Crypto winters are one of the greatest fears of crypto investors and are predicted to occur in four-year cycles, with the previous cycle occurring in 2018. Moving forth to the year of 2021, this phenomenon is believed to have commenced since early November 2021, where massive selloffs of Bitcoin and Ethereum took place as a result of a collective of negative catalysts such as the US Infrastructure Bill, China’s clampdown on Bitcoin mining and the emergence of the Omicron Covid variant, just to name a few.

As popular as Bitcoin and Ethereum are, they are still considered as speculative assets by many experts since they are heavily exposed to high volume trading and market manipulations on major exchanges. Unfortunately, the performance of many crypto sectors and projects closely follows the market patterns of Bitcoin and Ethereum, and thus are not performing well in this crypto winter.

Surprisingly, in the midst of this winter, a rising crypto asset class, GameFi, particularly a token such as Jedstar, has been less affected by the effects of crypto winters. In this article, we will reveal how Jedstar intends to shield itself against the negative effects of crypto winters, as opposed to crypto behemoths, namely Bitcoin, Ethereum and Binance Coin, and other GameFi tokens, such as Axie Infinity and Decentraland.

Briefly, GameFi is a booming crypto sector that is projected to reach $180 Billion in 2021, with an additional 10% increase in 2022. As a whole, the GameFi sector is the key to crypto mass adoption as gamers are usually not concerned about market corrections or crypto winters, and will continue to acquire gaming tokens to play the games they love or purchase gaming or virtual assets.

Short term: Market Performance

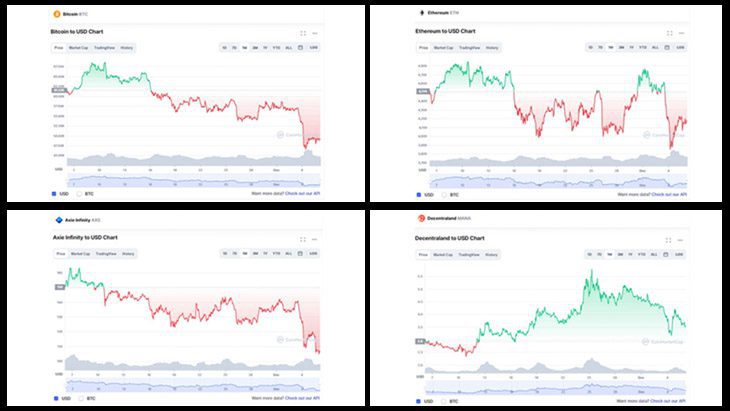

Following the market trends of Bitcoin and Ethereum last month, many crypto projects, including GameFi projects like Axie Infinity (AXS) and Decentraland (MANA), experienced a similar decline in market caps and prices, except for Jedstar. This is partially attributed to the low market cap of Jedstar.

At the time of writing, Jedstar ($JED) holds a small market cap of only $22 Million USD, whereas AXS and MANA share the same market cap of $6.1 Billion USD. Additionally, JED, AXS and MANA have achieved their estimated market cap peaks at $44 Million, $9.2 Billion and $10.6 Billion respectively.

In the previous month, $JED has gained a sharp increase in market cap from $8.4 Million USD ($0.19 USD) to $22 Million USD ($0.5 USD). On the other hand, the market cap of AXS has decreased from $9.2 Billion ($150 USD) to $6.5 Billion USD ($106 USD), while MANA saw an increase from $5.3 Billion ($2.9 USD) to $6.4 Billion USD ($3.5). Overall, in terms of market cap for this crypto winter, JED achieved a marked increase of 161%, while AXS and MANA have gained -29.3% and 20.8% respectively.

Based on short-termed market cap analysis, Jedstar has performed exceptionally well for the start of this crypto winter, regardless of the fact that volatility has a greater impact on lower market cap tokens.

Long Term: Diversification and Utility

Jedstar consists of a 3-token DECOsystem, where $JED has been launched 3 months ago, while its second token $KRED is awaiting its presale event on 17 Dec 2021. Acknowledging the devastating effects of crypto winters on cryptocurrencies, Jedstar sets itself up for success by adopting sector- and genre-related diversification strategies, as well as embarking on a utility-focused mission in the long term.

Firstly, as a crypto-sector diversification strategy, Jedstar differentiates itself from its GameFi counterparts, such as AXS and MANA, by tapping into the booming crypto sectors of DeFi with $JED and GameFi with $KRED. $JED is the flagship token of Jedstar and will be developed into a full-fledged DeFi token, where investors stand to earn KRED, JED-only perks as well as other additional crypto rewards which are currently not yet revealed. On the other hand, $KRED is primarily developed as a GameFi token to be used on Jedstar’s NFT marketplace, AGORA, and its games platform, STARDOME. Additonally, moving into the GameFi sector

Secondly, adopting game-genre diversification, Jedstar is currently working on multiple Play-to-earn and blockchain game genres. For comparison, P2E giants like AXS and MANA are primarily a single game and virtualand respectively that revolves within their own metaverses, whereas Jedstar is involved in the development of CCGs, MetaMMORPGs and hundreds of hypercasual games as a full-fledged multimedia and gaming studio. Jedstar has also revealed that it has plans for film development and a Metaverse within its MMORPGs with intricately woven fantasy lores.

For the long term, not known to many, Jedstar strives to further expand its utility through $KRED. $KRED positions itself as a universal currency across multiple gaming platforms and blockchain standards. Conventionally, in terms of utility, GameFi tokens such as Axie Infinity and Decentraland are generally market-monopolistic, wherein their tokens intend to only serve and be used within their very own games, NFT marketplaces and metaverses. As a solution to bring about mass adoption through gaming, KRED deviates from the intended use of these ecosystems through its unique utility where it is specially designed to be blockchain agnostic and will be used as a world’s first CAAS (Currency-as-a-service) across multiple games and platforms, which are not required to be Jedstar-related. What this means is that the use case of KRED is future proofed and further magnified as it can now be used by any entities involved in blockchain gaming, while not being technologically limited by any new blockchain standards in the foreseeable future.

In essence, diversification into the DeFi and GameFi crypto space, coupled with the development of multiple game genres and unique utility of $KRED, Jedstar is well equipped to protect its investors from the negative influence of future crypto winters.