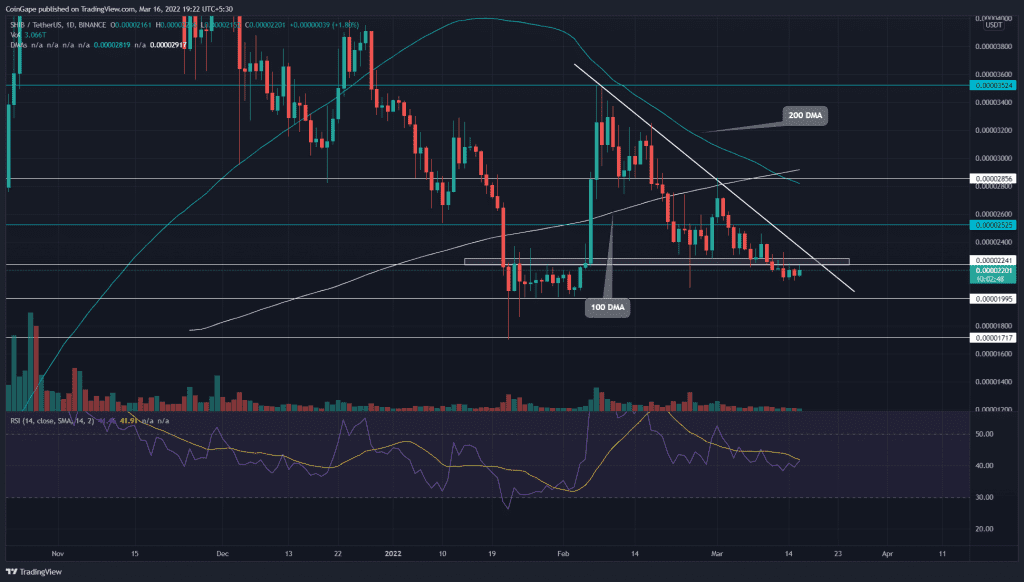

The Shiba Inu price(SHIB) has been trapped in a minor consolidation phase for the past five days. The coin chart showcased multiple short-body candles below the $.000022 support, suggesting indecision in market sentiment. However, despite the sloppy price action, the Shiba Inu use case got another pump as the Turkey ambulance service started accepting $SHIB as payment.

Key points:

- The 100 and 200-day MA bearish crossover could intensify the selling pressure

- The intraday trading volume in the Shiba Inu coin is $659.3 Million, indicating a 0.11% gain.

Source- Tradingview

Under the descending trendline influence, the SHIB/USDT pair has lost 38% from its last swing high of $0.0000352. On March 11th, the sellers poked another significant support of $0.000022, resuming the ongoing sell-off.

However, the never-ending retest phase has spent five days trying to sustain below the breached support. If the coin price continues to waver below the $0.00002 mark, the supply pressure should eventually pick up and dump the altcoin to a $0.00002 psychological level.

A follow-up breakdown should open the path to January low mark at $0.000017.

Contrary to the bullish thesis, if buyers revert the altcoin above the shared resistance of $0.000022 and descending trendline, the traders can expect a 12% rally, hitting the $0.000025 mark.

Technical indicator

The recent negative crossover of the 100 and 200-day EMA strengthens the bearish sentiment over the price. Moreover, the 20-day EMA dynamic resistance stands as the first line of EMA defense for sellers.

However, the Relative Strength Index breached a self-support level of 41%, showing a growing bearish momentum.

- Resistance levels- $0.0000226, and $0.0000253

- Support levels are $0.00002 and $0.000017.