Ripple has achieved the “strongest year ever” despite the lawsuit over XRP by the U.S. Securities and Exchange Commission (SEC), according to CEO Brad Garlinghouse. “Calling crypto the ‘Wild West’ is a farce,” he said, emphasizing that “most are complying with financial regulators globally.”

Ripple Has Best Year Despite SEC’s Lawsuit Over XRP

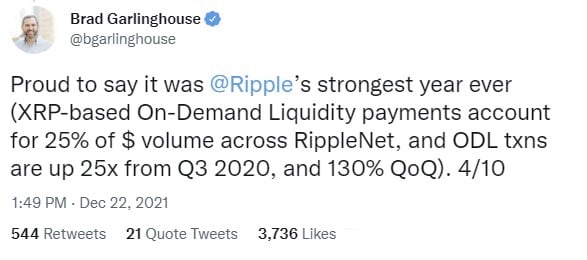

Ripple CEO Brad Garlinghouse talked about his company’s achievement and cryptocurrency regulation in a series of tweets Wednesday. He explained that despite the lawsuit over XRP, Ripple had the “strongest year ever.”

The U.S. Securities and Exchange Commission (SEC) filed a lawsuit against him, Ripple Labs, and co-founder Chris Larsen a year ago. The securities watchdog alleged that XRP should have been registered as a security.

While insisting that the SEC’s lawsuit against XRP “is an attack on crypto in the US, not just Ripple,” Garlinghouse detailed:

2021 has been a watershed year for crypto. Acceptance and awareness of the opportunity to bring billions of people into the global financial community has never been so clear. It’s been incredible to see a lot less ‘maximalism’, and many more builders joining the industry.

The CEO proceeded to outline Ripple’s progress over the year, such as launching new On-Demand Liquidity (ODL) corridors and its central bank digital currency (CBDC) solution. “All of this growth came from outside the US,” he opined.

Garlinghouse then noted that SEC Chairman Gary Gensler “has taken an aggressively anti-crypto approach and companies are already moving outside the US.” He asserted that “the SEC today won’t answer questions about the legal status of ETH, much less anything else,” elaborating:

Calling crypto the ‘Wild West’ is a farce – most are complying with financial regulators globally. This industry shouldn’t be punished for asking for regulatory clarity & regulation that is consistently applied with a level playing field.

What do you think about Garlinghouse’s comments? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer