Not so long ago, the Shiba Inu [SHIB] community was wondering when SHIB would bounce off its short-term support or crash further.

The narrative has changed since then after the rally it delivered at the tail end of October. Nevertheless, it is off to a bearish start this month but will we see prices revert to the lower range or will the bulls dominate?

Here’s AMBCrypto’s price prediction for Shiba Inu (SHIB)

Perhaps the latest activity may shed some light on the net possible outcome for SHIB. For example, we observed the return of sell pressure in the last three days, which is normal. Sell pressure is expected after a rally of more than 40%.

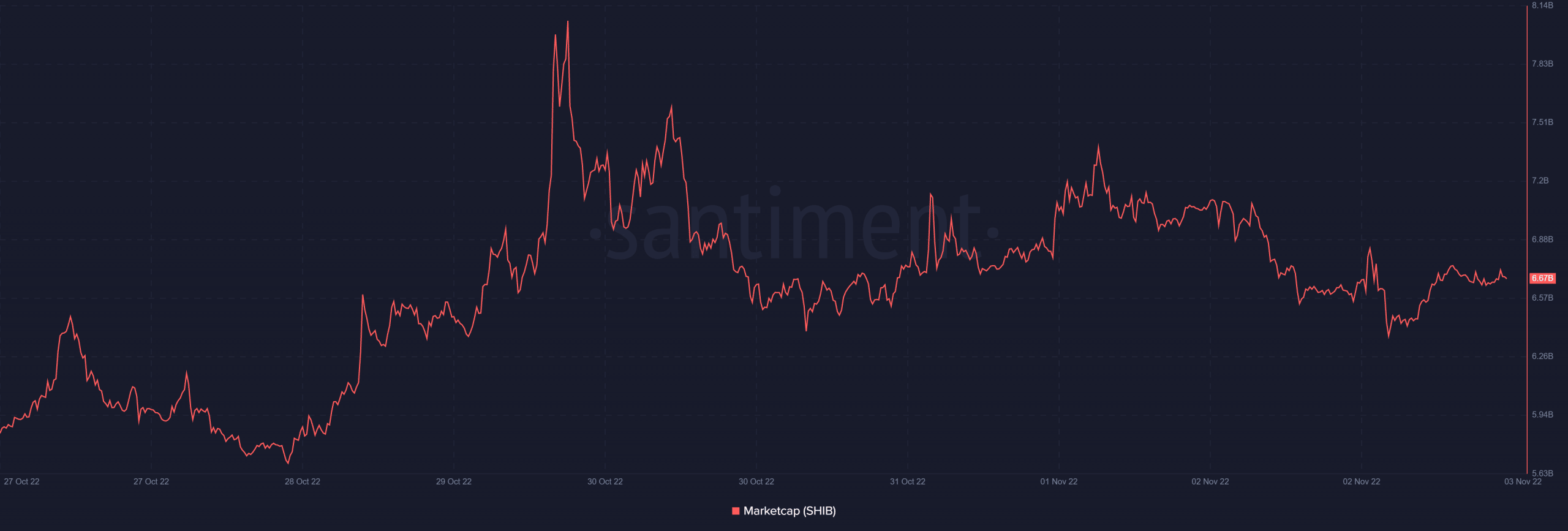

SHIB’s $0.00001218 press time price already represented a 19% retracement from its October peak. However, its outcome in the last 24 hours demonstrated a return of bullish demand.

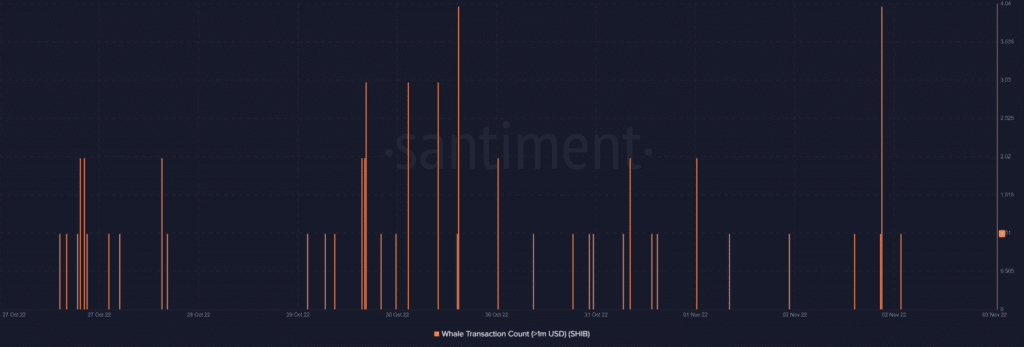

The price, at the time of writing, represented a 3.57% gain in the last 24 hours. Interestingly, the upside was backed by a strong surge in the whale transaction count in the last 24 hours.

The upside suggested that the whale activity observed was incoming buying pressure. Roughly four whale transactions occurred on 2 November which in the grand scheme of things may not necessary be a heavily bullish sign.

On the other hand, whales often have a bigger impact on the price. A market cap analysis reveals that SHIB’s market cap surged by over $110 million in the last two days.

Such market cap increases have historically ushered in more liquidity. Whether or not that will be the case this weekend, is anyone’s guess.

Can SHIB secure enough bullish volumes?

