Decentralized Finance (DeFi) has grown exponentially this year. Data from DeFi Pulse highlights that the total value locked across these projects has topped $111 billion, reflecting a growth of nearly 420% over a year. As DeFi projects are poised to skyrocket, they continue to explore newer technologies and liquidity solutions. However, numerous problems have emerged simultaneously. The most pertinent ones are—trustworthiness of the project and higher risks.

To mitigate these problems, SYNC Network, a Layer-2 scaling platform, has come up with a unique idea to create liquidity NFTs for DeFi markets. By introducing the protocol, its developers aim to bring resilience and mitigate the risk associated with the decentralized industry.

SYNC Network’s Blockchain Composition

SYNC Network is a fully decentralized and community-governed ecosystem, running atop the Ethereum blockchain. Per its white paper, two main smart contracts comprise the protocol’s core: SYNC (ERC-20) and CryptoBond (ERC-721). While the CryptoBond smart contract will enable users to mine SYNC tokens it would also open a tradable stake position for them.

At present, there are about 154 million $SYNC in circulation. However, the total supply is uncapped to factor in the inflationary and deflationary effects from market propellers. When an NFT bond is minted an equal proportion of SYNC tokens are burned from the total circulating supply.

CryptoBonds: What They Are & How To Mint Them

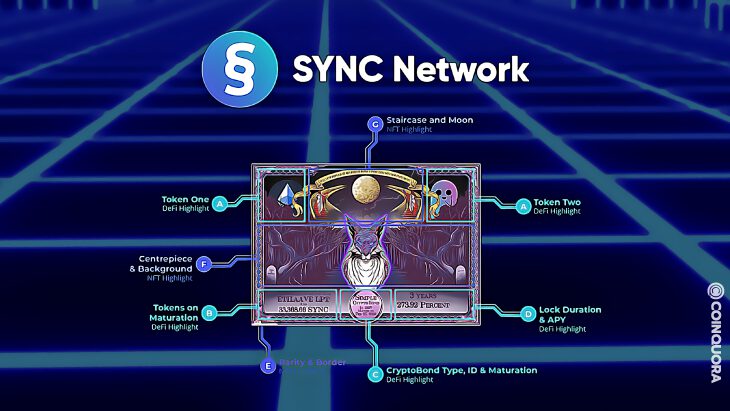

SYNC Network offers a novel NFT asset — Cryptobond. Unlike traditional NFTs, cryptobonds are much more than a piece of digital art. These so-called wrapper NFTs can represent bulks of data, including tokens, liquidity, and much more. SYNC Network uses these bonds as digital interest-earning assets. Consumers will receive the principal amount and accrued interest in the form of NFTs, tradable on secondary markets like OpenSea and Rarible.

Currently, the SYNC network offers two types of NFT bonds–simple and periodic. While periodic bonds allow quarterly payment withdrawal (in about 90-days), simple bonds allow payout only upon maturation of the contract.

If a consumer wants to mint these NFT bonds on the network, they should lock their liquidity pool tokens (LPTs) and an equal amount of SYNC tokens. At the time of writing, there are a total of 1888 crypto bonds on the network. These randomly-generated bonds feature a rarity algorithm that enables more than a trillion possible combinations.

In addition, the bonds have several unique features, including personal liquidity mining rewards. The protocol automatically adjusts these rewards on a day-to-day basis based on the liquidity pools’ supply and demand metrics. Besides this, users can use cryptobonds are utilized as collateral on the protocol’s peer-to-peer lending platform, opening the door to greater financial flexibility and inclusion.

Coalitions and the Syncronauts 777

The SYNC network has already joined forces with some major players of the ecosystem including DEXTools, TrustSwap, AMPNet, MurAll, and NFTfi. Having carefully and diligently vetted these coalitions, the SYNC team offers a wider range of benefits to its collaborators, as well as consumers.

Simultaneously, to facilitate distributed governance, SYNC has recently launched a set of 777 unique Syncronauts that are randomly generated from a pool of more than 300 traits. These Syncronaut NFTs act as a pass for owners to become a member of the Syncronauts DAO. The members, in turn, can vote to decide where the project will head next. They can also write proposals, helping not just the SYNC protocol but the wider crypto-collectibles industry as well.

Establishing Market Certainty for Investors

Despite DeFi’s rapid growth, there are significant risks for industry participants. Numerous projects in the space have been utilizing stake and proof-of-liquidity mechanics to develop a trustless decentralized market. However, only some of these are genuinely reliable and secure.

SYNC Network incentivizes to strengthen liquidity pools. And greater the amount of liquidity locked in through CryptoBonds, the greater will be the market certainty for investors. In other words, offsetting volatility is now possible like never before, thanks to SYNC’s innovative ecosystem. Much more than a standard, crypto-based risk management platform, the network is set to become the harbinger of stability and sustainable business growth. And finally, therefore, SYNC serves as a catalyst for DeFi evolution to its maturity and mass adoption.