A lot of cryptocurrencies might think they’re too cool for the centralized crowd, but a little mainstream acceptance can be nice, and four crypto assets discovered just that as they were listed on the trading platform Robinhood. These were Shiba Inu [SHIB], Solana [SOL], Polygon [MATIC], and Compound [COMP].

#ShibaInu, #Solana, #Polygon, & #Compound were all listed on #Robinhood today. Notably, $SHIB saw the biggest increase in interest, with a +30% pump. Trading volume is high, and all four of these assets should be expected to have very high volatility. https://t.co/EpjR6Q2z22 pic.twitter.com/W1jAIxy0NJ

— Santiment (@santimentfeed) April 12, 2022

Of the four, Solana had the highest market cap ranking, so let’s see how SOL’s price dealt with its brush with fame.

Robinhood: a new SOL-mate?

Like most of the top 10 assets, SOL was hit hard by the market’s recent dive into red territory. At press time, SOL was changing hands at $104.17, having lost 17.30% of its value in the past week. However, the coin was up by 1.17% in the past 24 hours. So, exactly what kind of volatility can investors expect from here on?

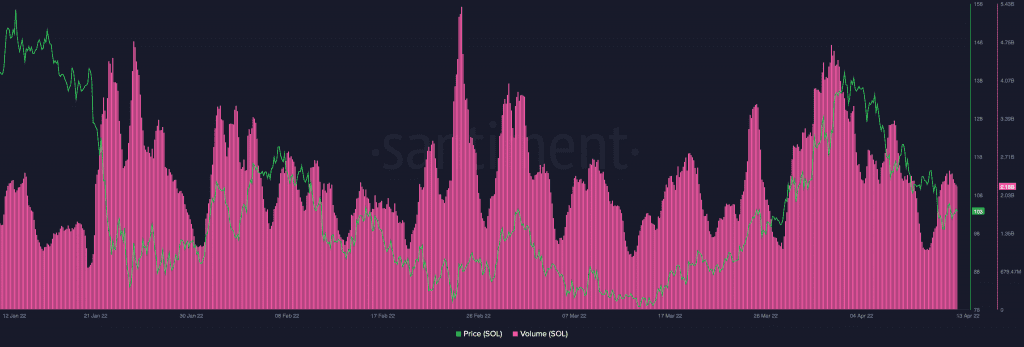

First thing’s first. Santiment data showed that Solana’s trade volume did not see any significant change after the Robinhood listing. In fact, there was a slight downtrend at the time of writing.

Source: Santiment

However, Trading View revealed something interesting about the asset’s volatility. The Relative Volatility Index [RVI] clocked in at above 50, which indicates that potential volatility could take the asset’s price upwards. This is a bullish sign.

On the other hand, the historical volatility indicator was pointing downwards. Though this hints at lessened risk, bulls might not want to be too quick to go shopping – especially when looking at the macroeconomic factors affecting the market.

Just to be more sure, however, let’s analyze the Bollinger Bands. This particular indicator revealed that the bands were far apart, which again signals price volatility. However, note that the candles are moving closer to the lower band, which suggests that traders no longer see SOL as such an overbought asset.

That being said, another factor to keep an eye on is how OpenSea formally launches Solana NFTs on its marketplace. This isn’t so much about the NFTs themselves, but rather how the integration affects Solana’s own NFT marketplaces – and their business.

DOGE walked so SHIB could run

Solana might be in an interesting place, but there’s no question as to how the crypto community’s second-favorite dog coin reacted to being listed on Robinhood. At press time, SHIB was trading at $0.00002689. This came after rocketing upwards by 17.41% in the past 24 hours, despite a weekly rally of only 2.74%

For its part, Robinhood wasted no time in leveraging the news to draw tail-wagging investors to its platform.

We dropped new crypto 👀

And we’re giving away $100K of it. Quote tweet this tweet with your Robinhood Username (@ included!) to get some 🪙 #RobinhoodCrypto

The first 10K quote tweets will receive $10 of SHIB. pic.twitter.com/0jsBKYfJvw

— Robinhood (@RobinhoodApp) April 12, 2022