This is an opinion editorial by Dan Luddy, a mechanical engineer and energy consultant with 15 years of experience in high performance building design.

The energy we use to heat our buildings is a major contributor to global greenhouse gas emissions and is a focus of decarbonization initiatives. By reusing waste heat, Bitcoin mining could be profitably integrated into commercial and residential buildings and be a catalyst for electrification retrofits that would improve building performance and reduce global carbon emissions.

Reducing Emissions From Buildings

A significant portion of building energy use is in the form of heat, most of which comes from burning natural gas.

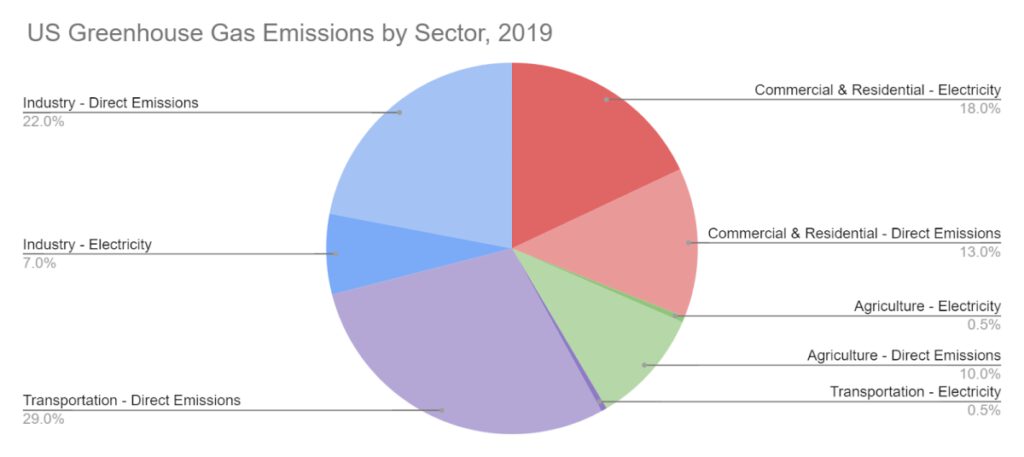

Emissions associated with commercial and residential buildings account for over 30% of US greenhouse gas emissions. Source: EPA Greenhouse Gas Inventory 2019

As a replacement for gas, electric resistance heating is a simple technology and eliminates emissions on-site. But it is 3-5X more expensive than gas at average utility rates and is only as clean as the power plant that generates the electricity.

A more effective solution is heat pumps, which absorb and compress heat from outdoor air, water or from a geothermal well. Heat pumps are a much more efficient option, so operational costs are comparable to gas. However, most heat pumps need electric backup in very cold temperatures (

Eliminating greenhouse gas emissions from the built environment runs into a cost impediment: New equipment, new infrastructure and minimal return in operational cost savings. This financial challenge is where bitcoin mining could change the equation by providing heat as a byproduct.

Electrifying With Bitcoin Mining

Almost all the power drawn by a mining ASIC is converted into heat, which needs to be removed from the machine. Air-cooled ASICs have fans that blow the heat out. This can be used for heating the surrounding air, but is hard to compress, transport or store for other uses.

Fluid-cooled ASICs (water or dielectric liquid) present a better opportunity for integration with building systems. By connecting fluid-cooled ASICs to hot water systems with piping, a pump and a heat exchanger, the mining operation provides a source of hot water that can be used in a building. Additionally, the ASICs can run 80% faster and 5% more efficiently than air cooled equipment.

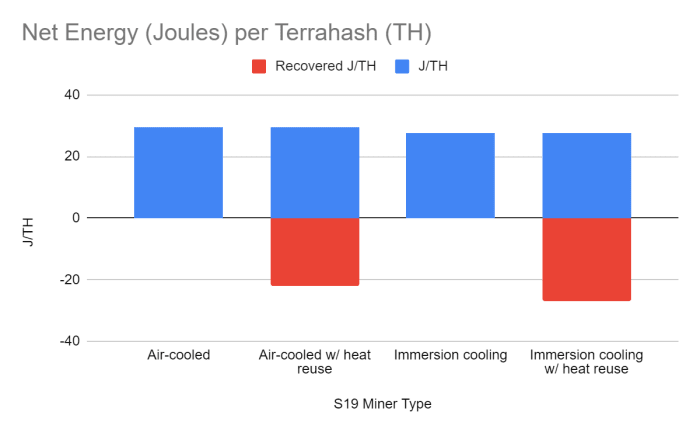

Fluid cooled ASICs use approximately 5% less energy than air cooled ASICs for the same TH. Furthermore, fluid cooling allows for more effective capturing of heat energy to offset the energy cost of mining. Source: Author

The hot water generated by Bitcoin mining can be used for a number of uses within different building typologies, including space heating, domestic hot water, pool heating and industrial uses. There are many buildings that have both a large electrical service and year-round hot water demands, including hotels, multifamily housing, laboratories, university buildings, manufacturing facilities and more.

