The agency’s worries about the forthcoming project include liquidity and the possibility of share controls. The SEC has informed Bitwise investment company about salvaging issues with share monopolization, fraudulent acts, and other possible challenges that can arise in its planned spot Bitcoin ETF. This information was passed as a notice to Bitwise on Tuesday.

What is Bitwise?

Bitwise was the first and biggest cryptocurrency index fund manager in 2017. Since its inception, the company has consistently sought the most favorable investment opportunities for its investors. As a result, users can leverage the platform for their profits with over 12 cryptocurrency funds and access 19 various cryptocurrency coins in a streamlined fund pattern.

Related Reading | Ethereum Gets Extra $38M In Staking From Ether Capital, Why Are They Doubling Bet On This Network?

The company boasts of providing investors simplified and advanced access to a well-developed platform that offers solutions to their most complicated questions.

SEC’s Concerns About Proposed Spot Bitcoin ETF

The Securities and Exchange Commission (SEC) has postponed its decision to allow the spot Bitcoin ETF deployment by Bitwise Asset Management. In addition, the agency sought more clarification from Bitwise concerning the matter.

In their notice sent to the investment company, the agency asked Bitwise to address how it will salvage share monopolization, fraud, and other possible problems in its planned spot Bitcoin ETF.

Bitwise And NYSE

In October last year, Bitwise and NYSE Arca presented their rule changes. After that, however, the United States SEC delayed its stand on the proposal, adjourning it till February 1, 2020. On reaching today, the regulator still deferred.

While the SEC delayed some proposals, it approved VanEck Bitcoin ProShares Bitcoin Strategy.

The Notice Buttressed

The Security and Exchange Commission pointed out the Bitcoin ETP TTrust’stransparency and liquidity area in the notice. Furthermore, the agency asked that the investment company throws more light on BBitcoin’ssuitability.

Also, the notice read that the coin markets are prone to manipulation; therefore, Bitcoin’s suitability is a fundamental asset for an ETP (Exchange Traded Products).

The agency’s delay followed after it postponed the Bitcoin exchange-traded funds by numerous issuers in the past months, including SkyBridge, Valkyrie, and Fidelity.

Related Reading | Bitcoin Outperformance Leaves Major Tech Stocks In The Dust In Last 30 Days

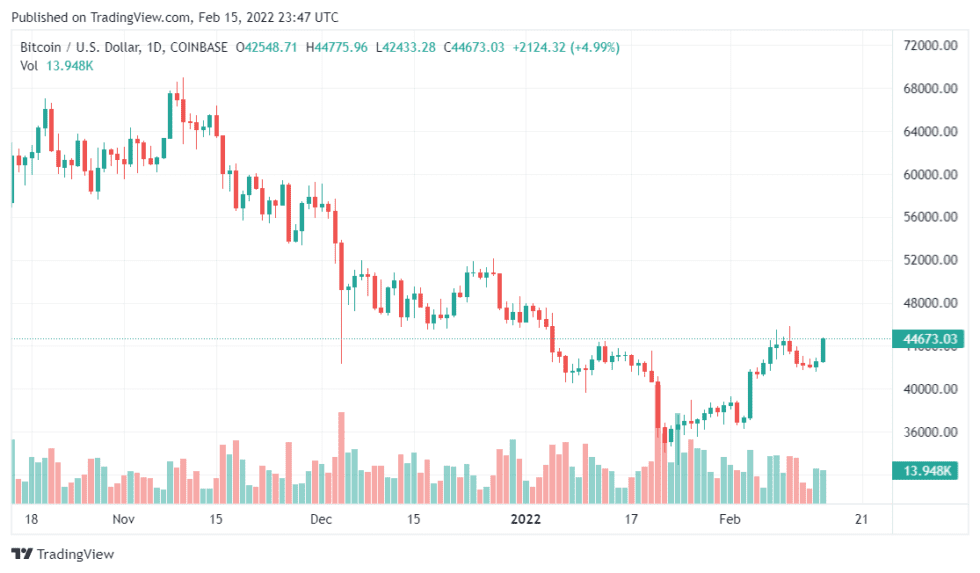

By 1.30 pm ET, the world’s leading crypto-coin traded at $38,468.16. This declined after it recorded an All-Time High price of circa $69,000 in November 2021.

Previously in December, the SEC delayed investment company Kryptoin’ssubmission for a spot Bitcoin exchange-traded fund. This rejection came after 8-months scrutiny of the proposal.

However, this decision was no surprise as the Security and Exchange Chairman had already stated his perception for BTC futures Exchange Traded Fund to an independent ETF that possesses the Bitcoin itself.

Featured image from Pixabay, chart from TradingView.com