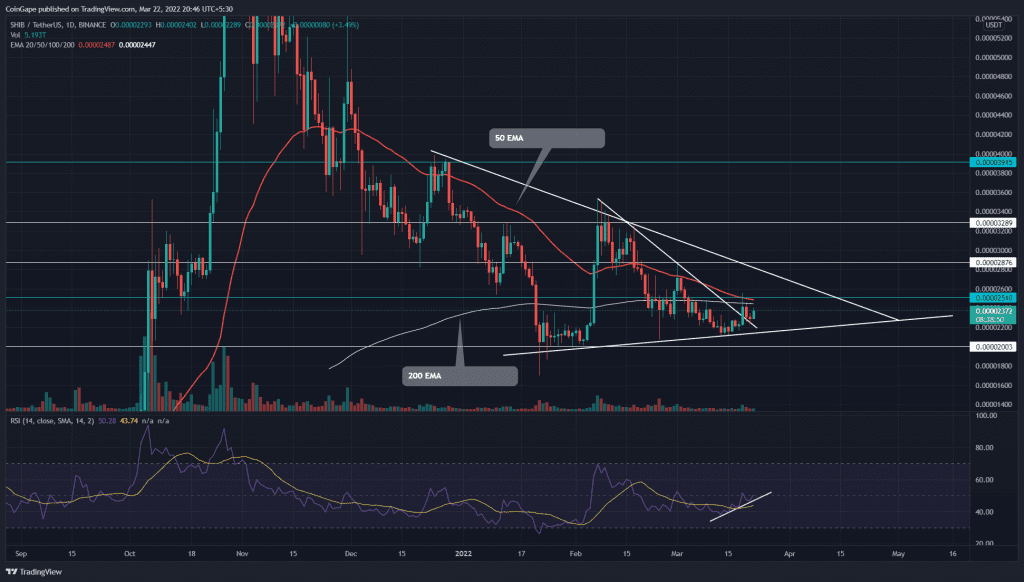

A descending trendline breakout reinforces the SHIB price attempts to rebound from the bottom support trendline. However, the shared resistance of $0.000025, 50-and-200-day EMA prevents the coin price from rising higher. The buyers need to gather enough bullish momentum during the ongoing retest if they want to overcome the overhead barrier.

Key points:

- The SHIB price displays morning star candle for trendline retest

- The expected bull cycle would surge SHIB price by 17%

- The intraday trading volume in the Shiba Inu coin is $885.9 Million, indicating a 4% gain.

Source- Tradingview

The recent bear cycle within the symmetrical triangle pattern plunged the Shiba Inu(SHIB) price to the $0.0000213 mark, registering a 40% loss. Furthermore, a steeper descending trendline carried the downfall, undermining a buyer’s attempt to rally higher.

On March 13th, the altcoin bounced back from the support trendline and poked the steeper resistance trendline on March 19th. This bullish breakout triggered a new bull cycle which would drive the altcoin to the overhead trendline($0.0000275).

Moreover, the altcoin currently resting the breached trendline shows the formation of the morning star candle. Sustaining this breakout hints, the prior resistance had flipped to support, and the road to overhead trendline displays a quick gain of 15.4%.

Best optionsEarnEarn 20% APRWalletCold WalletEarnEarn 20% APR

Contrary to the bullish thesis, fallout from the support trendline will resume the downtrend rally and plummet the altcoin to a $0.00002 psychological level.

Technical Indicator

The 50-and-200 EMA moving near the $0.000022 resistance strengthens the sellers’ defense at this mark. However, the price action set up the new relief rally could prevent the potential death crossover among these EMAs.

The Relative Strength Index slope rallying higher bolsters the possibility of bullish reversal from $0.00022 support.

- Resistance levels- $0.000025, and $0.0000287

- Support levels are $0.000022 and $0.00002.