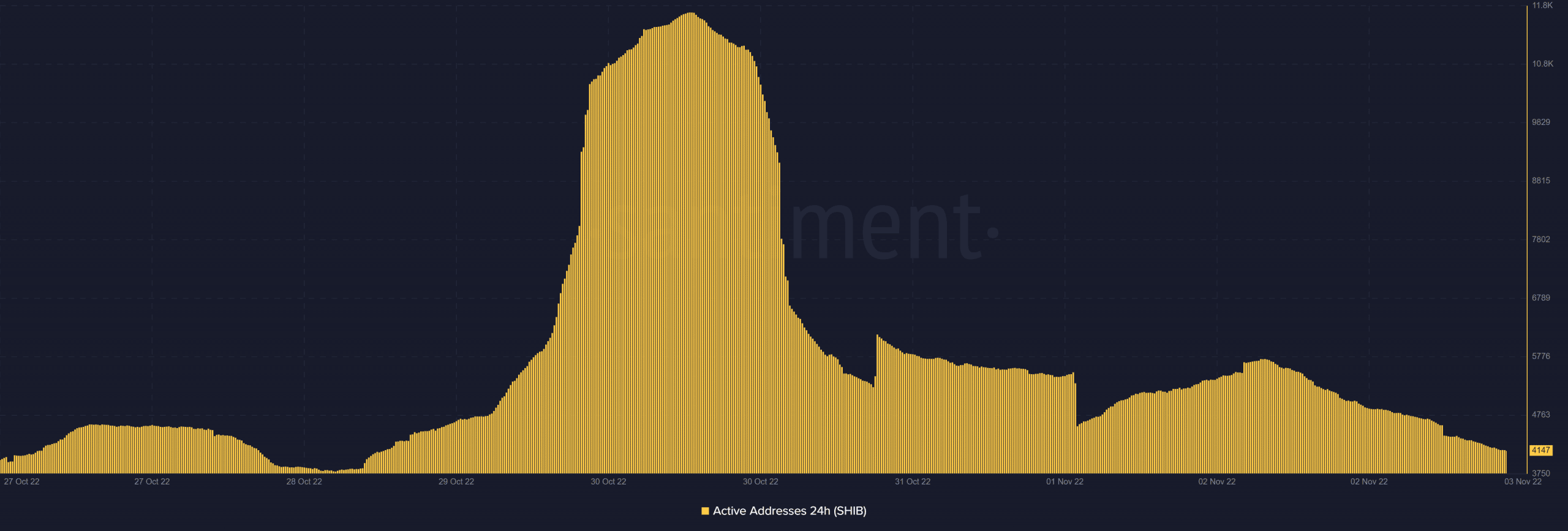

Notably, limited retail participation was observed. For example, daily active addresses surged slightly on Wednesday (2 November) but have since dropped closer to weekly lows.

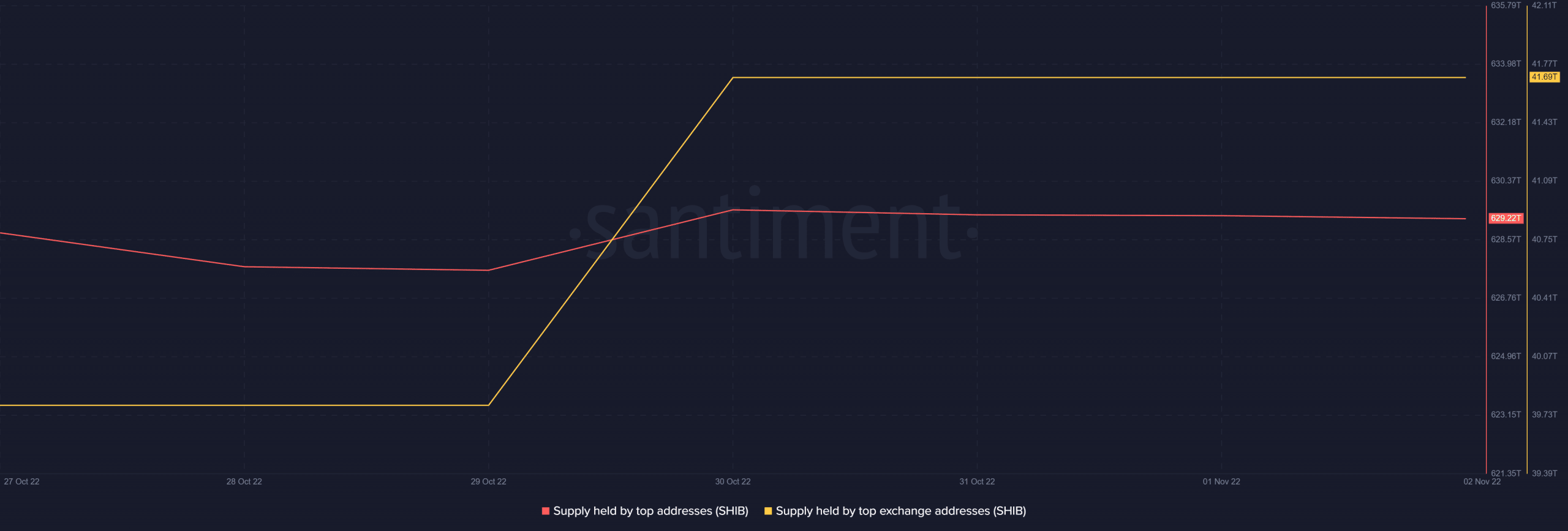

The current level of daily active addresses indicates a lack of strong enough demand to support more upside. In addition, the supply of SHIB held by top non-exchange addresses barely registered the latest whale activity.

However, the supply of SHIB held by top exchange addresses registered a notable increase in the last seven days. While this may indicate accumulation, it also suggests that the accumulation might be short-term since holders are not moving their holdings to wallets.

Conclusion

The recent whale accumulation might have shut down the previous sell pressure that kicked off at the start of November. However, the lack of follow-up retail volumes suggests that we might not see another major move perhaps until the weekend.

Regardless, the market could still shift especially on 4 November but it remains to be seen which side the coin will land on.