The United States Securities and Exchange Commission (SEC) has charged the founders of Ormeus Coin with fraud. The two founders allegedly ran a multi-level marketing business that defrauded investors through misleading statements and false claims.

The United States Securities and Exchange Commission (SEC) has charged the founders of Ormeus Coin with fraud. The agency published a press release on March 8 on the matter, saying that the two siblings, John and JonAtina (Tina) Barksdale, had run a fraud operation that resulted in $124 million stolen.

The SEC said that the two individuals were responsible for offering two unregistered securities offerings that utilized a multi-level marketing scheme that used tactics such as misleading roadshows and YouTube videos to promote their business. The Barksdales had offered and sold subscription packages that included Ormeus Coin and an investment in a crypto trading program.

The press release reads,

“The complaint alleges that at the events, in the produced materials, and currently on Ormeus Coin’s website, the defendants falsely claimed that Ormeus Coin was supported by one of the largest crypto mining operations in the world, even though they abandoned their mining operations in 2019 after generating less than $3 million in total mining revenue.”

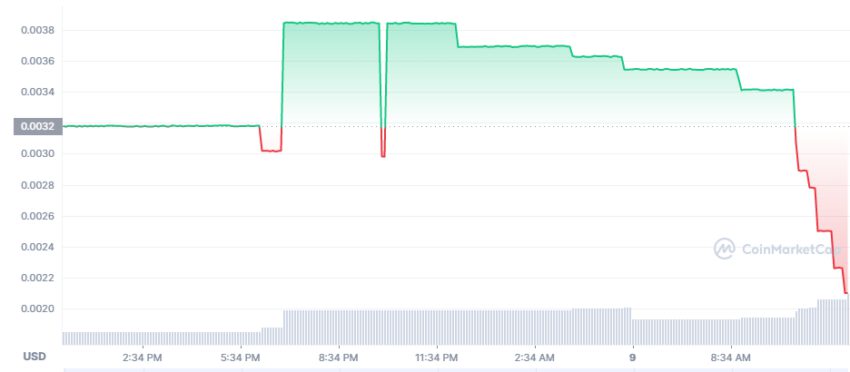

The statement also alleges other various false statements had been made. Ormeus Coin has dropped from $0.003839 to $0.002782 in the past 24 hours, a fall of roughly 21%.

US officials not taking crypto fraud lightly

The latest incident of fraud alleged by U.S. agencies is just one of many that have taken place in the past year. U.S. officials are rapidly stamping out fraudulent cases and unregistered securities as the crypto market grows popular.

The U.S. Department of Justice recently issued a notice on the owners of EmpowerCoin, ECoinPlus, and Jet-Coin. The department said that the founders had committed wire fraud and money laundering, resulting in over $40 million being stolen. Such cases are increasing in frequency.

The SEC has been clear on the crypto market needing supervision and ensuring investor protection. The Ripple lawsuit, which alleges that XRP is an unregistered security, continues and is unlikely to be resolved within the next 30 days.

The SEC is also investigating the NFT market over securities violations. This will prove to be another challenge for the SEC, which has its hands full as it also looks into crypto ETFs.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.