The plans to add crypto to credit cards impressed the community. With such additions, users can access credit facilities in crypto for payments or other activities. A credit card is one of the fastest means of accessing money for payments. Many countries operate a cashless economy whereby debit and credit cards reign.

But according to a new report, the Singaporean Monetary Authority aims to stop such opportunities. The reason behind the decision is the crash of Three Arrows Capital, or 3AC, as popularly called. The Singapore-based crypto hedge fund filed for bankruptcy, causing terrible losses and many negative events.

Singapore Central Bank Release Two Papers On Crypto Regulation

The bank released two consultation papers in the plan to regulate crypto better. The papers propose how DPTSPs (digital payment token service providers) and stablecoin issuers should operate under the “Payment Services Act.”

The bank published the papers to reduce the consumer’s risks when engaging in crypto trading. The documents also aim at improving the way by which stablecoin transactions take place.

The first paper contains the bank’s proposals to guide how DPT services and other services involving top coins, such as BTC, XRP, and Ether, operate. The guideline reiterates that leveraging or credit facility in DPTs trading would lead to more significant losses than the user’s investment.

So section 3.20 of the paper shows MAS’s proposal to ban DPTSPs from offering credit facilities to retail customers in crypto and fiat. Moreover, MAS insists that crypto service providers stop accepting credit card deposits in exchange for their services.

More importantly, MAS suggests that DPTSPs should keep their customers’ assets different from theirs. By that, they can hold these assets for their customer instead of repeating the failure of 3AC in June.

But if the providers don’t want to hold the assets separately, they could carry out tests to identify the level of knowledge their customers have on crypto investment risks.

Provisions Of The Second Paper

The second paper focused on stablecoin issuers in Singapore. It outlined some requirements they must meet to operate in the country.

Section 4.21 of the paper MAS proposes that issuers should stop lending or staking stablecoins pegged to a single currency (SCS) and lending other crypto assets.

Another significant proposal is to mandate a minimum capital base of $1 million or 50% of the SCS issuer’s annual operating expenses. MAS stated that the SCS should always hold this capital, including liquid assets.

After releasing the papers, MAS has opened the floor for comments by December 21, 2022. So, the Singaporean crypto community can react to the proposals.

The latest development may not sit well with many operators. But MAS aims to protect investors’ interests and capital due to the recent trend of crashes, liquidations, and losses.

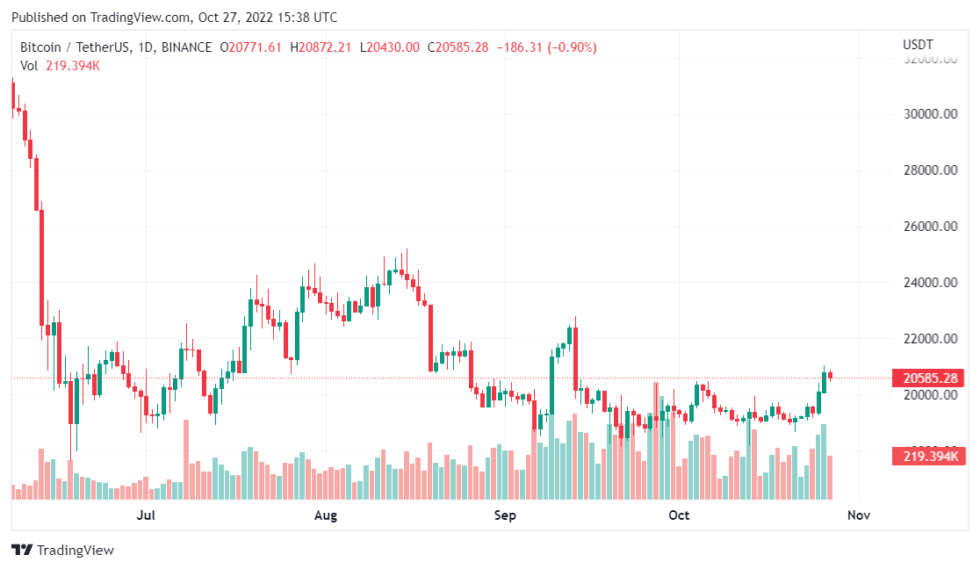

Featured image from EyeEm, Chart: TradingView.com