The famous author of the best-selling book Rich Dad Poor Dad, Robert Kiyosaki, has warned that stock, bond, and real estate markets will crash as the Federal Reserve continues to raise interest rates. Noting that the Fed will pivot, he advises investors to buy bitcoin.

Robert Kiyosaki Recommends Buying Bitcoin Before Fed Pivot

The author of Rich Dad Poor Dad, Robert Kiyosaki, has advised investors to buy bitcoin before the Fed pivots, reiterating that the Federal Reserve’s interest rate hikes will destroy the U.S. economy. Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

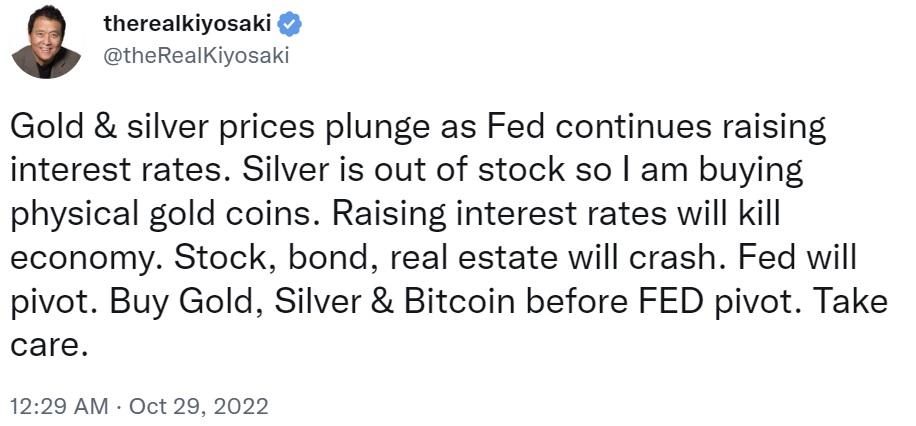

Kiyosaki tweeted early Saturday morning that the prices of gold and silver are plunging as the Federal Reserve continues to raise interest rates. He warned that rate hikes will kill the U.S. economy, cautioning that stock, bond, and real estate markets will crash. He stressed that the Fed will pivot, advising investors to buy gold, silver, and bitcoin before the Fed pivot occurs.

Many economists and strategists have predicted that the Fed will not pivot anytime soon. Strategists and fund managers told Reuters’ Global Market Forum Friday that a Fed pivot is not on the horizon even as over-tightening risks loom. They believe that there is a greater chance of the Federal Reserve raising interest rates too far and tipping the U.S. economy into a recession.

Bank of America’s strategists, led by Michael Hartnett, wrote in a note Friday that it is too early for a Fed policy pivot “absent sudden collapse in inflation & payrolls.” JPMorgan strategist Julia Wang said Thursday that a Fed pivot is unlikely in the near future given persistent inflation. She told Bloomberg: “For us to get to a point where labor market conditions are more fundamentally consistent with the Fed’s inflation target, we think will probably take us to end of next year. So hence, that’s why we expect a pivot really only in Q4 2023.”

This was not the first time that the renowned author said Fed rate hikes will destroy the U.S. economy. He gave a similar warning in September.

Last week, Kiyosaki said the U.S. dollar is toast citing Saudi Arabia’s request to join the BRICS nations. Moreover, he predicted that the U.S. dollar will crash by January and warned about World War III.

The Rich Dad Poor Dad author has been pushing bitcoin for quite some time. Earlier this month, he explained the reason he buys BTC. He has distinguished the largest crypto from fake money on several occasions, emphasizing that the end of fake money is here. Kiyosaki also recently urged investors to get into crypto now before the biggest economic crash happens.

Do you agree with Robert Kiyosaki? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer