With the continuous improvement of living standards, people have begun to realize the importance of financial management in order to secure more funds for the future. However, any financial tool carries risks, and a comprehensive understanding of a financial product, especially its attributes and flaws, is needed before one starts using it.

Newcomers to financial management stand to lose all their hard-earned funds without prior knowledge of the product they are investing in. Read on to find out how to embark on a sound financial management strategy.

Essentially, financial management can be divided into four steps:

- Set clear financial goals. Your financial plans must be aligned with your life goals. A clear and specific plan will help you realize your goals in an efficient manner. For example, if you wish to buy a car, you need to decide how much money to save and when to buy it. In addition, financial management must be an ongoing process that is subject to changes as priorities shift.

- Find out your financial status. Before you embark on personal financial management, you should know the state of your personal assets. In short, you need to figure out how much money you have, and how much of that can be allocated toward investment. Be sure to find out where your current personal financial shortcomings are.

- Figure out your risk tolerance. People’s tolerance for risk varies. Medium and high-level investment strategies are not advised if your psychological tolerance is on the average level. Take playing football as an example. Risky assets are akin to strikers, who’re responsible for gaining high returns; Stable assets more like central defenders, who can also generate income under normal circumstances, but perhaps not as often. Capital-guaranteed assets are guards. For example, treasury bonds, fixed deposits, and monetary funds. Guaranteed assets are like goalkeepers, savings insurance and physical gold are typical guaranteed assets. Assets need to be reasonably matched among these four types in order to obtain better stability, profitability and liquidity in the long term.

- Flexibility is essential. Financial plans cannot be static. When the market environment or the investor’s own financial situation changes, the financial plan needs to be adjusted according to the scenario presented. It is recommended to review your personal financial plan every six months and make timely adjustments.

For those who pay attention to investment and financial management, it is not difficult to detect the current market is one of negative sentiment made even more depressed due to tense Russia and Ukraine relations and soaring commodities prices. The prices of most investment products such as stocks, funds, and cryptocurrencies have fallen for several months with no rebound signal insight. People are getting timid and begin wondering: are there no safe and risk-free ways to gain profits amid such volatility?

An answer such as “Crypto space” might elicit laughter. The volatility in the crypto world is similar to riding a roller coaster. Even an experienced trader can easily keel over amid such instability. Entering the cryptocurrency space at this time is like asking for a dead end.

A little-known fact is, that there are safe niches for investment in the crypto space. Indeed, investors have tended to favor depositing their crypto assets with exchanges since the early days. Although the overall gains achieved from depositing such assets with exchanges could be lower than that of trading assets directly, users got accustomed to depositing plans offered by exchanges as such plans provide stable, guaranteed returns versus letting funds sit idle.

The gains obtained from depositing such digital assets in fixed deposit plans are provided by the trading platforms themselves, and APYs offered usually tend to be conservative. Most crypto exchanges offer APYs no higher than 7% for mainstream assets — APYs offered for USDT deposits typically range between 3% – 7%, while APYs offered for BTC deposits range from 0.66% to 1%. ETH deposits usually provide APYs between 1% to 5%.

To address the concerns around low APY and cater to the market demand, Huobi Global, a world-leading crypto asset exchange, launched an innovative product at the end of last year —PrimeEarn, a financial management platform promising users high APYs for depositing mainstream digital assets.

PrimeEarn allows users to deposit mainstream assets such as BTC, ETH, USDT, and HUSD for the highest annualized returns available in the market today. Since the PrimeEarn series was first launched in December last year, products have sold out in record time — for example, the latest PrimeEarn High-Yield Tuesday event (held April 26) saw USDT and BTC fixed deposit products sold out within 1 minute, with HUSD fixed deposits snapped up in 4 minutes.

This begs the question: Why is PrimeEarn so popular among investors? Why is it the deposit plan of choice when the market is experiencing huge volatility?

- High APY: Huobi’s PrimeEarn High-Yield Tuesday enables investors to gain up to 40% APY for depositing mainstream assets such as BTC, ETH and USDT for 14 days, the highest available rate in the market.

- Low risk: PrimeEarn provides 14-day fixed deposit plans for mainstream assets with guaranteed returns, regardless of market sentiment.

- Mainstream assets: There are few deposit products available in the market for the top 3 major assets (BTC, ETH and USDT) by 24h trading volume in the market. The PrimeEarn platform offers investors the opportunity to deposit the most popular mainstream assets and gain attractive APYs in return.

- Fixed deposit: The long-term deposit period offered by Huobi PrimeEarn means income loss arising from idle funds can be effectively avoided.

- No tiered APY: In contrast to some platforms which set tiered APY for deposit products, PrimeEarn sets no such condition — with no tiered APY, investors truly enjoy returns as advertised.

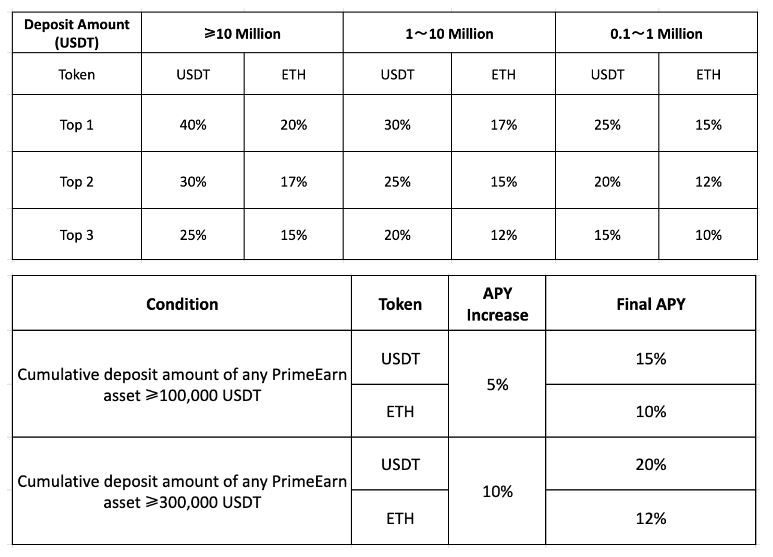

The 13th PrimeEarn Tuesday event will be rolling out next Tuesday; users can either team up to win 40% APY for USDT deposits or deposit a certain amount of assets to enjoy up to 20% for USDT deposits and 15% for ETH deposits. In addition, all users who participate in the 13th PrimeEarn will have a chance to obtain 1% or 0.2% APY booster coupons for USDT and ETH deposits, respectively.

To participate in the 13th PrimeEarn event (11:00 on May 3, UTC), click here.

Disclaimer: This is a paid post and should not be treated as news/advice.