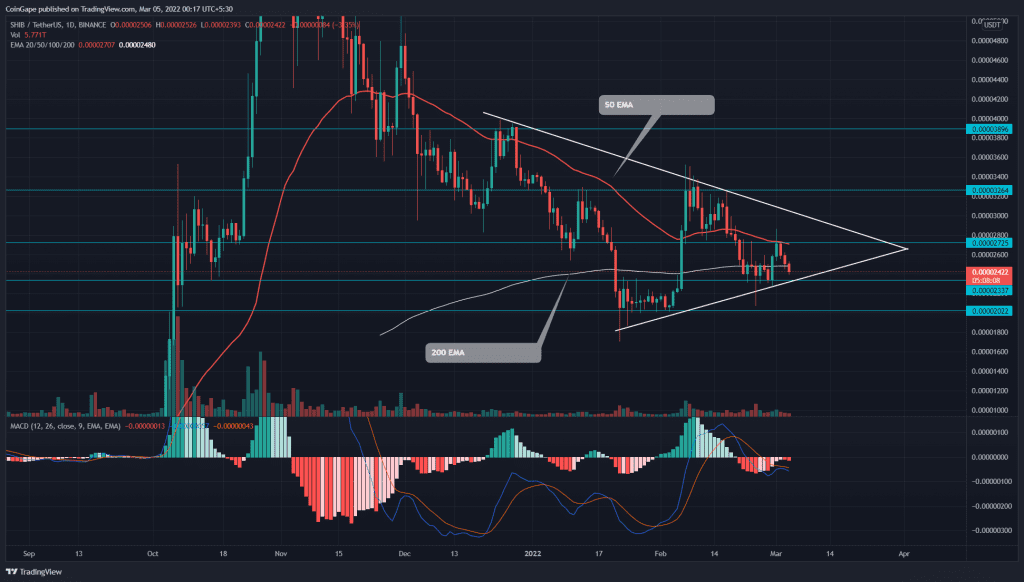

Shiba Inu price would soon retest weekly support of $0.000023, suggesting a reversal opportunity for traders. The meme coin forming a symmetrical triangle pattern in a longer time frame preparing for its upcoming rally. Moreover, the recent announcement about Richmond and Shiba Inu partnership, along with the American movie theater chain (AMC) accepting SHIB.

Key technical points

- The SHIB price plummets below the 200-day EMA

- The SHIB price tumbled by 11% in the last three trading session

- The intraday trading volume in the Shiba Inu coin is $1.2 Billion, indicating a 29% gain.

Source- Tradingview

On March 1st, the Shiba Inu (SHIB) buyers attempted to breach the combined resistance of $0.000027 and the 50-day EMA. However, the intense supply pressure reverted the altcoin forming a long-wick rejection candle.

The bearish reversal displayed three consecutive red candles, registering an 11% fall in the last three days. However, the altcoin steadily approaching the immediate support of $0.000023 with decreasing volume activity indicates weakness in selling momentum. A reversal sign at this support would suggest the traders are accumulating at this dip, which would drive the Shiba Inu price 25% high, hitting the overhead resistance trendline.

Moreover, the SHIB chart shows a symmetrical triangle pattern formation in the daily time frame chart. The pattern’s support trendline would bolster the buyers to rebound from the $0.000023 level and begin the next bulls cycle.

However, a breakout and closing beyond the converging trendlines would signal the next directional move in SHIB price.

Technical Indicator

The flattish 50-and-200 EMA suggests a short-term sideways rally. However, the coin price trading below these EMA indicates the sellers have the upper hand.

The Moving average convergence divergence shows the MACD and signal line has recently nosedived below the neutral zone, projecting a negative sentiment.

- Resistance levels- $0.000025, and $0.000027

- Support levels are $0.000023 and $0.00002.