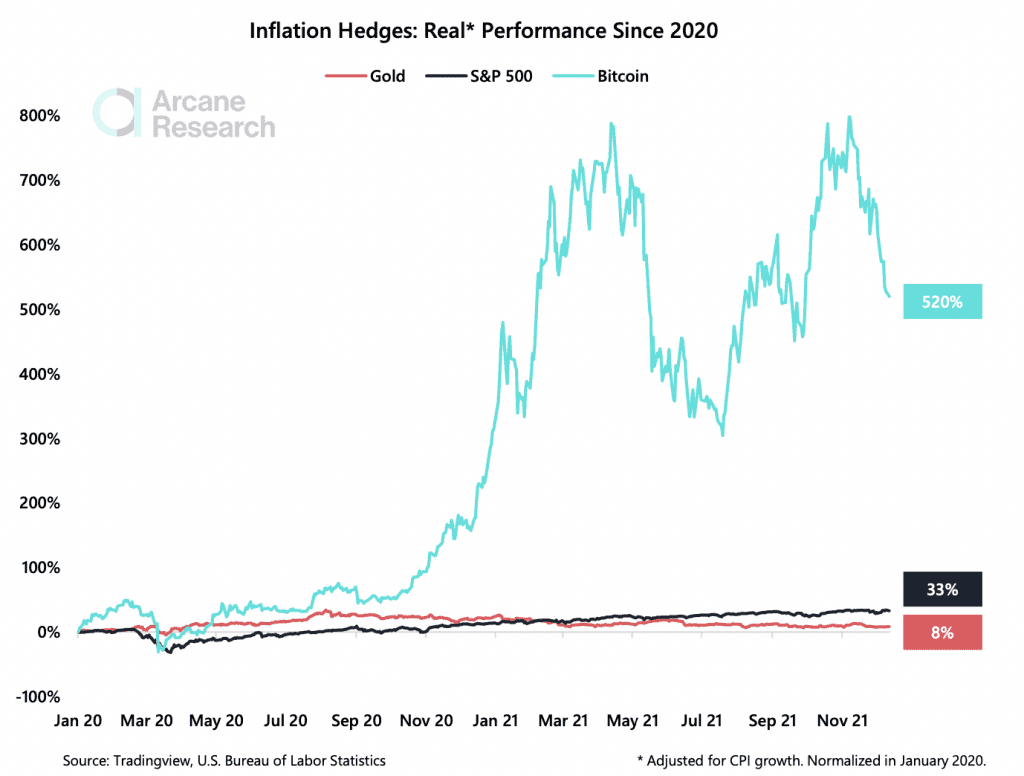

“During the same period, gold has had a real return of 8%, while the S&P 500 has returned 33% in real terms. Bitcoin’s unmatched returns during this highly inflationary period illustrates that Bitcoin has indeed been an excellent inflation hedge.”

What’s more, the report pointed out that a Bitcoin holder’s purchasing power would have spiked by 520% since January 2020.

Simply put, while Bitcoin’s recent price performance might have left new investors feeling down as well, zooming out and looking at the big picture shows that Bitcoin did outpace inflation – by a lot.

Source: Arcane Research

Feeling the pinch

That said, however, some experts don’t think Bitcoin will be the silver bullet to a global rise in prices. One point of concern is the Federal Reserve’s announcement of tapering – or thinning down on asset purchases meant to boost the economy during the pandemic.

In a Huobi Research report, author William Lee proposed that tapering might affect Bitcoin’s future price performance, or make it harder for the asset to rally. He concluded,

“Therefore, under the influence of market expectations, it is difficult for various high-risk assets, represented by Bitcoin, to continue to rise in the future, and even the possibility of further decline cannot be ruled out.”

Now, all eyes are on Plan B’s Stock-to-Flow model, as well as USA’s crypto regulatory scene to see how things play out.

Keep a stiff upper “dip”

Well, one might wonder, could more traders and investors be “buying the dip” in order to thicken their inflation hedges? While it’s hard to discern the motives of Bitcoin holders, on-chain analyst Willy Woo shared his take.

Buying the dip visualised (spot volumes seen on-chain). It has been happening, it’s moderate, but most importantly, as yet there’s no signs of a further sell-off cascade. Also worth keeping in mind longs have already been flushed. pic.twitter.com/j5cjUOIGmA

— Willy Woo (@woonomic) December 13, 2021

Calling the buying activity “moderate,” Woo claimed that long positions had already been liquidated.