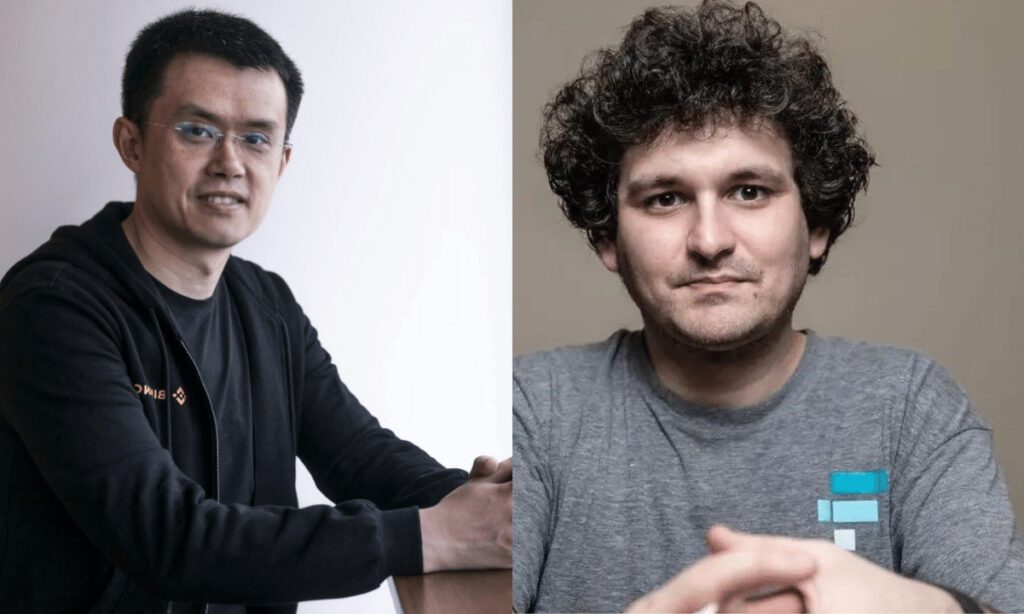

Amid massive uncertainty surrounding FTX and its ability to process withdrawals, the exchange’s CEO Sam Bankman-Fried (SBF) has announced that the company is being sold to Binance.

Binance CEO Changpeng Zhao (CZ) has also confirmed the news, stating that Binance will help FTX navigate its current “liquidity crunch.”

FTX Comes Full Circle

In a tweet thread on Tuesday, SBF told followers that things had come “full circle,” and that Binance would go down as FTX’s first and last investor. “We have come to an agreement on a strategic transaction with Binance for FTX (pending DD etc.)” said the CEO.

SBF confirmed previous rumors that the exchange was having trouble clearing its withdrawal backlog. This contradicts prior claims from both himself and FTX and that the exchange’s queue was “returning to normal levels,” and that assets were “fine.”

Multiple on-chain analysis firms found on Monday that FTX was experiencing hundreds of millions of dollars in net outflows, while Binance was experiencing roughly the same in net inflows. On Tuesday, on-chain data showed that FTX had gone hours without processing any Ethereum, Tron, or Solana-based withdrawals.

The young billionaire said Binance’s aid will help his exchange resolve its issues, and protect customers.

“This will clear out liquidity crunches; all assets will be covered 1:1,” he confirmed. “This is one of the main reasons we’ve asked Binance to come in. It may take a bit to settle etc. — we apologize for that.”

SBF thanked CZ and Binance for their aid while dismissing “rumors” about media conflict between the two exchanges. The two billionaires traded barbs over the weekend when CZ implied that FTX was trying to lobby against other industry players behind their backs, and promised to dump Binance’s FTT tokens.

“Binance has shown time and again that they are committed to a more decentralized global economy while working to improve industry relations with regulators. We are in the best of hands,” concluded SBF.

CZ’s Response

CZ confirmed on Tuesday that Binance signed a non-binding Letter of Intent with FTX to protect users amidst its “significant liquidity crunch.”

“Binance has the discretion to pull out from the deal at any time,” he clarified. “We expect FTT to be highly volatile in the coming days as things develop.”

FTT dropped by over 30% early on Tuesday but appears to have recovered slightly following the announcement of Binance’s acquisition deal.

Many in the crypto community suspected that FTX’s liquidity crunch, and collapsing token, were orchestrated by Binance as a way to target a weakened competitor. CZ denied these rumors on Monday, claiming that “no one” could have orchestrated FTX’s troubles.

SBF was known for having used his company to offer rescue deals to other distressed firms during the crypto bear market, including Voyager and BlockFi.In June, he told Forbes that there were still numerous crypto exchanges that were “secretly insolvent,” but did not specify which ones.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.