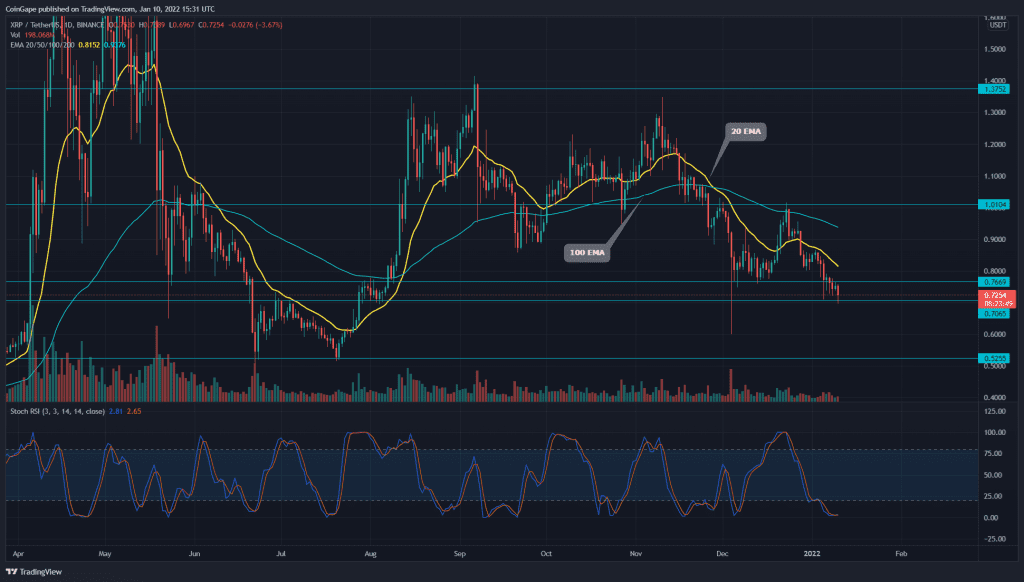

The XRP price chart shows an overall sideways rally. However, this new year has only extended the correction phase, and the price has plunged to the $0.7 support. The daily chart shows several lower rejection candles at this level, indicating the presence of intense demand pressure.

Key technical points:

- The XRP price shows a lower price rejection candle at $0.7 support

- The XRP price chart shows the 100-and-200-day EMAs are on the verge of a bearish crossover

- The intraday trading volume in the XRP coin is $1.7 Billion, indicating a 6.8% fall.

Source- Tradingview

Previously when we covered an article on Ripple coin on 22nd December 2021, the coin price hinted at a bullish reversal with a cup and handle pattern. However, the price could never breach the $1 neckline and instead, it was rejected with a bearish engulfing candle.

Moreover, the bloodbath in the crypto market fueled the selling pressure in this coin and pushed the price back to the bottom support zone near $0.76 and $0.7.

The crucial EMA(20, 50, 100, and 200) indicates a downtrend for the XRP price. Moreover, the chart shows the 100 and 200 EMA are poised to give a bearish crossover, which could fuel the bearish momentum in the market. However, in the case of a bullish reversal, the 20 and 100 EMAs are controlling the minor and major pullbacks respectively.

advertisement

The daily-Stochastic RSI line has dropped to the oversold territory. Moreover, the K and D line provides a bullish crossover, indicating the increasing underlying bullishness in this coin,

XRP Price Chart Shows A Falling Wedge Pattern

Source- Tradingview

The XRP price is currently hovering above the $0.7 support, indicating demand pressure from this level. Moreover, the XRP price action displays a falling wedge pattern in the 4-hour time frame chart. This pattern could signal a bullish reversal if the price breakout from the overhead resistance trendline.

The important resistance levels for XRP price are at $0.77, followed by $0.85. As for the opposite side, the support levels are $0.7and $0.62.