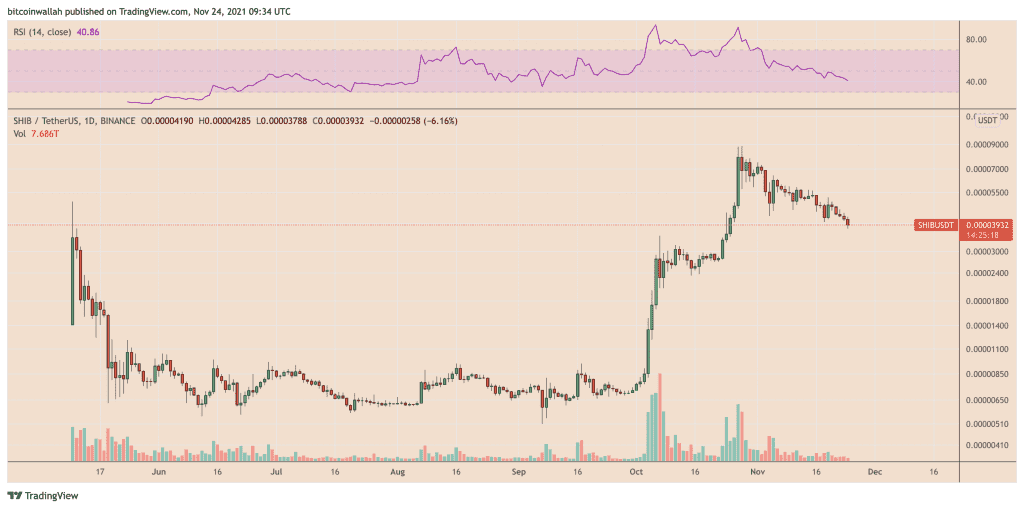

Shiba Inu (SHIB) edged further down on Nov. 24 as its appeal among the army of retail traders, who helped it rally by more than 535% to a record high of $0.00008854 earlier this year, declined.

SHIB’s price dropped by nearly 60% after establishing the said all-time high on Oct. 28, signaling that traders have been actively locking their Shiba Inu profits. That has further resulted in a substantial drop in SHIB’s benchmark instrument SHIB/USDT’s volumes on Binance, underscoring a weak retail interest.

In doing so, SHIB tokens’ reported market capitalization slipped to $21.30 billion from around $28.31 billion in just five days beginning Nov. 19.

Google’s keyword search data also showed a declining interest in the “Shiba Inu” markets, with its score on a 12-month timeframe dropping down from a perfect 100 to 20, much in line with the SHIB’s 60% price correction.

Alex Krüger, an independent market analyst, referred to the dropping Google Trends for the keyword “Shiba Inu” as a sign that the token has been topping out, i.e., the beginning of its bear cycle.

More selloff ahead?

The latest bout of selling in the Shiba Inu market pushed its prices below a critical upward sloping support (the velvet trendline), triggering its potential to undergo further declines.

For instance, the levels defined within the scope of the Fibonacci retracement graph, drawn from a swing low of $0.00000614 to a swing high of $0.00008933, provided potential entry and exit points as the SHIB price trended lower, as shown in the chart below.

So it appears the SHIB price’s latest price had it test the 0.618 Fib line at $0.00003792 as its interim support level. A rebound off the said price floor raised SHIB’s potential to retest the upward sloping trendline as resistance, which coincides with the 0.5 Fib line at $0.00004773.

Conversely, a move below $0.00003792 may risk sending the SHIB price to the 0.786 Fib line at $0.00002394. Market analyst Income Sharks also highlighted the area around $0.00002394 as a potential “buy zone” while referring to a weekly SHIB chart.

$SHIB – Think we see weekly supertrend support eventually touch. This is where I would look to get back in if I was to play this. pic.twitter.com/nBmtfB77n6

— IncomeSharks (@IncomeSharks) November 23, 2021

SHIB price Bull Flag setup

Offsetting the selloff fears in the SHIB market is the occurrence of a potential Bull Flag setup.

Related: Shiba Inu in danger of ‘topping signal’ as SHIB price loses 50% in 3 weeks

In detail, the SHIB price has been trending lower inside a downward sloping channel since topping out at $0.00008854 on Oct. 28. The channel more or less appears like a Bull Flag, a bullish continuation indicator that appears as a consolidation phase following a strong move higher, as shown in the chart below

Typically, traders place their upside target at length equal to the height of the previous uptrend (called Flagpole), anticipating that the instrument would break above the Flag range with higher volumes. As a result, SHIB has the potential to rally by as little as $0.00005100, its Flagpole’s height.

That puts the Shiba Inu token en route toward $0.00010000.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.