- Bitcoin is an “off-the-grid” alternative to the traditional financial system, SEC Chairman Gary Gensler said.

- Gensler joined former SEC chairman Jay Clayton on Wednesday to talk about Bitcoin, cryptocurrency, and ETFs.

- Issuers should “come within the investor protection remit” to launch a spot BTC ETF in the U.S., Gensler said.

Bitcoin is a competitor to the U.S. banking system and its worldwide consensus, the Securities and Exchange Commission (SEC) Chairman Gary Gensler said on Wednesday.

“We layered over our digital money system about 40 years ago with money laundering and various sanctions and regimes around the globe; we layered that over a digital currency system called our banking system,” Gensler said. “In 2008, Satoshi Nakamoto wrote this paper in part as a reaction, an off-the-grid type of approach. It’s not surprising that there’s some competition that you and I don’t support but that’s trying to undermine that worldwide consensus.”

Gensler’s remarks came during the DACOM Summit 2021, a compliance and market integrity event live-streamed on Wednesday. The SEC chairman joined Jay Clayton, who was in Gensler’s shoes as the commission’s head a few years past, for a conversation around Bitcoin, cryptocurrencies, digital assets, exchange-traded funds (ETFs), and decentralized finance.

Bitcoin, The Dollar, And Digital Assets

Throughout the conversation, the SEC chairman kept drawing a dividing line between Bitcoin and digital assets. While Gensler did not vouch for one or the other, he acknowledged their differences, highlighting the securities-like nature of many projects.

“These have largely been about raising money for entrepreneurs, and as such, meet the time-tested definition of an investment contract and thus falls under the securities laws,” Gensler said, referring to the many tokens being created and traded worldwide outside of his regulatory scope.

Gensler has said time and again how he views the cryptocurrency sector as a “Wild West.” He urged the “gatekeepers” of the many cryptocurrency projects in existence to “find a path to register and get within the investor protection remit.” Such projects, “whether it’s a trading platform or token,” he added, are “not going to evolve well outside of the tenets of public policy.”

When talking about digital assets, Gensler commented how, in his opinion, such developments already exist and don’t demand decentralization to function. The SEC chairman also drew a parallel between the U.S. dollar and the concept of digital currency, downplaying their differences.

“The U.S. dollar, the euro and the yen, and most of the public companies, are digital,” he asserted. “You buy and sell stocks that are digital, you buy and sell treasuries that are digital; there is no physical treasury debt any longer. I tend to call these digital assets.”

However, Gensler didn’t outright remove the right of other digital assets to exist. Ultimately, he said, investors should decide what’s worthy of investing their money in. Still, he demands clear and straightforward information on each project’s objectives with their offerings.

“At the core of our bargain in the securities markets is: investors get to decide what risks they want to take. But the people raising the money, the issuers, should share full and fair disclosure,” he said, adding that while the value proposition is “for the market to decide,” it must be “within public policy frameworks.”

Gensler highlighted the importance of “full and fair disclosure” in the perspective of “investor protection and fraud prevention.” If these digital assets fail to come under the regulatory umbrella of the SEC, he added, there could be financial instabilities in the future.

“We’re gonna have a ‘spill in Aisle 3’ and…it might be a financial instability event, or come from stablecoins, or by the investing public getting hurt by fraudsters or good-faith actors promoting and raising money,” the commission’s chairman said. “And the investing public didn’t, in hindsight, get enough information.”

“The innovations around DeFi could be real, but they won’t persist if they stay outside of the public policy frameworks,” he added.

On stablecoins, Gensler equated them to “poker chips at the casinos,” highlighting how the majority of the movement in that sector has been done inside trading platforms.

“They were initially brought forward to make the trading platforms more efficient, but it also allowed people around the globe to avert money laundering and tax compliance in jurisdictions,” he said.

The SEC chairman also shared that his commission is collaborating with sibling agencies such as the Commodity Futures Trading Commission (CFTC) in figuring out how different tokens should be treated by U.S. markets and its regulatory body.

“We’re working together to sort through that,” Gensler said. “But right now the public is not protected as it could be and as I believe it ought to be in this space. Technologies don’t long persist outside of public policy norms; people get hurt, trust is diminished. It’s far better to bring it inside the policy frameworks, and that’s what we’re going to try to do at the SEC.”

When Will The SEC Approve A Spot Bitcoin ETF?

When asked about bitcoin ETFs and the double standards being applied by the SEC to such products, Gensler declined to comment, saying he couldn’t discuss matters the commission is currently evaluating. But he did shed some light on what issuers need to do to have a spot bitcoin ETF approved in the U.S., although he said they already know what the SEC’s demands are.

“These platforms need to come in, get registered, come within the investor protection remit, ensure for the appropriate anti-manipulation and transparency, and deal with the custody issues,” Gensler said.

On November 29, asset manager Grayscale Investments sent a letter to the SEC outlining discrepancies in the agency’s rejection of spot ETFs and acceptance of derivatives-based offerings.

“The Commission has no basis for the position that investing in the derivatives market for an asset is acceptable for investors while investing in the asset itself is not,” the letter said.

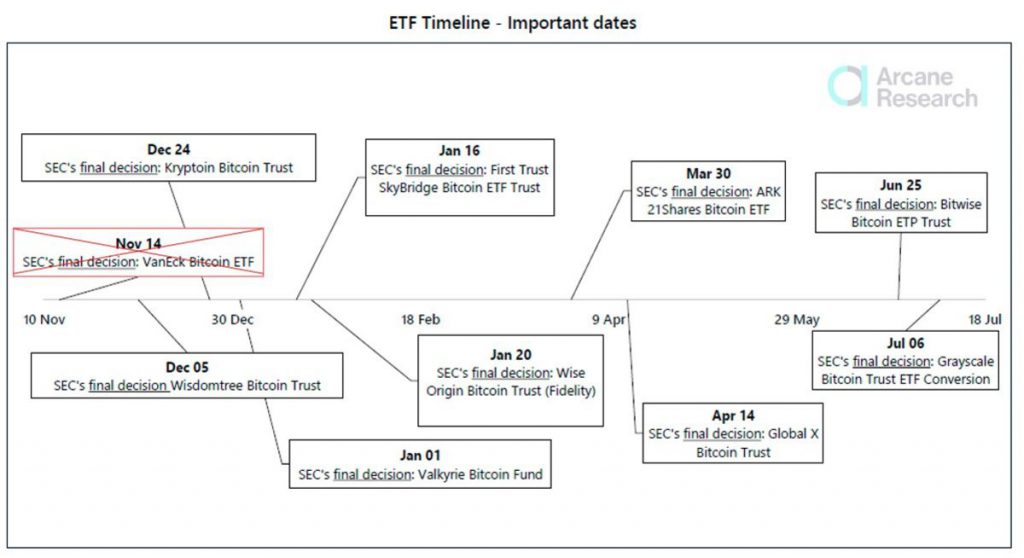

The SEC had denied VanEck’s spot bitcoin ETF proposal earlier that month, and a few more deadlines are coming up on its schedule. The commission has nearly ten filings lined up on its desk, awaiting approval.

Spot bitcoin ETF applications on the SEC’s desk. Source: Arcane Research.