Ripple Singapore has rejected crypto influencer BitBoy’s application to be the Director of Strategy and Operations.

Ben Armstrong (aka BitBoy) tweeted a rejection letter from Ripple’s Talent team after applying for a senior position earlier this year.

Background of Armstrong’s application

On Nov. 4, 2022, Armstrong applied for the senior position in response to a Ripple Singapore LinkedIn advertisement. He cited Ripple’s CTO, Joel Katz, as an inspiration.

If successful, Armstrong would be responsible for driving Ripple’s corporate strategy through cross-functional teams and ensuring cooperation between operating regions. He would also need to partner with the Finance Department to push annual planning.

Unfortunately for BitBoy, the company responded that it would review his application but only four days later sent Armstrong a rejection letter.

At press time, the job post had received over 200 applicants.

XRP sees third week of $1 million inflows

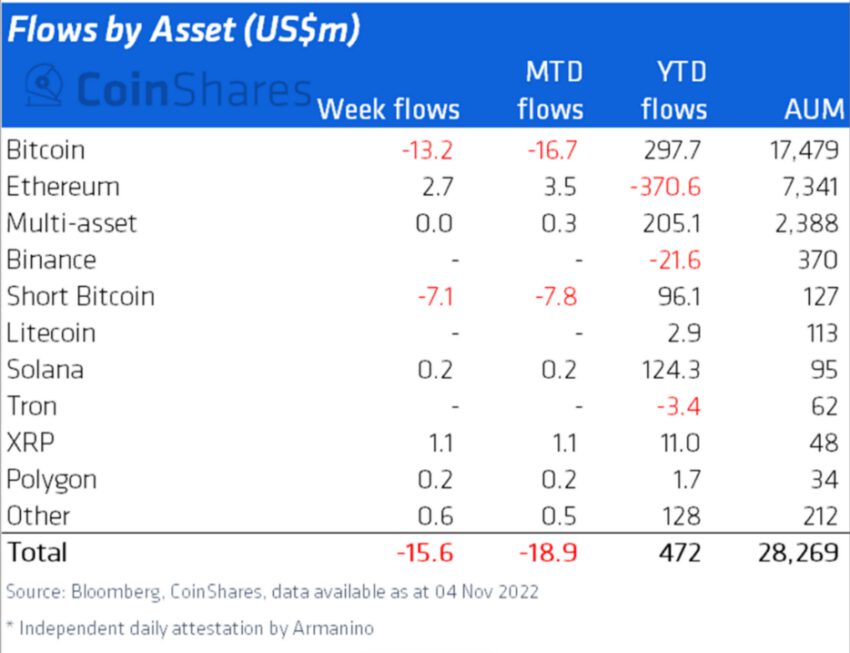

As the SEC vs. Ripple case draws near its second anniversary in Dec. 2022, investors have grown increasingly bullish on the price of XRP, anticipating a Ripple win. Accordingly, XRP has seen $1.1 million in asset inflows for the third week running.

In the latest developments in the case, Coinbase and Senator Cynthia Lummis (R-Wyo) were among 12 entities that filed amici curiae briefs to show their interest in the case. The U.S. Securities and Exchange Commission responded by asking Judge Analisa Torres to set a deadline of Nov. 11, 2022, for all amici briefs to be filed. It has also asked Judge Torres to extend the window to file reply briefs to Nov. 30, 2022.

In Dec. 2020, the SEC accused Ripple Labs and two executives of misleading XRP investors by not registering XRP as a security with the SEC. The SEC accused CEO Brad Garlinghouse and co-founder Christian Larsen of selling XRP while ignoring legal advice that it may be an investment contract.

Ripple has argued that XRP is used for making cross-border payments and is not a security. Furthermore, its use in international payments puts it outside the jurisdiction of the SEC. Ripple has also lobbied aggressively to bring crypto assets under the supervision of the Commodities and Futures Trading Commission.

SEC vs. LBRY another crucial case to watch

Ripple’s aggressive litigation has not stopped the SEC from pursuing other enforcement actions against crypto industry participants.

On Nov. 7, 2011, the SEC won a court case against LBRY, a decentralized content distribution network, following a 2021 complaint. In the complaint, the SEC alleged that LBRY had offered its LBC token as an investment contract without providing investors with full disclosure.

LBRY launched its LBC token in 2016 and sold over 50 million tokens directly to the public and through centralized exchanges. LBRY said that the token would grow in value as the company continued the development of the LBRY network.

Despite the company appending various disclaimers to promotional materials, the court ruled that LBRY knew its tokens were investment vehicles and failed to inform investors fully.

LBRY has decried the ruling, saying that it sets a “dangerous precedent” that would result in most cryptos in the U.S. being classified as securities.

After the ruling, LBRY hinted that it may appeal. If true, this could, together with the Ripple case, reshape regulations either in favor of or against the crypto industry. Either way, the crypto industry is not going down without a fight.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.