Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

- Shiba Inu witnessed a patterned breakout, can the sellers step in to inflict a reversal?

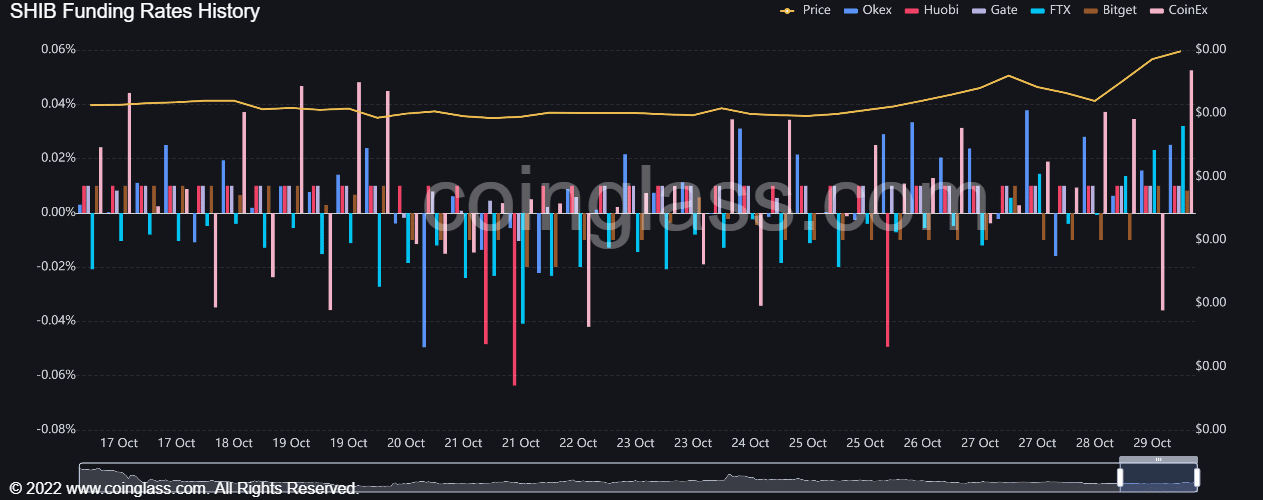

- The funding rates revealed a one-sided bullish edge for buyers.

Shiba Inu [SHIB] finally found a bullish volatile break beyond the chains of its two-month trendline support (yellow, dashed). The dog-themed finally altered the near-term narrative in favor of the bulls as the price rose above the EMAs. (For brevity, SHIB prices are multiplied by 1,000 from here on).

Here’s AMBCrypto’s price prediction for Shiba Inu [SHIB] for 2023-24

The recent bullish pattern’s breakout paved a path for solid double-digit growth over the last day. A plausible reversal from the $0.01198-level could aid the sellers in easing the heightened buying pressure.

At press time, SHIB traded at $0.0121, up by 16.4% in the last 24 hours.

SHIB exhibited overbought readings, can the sellers re-enter?

The meme token’s ascent from above the $0.01014-level over the last three days set the foundation for a robust bull run above the 20 EMA (red), 50 EMA (cyan), and 200 EMA (green).

SHIB’s recent revival chalked out a bullish pennant on the four-hour timeframe. After a bullish engulfing candlestick, the pattern saw an expected breakout that set the stage for buyers to induce a rally.

While the 20/50 EMAs looked north, the resultant golden cross reaffirmed a strong bullish edge. A rebound from the $0.012-region could halt the streak of the ongoing green candles. In this case, the $0.01163-mark would be the first major support level for the sellers to test.

An immediate or eventual close above the $0.01212-mark can expose the token toward a short-term upside. In such circumstances, SHIB could witness a bearish invalidation.

Furthermore, the Relative Strength Index (RSI) marked a steep uptrend toward its overbought region. A likely reversal from this zone can ease the buying pressure in the coming sessions. Also, its lower peaks over the last few days bearishly diverged with the price action.

Funding rates turned positive on all exchanges

Over the last few hours, SHIB/s funding rates across all the exchanges turned positive after a substantially long time. This reading entailed a strong bullish sentiment in the futures market. Any potential decline from these highs could slow down the bull run in the coming times.

Also, the alt shared a 69% 30-day correlation with Bitcoin. Thus, keeping an eye on Bitcoin’s movement with the overall market sentiment could be essential to identify any bearish invalidations.