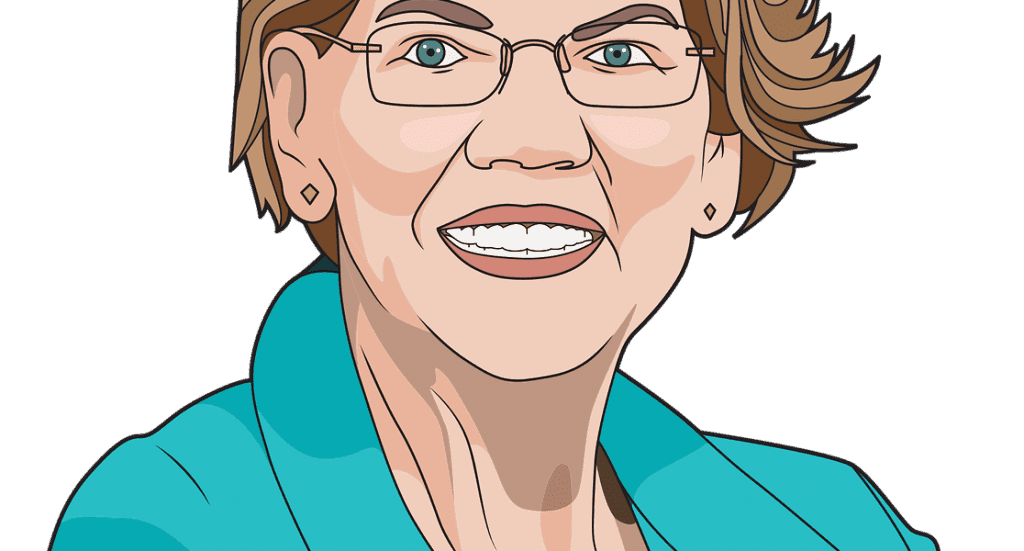

- Massachusetts Senator Elizabeth Warren has, once again, attacked DeFi and stablecoins, calling them “shady” and brimming with “scammers, cheats, and swindlers.”

- In the past, Warren has criticized cryptocurrencies, crypto exchanges, and Bitcoin’s energy consumption, calling on greater oversight of the whole crypto industry.

Once again, Massachusetts Democrat Senator Elizabeth Warren has captured headlines with her unrelenting criticism of decentralized finance (DeFi) and stablecoins. The latest episode took place during a Senate Committee on Banking, Housing, and Urban Affairs hearing held on Tuesday.

Warren described stablecoins such as Tether (USDT), as “the lifeblood of the DeFi ecosystem,” adding that they are used to trade between different cryptocurrencies and to facilitate money lending and borrowing outside the regulated baking sector.

However, she noted:

Stablecoins pose risks to consumers & our economy. They’re propping up one of the shadiest parts of the crypto world, DeFi, where consumers are least protected from getting scammed.

Additionally, the swelling DeFi industry “is where the regulation is effectively absent and—no surprise—it’s where the scammers and the cheats and the swindlers mix among part-time investors and first-time crypto traders.”

In turn, she called on official oversight saying, “Our regulators need to get serious about clamping down before it is too late.”

Senator Warren warns investors about stablecoins

Concurring with Warren’s opinions was Ohio Senator Sherrod Brown, who at the same hearing, deemed stablecoins “magic money.” And contrary to what they claim, Brown has it that stablecoins are neither decentralized nor transparent.

“If you put your money in stablecoins, there’s no guarantee you’re going to get it back,” he warned.

This year, Warren has taken multiple stances against DeFi, stablecoins, and cryptocurrencies at large, calling them a “lousy investment.” In July, she wrote to Treasury Secretary Janet Yellen urging greater regulation of the crypto industry.

All the warning signs are flashing,” Warren said at the time. “The hype, the volatility, the wild claims that turn out to be false. As the crypto market grows, so do the risks to our financial stability and our economy.

She also claimed that the same risks were associated with crypto exchanges in a letter addressed to the Securities and Exchange Commission (SEC).

Earlier this month, Warren charged after Bitcoin miners and their environmental impact. She specifically hit at the New York-based Bitcoin mining firm Greenidge Generation. The company has for months, been on the frontline of Bitcoin’s environmental controversy since its mining energy comes from natural gas. Fossil fuel is not as environmentally friendly as other renewable sources of energy.

Before that, in an interview with CNBC, Warren stated that “one of the easiest and least disruptive things we can do to fight the climate crisis is to crack down on environmentally wasteful cryptocurrencies.”

Tether, the largest stablecoin in the industry with a $78 billion market value, is currently facing a class-action lawsuit. Allegations, which have been made before, are a false representation of the ratio of its reserves to stablecoin issuance.