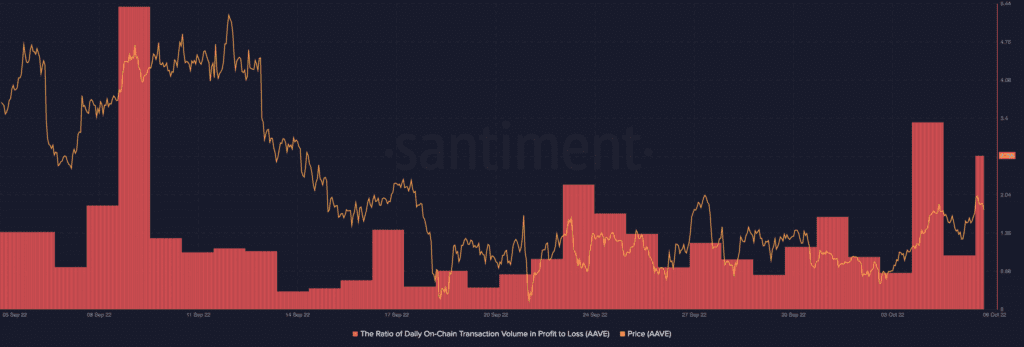

As a result of the rally in the price of AAVE since the beginning of the trading week, there has been a surge in profit-taking levels for the crypto asset, data from Santiment revealed.

At press time, exchanging hands at $78.90, the price of the ghost token has increased by 8% since the beginning of the week. This growth in price has led many AAVE holders to go about taking profit as the asset’s ratio of daily on-chain transaction volume in profit to loss has gone up since the week started.

At press time, this was 2.736, data from Santiment showed.

Like many other cryptocurrency assets, AAVE shares a statistically significant positive correlation with Bitcoin [BTC]. As such, it is believed that its price might see some more growth if the price of the leading coin stabilizes above the psychological $20,000 price region.

But will that be enough?

The week so far has been marked by a rally in AAVE’s price. On the daily chart, buying pressure for the crypto asset increased in the past few days.

With increased liquidity pumped into the AAVE market since Monday (3 October), its Relative Strength Index went up to lie at the neutral 50 region as of this writing.

This also caused its Money Flow Index to attempt a cross-over above the center line, and as of 5 October, it touched 53. Although at press time, this rested on the 50 center line.

Also, the dynamic line (green) of AAVE’s Chaikin Money Flow rose above the center line (red) to a high of 0.04 during the intraday trading session on 5 October. At press time, it was positioned at 0.02.

While these key indicators rallied due to the growing buying pressure since the week started, the increased profit-taking that has accompanied the price rally has caused these indicators to grow flat.

This indicated that AAVE buyers have been unable to sustain the rally. As of this writing, the sellers were spotted gearing up to overrun the market.

On the chain, the intensity of whale transactions is known to be a great determinant of where the price of an asset would go next.

As per data from Santiment, the average daily count of whale transactions above $100,000 since the beginning of the week stood at 9 transactions.

As for whale transactions above $1,000,000, the highest daily count this week was two transactions recorded on 4 October. With a very minimal whale transactions count on the AAVE network, there might not be enough to support a rally in its price just yet.

Finally, the long stretch of AAVE’s Mean Dollar Invested Age (MDIA) suggested stagnancy on the token’s network, which might make it for its price to climb.

While a rally in BTC’s price might cause AAVE to post some gains, continued stagnancy on its network would make any such rally short-lived.