Bitcoin and gold have been jousting in a long battle for supremacy over the year. With Russia invading Ukraine, financial markets across the world took a lot of heavy hits. For instance, Russia saw its stock market crash by over 45%. As expected, Bitcoin was not spared from this onslaught either. At least, for a while.

Hostile environments

Bitcoin has emerged lately as “digital gold,” giving its physical counterpart a run for its money. Year on year, Bitcoin outperformed gold and investors flocked to the digital assets as the new, dominant inflation hedge. Now, the Russian invasion has created a hostile situation for both gold and Bitcoin. However, the latter has emerged a clear winner.

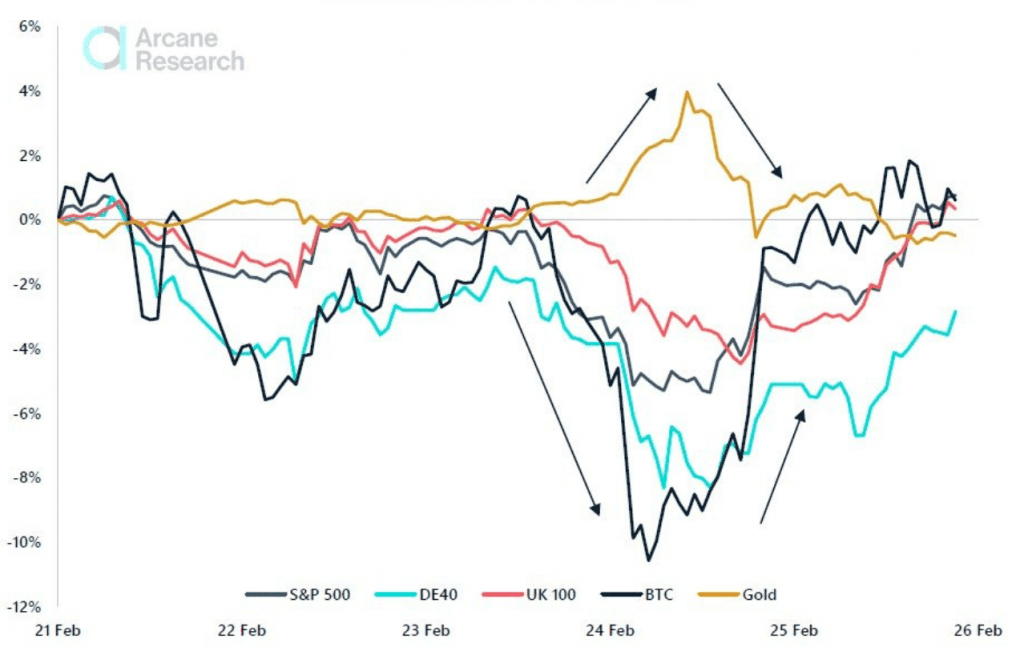

Arcane Research’s Week 8 report highlighted Bitcoin’s impressive surge, when compared to the yellow metal. BTC was the “best performer” in February following a 12% surge, according to the same.

Gold, on the other hand, didn’t record the same degree of surge. In, fact it was negatively correlated to the digital gold.

Source: Arcane Research

Source: Arcane Research

In fact, if a comparison of the indices is looked at, the figures would be something like,

Bitcoin (BTC): $44035, +5.83%;

Ether (ETH): $2968, +4.36%;

S&P 500 daily close: $4306, −1.55%;

Gold: $1949 per troy ounce, -2.59%

Turn by turn

On 24 February, gold was on top as it thrived in the aforementioned environment, raising the question of which asset would be the better inflation hedge. This can be evidenced by the massive hike on the graph around the same period. Furthermore, gold moved up the charts while most of the other assets lost value.

In fact, the price of gold climbed to a 13-month high on 24 February. It traded as high as $1,974 on 25 February, its highest level since September 2020. Russia, after HODLing gold since 2008, increased reserves from 450 tonnes to 2,200 tonnes.

The report connected the dots and stated,

“As more sanctions reach Russia, the long-term implications for gold could be interesting to follow. There’s a potential scenario of Russia seeking to use Gold for barter.”

Even so, despite its recent recovery, Bitcoin still has a long way to go before competing with the precious metal. Especially given their massive market cap difference.

#Gold Market Cap: $12.354 T#Bitcoin Market Cap: $842.67 B

Progress (Bitcoin surpassing Gold)

▓░░░░░░░░░░░░░░░░░░░ 6.82%— Bitcoin vs. Gold (@VersusBtc) March 2, 2022

Could gold further increase this market cap gap? Well, gold enthusiasts such as Peter Schiff asked users to witness “the pace of the ascent to pick up.”