Ripple’s (XRP) price could not sustain the previous session’s gains on Saturday. XRP bounce back strongly on Friday after the Russia-led war on Ukraine send shockwaves across global markets on Thursday. But the price finds it difficult to move beyond the 50-day EMA (Exponential Moving Average) as it hovers near the crucial barrier.

- Ripple (XRP) edges lower on Saturday as volatility keeps investors on edge.

- However, the downside risk remains intact as the price fails to test $0.80.

- XRP bulls missed the opportunity to capitalize on Friday’s sound bounce back.

As per the Whale Alert, the US-based Bittrex exchange transferred 20 million XRP to the Korean platform Upbit.

At the time of writing, XRP/USD at $0.76, down 1.21% down for the day. The sixth-largest cryptocurrency by market cap held the 24-hour trading volume of $3,956,429,359 with losses of 0.41%.

XRP looks for bearish reversal

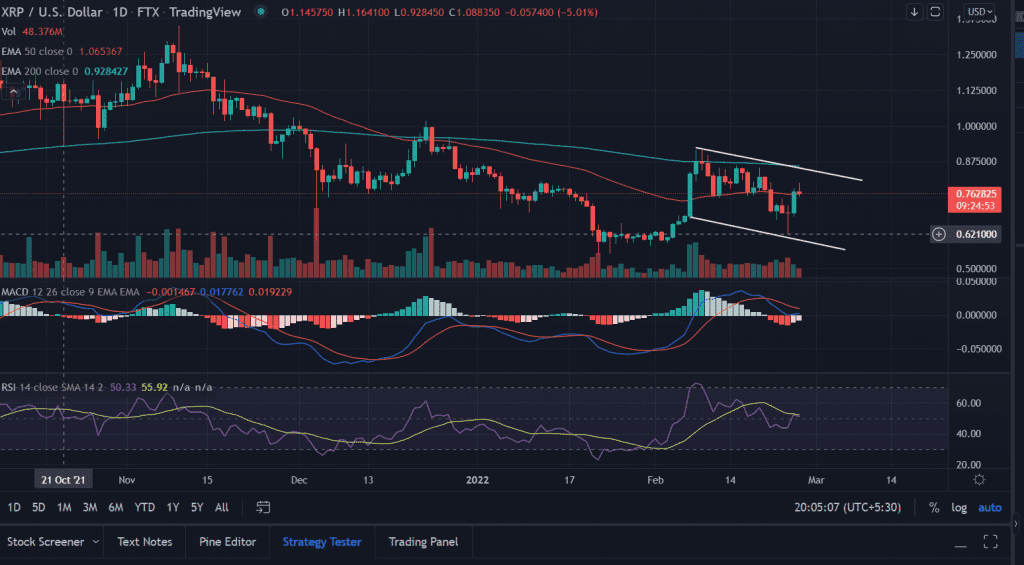

On the daily chart, Ripple (XRP) has been trading lower since the price made swing highs $0.91 as it moves inside the ‘rising wedge’ formation. It is a bearish reversal pattern as the price continues to trade in ‘lower high lower low formation’. As the price tested the lows of $0.67 and $0.622 and is one of the ways to revisit $0.58.

Furthermore, the price remains pressured below 200-EMA (Exponential Moving Average) at $0.85 since December 24. If the price sliced below the 50-day EMA of $0.76 then it could fall toward the lower trend line of $0.58.

On the flip side, if the price is able to break above the psychological $0.87 level then it could move toward the critical $1.0 level.

Technical indicators:

RSI: The Daily Relative Strength Index (RSI) trades at 51 below the average line.

MACD: The Moving Average Convergence Divergence (MACD) hovers just above midline with upside momentum.