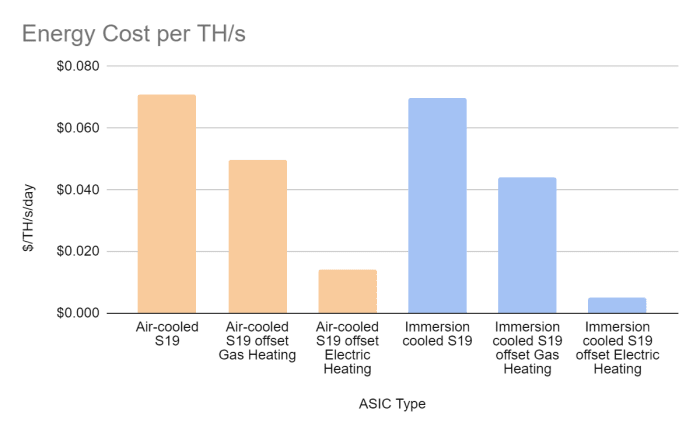

When used to replace gas heating, reused waste heat can offset ~33% of the costs of mining. Since the water-cooled equipment runs more efficiently, the miners can run profitably even at retail electric rates by running faster and selling the excess heat. Furthermore, the building is then eliminating on-site fossil fuel emissions associated with heating.

Reusing heat in the building can recoup a significant portion of the mining operation’s energy costs. The chart above assumes an average electricity rate of $0.10/kWh. Source: Author

Solar Integration

The reuse of waste heat makes a financial case for integrating bitcoin mining into building systems, but it would be more attractive if considering integration of on-site solar photovoltaic (PV) production. PV arrays on rooftops or integrated into parking canopies have dropped significantly in price in the last decade, which has led to greater levels of adoption. Depending on the utility provider and connection, power generated by the PV panels in excess of the building demand can either be sold back to the grid via net metering, stored on site or at worst, wasted.

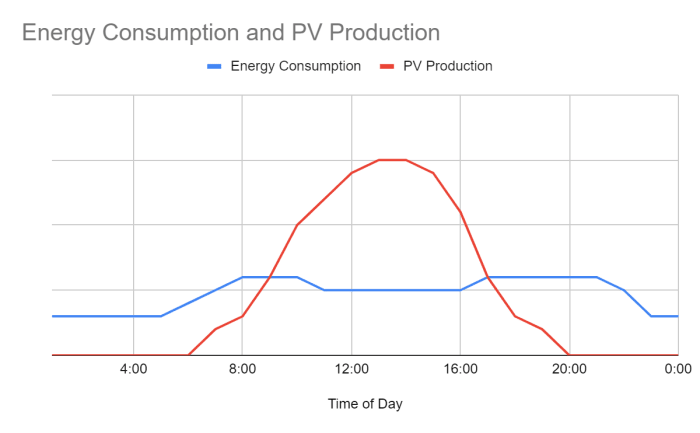

On-site PV solar installations can produce excess power during peak conditions. While some utilities allow consumers to sell power back to the grid (net metering), using that power for Bitcoin mining may be more profitable depending on market conditions. Source: Author

A Bitcoin mining system on site presents another option to utilize excess solar PV production. Depending on the difficulty adjustment and utility net metering agreement, using the excess energy to mine bitcoin may be more profitable than selling it back to the grid. This additional revenue option incentivizes building owners to maximize PV arrays on-site, generating additional capacity and reducing dependence on electricity generated from fossil fuels.

Demand Response

Many utilities are offering demand response programs to curb excess demand during periods when the grid is reaching maximum capacity, such as during a heat wave. In many of these programs, building owners can receive incentives or payments by the utility to modify its operations during peak conditions to shedding a certain percentage of load and stabilizing the grid when needed.

A building modified to operate with a bitcoin mining system can respond favorably within these programs. Mining rigs can be shut down almost instantaneously, and demonstrate a significant reduction in peak demand, helping to shift electrical resources to more essential life and safety resources. Participation in these programs can generate additional revenue, essentially providing payments to the building to not mine during specific times.

Decentralization

One of the fascinating characteristics of bitcoin mining is the scalability. Depending on the price of electricity, the potential to reuse heat and access to infrastructure, single ASICs can operate cost competitively compared to large-scale miners with massive data centers. Commercial and multifamily buildings provide a mining operation size that is in the middle of that range. There are thousands of buildings around the world where mining could be successfully integrated, which would expand the bitcoin network and further distribute hashing power.

Potentially there could be a day where bitcoin miners not only secure the network, but also provide hot water for affordable housing units, heat for schools and offices and absorb excess solar energy from rooftops.

Future Scenario — Low Carbon Housing With Bitcoin Mining

Consider an apartment complex that has opted to install a fluid-cooled unit in the basement in the room that used to house a gas-fired boiler. The electrical system retrofit and mining equipment has been financed and installed by a mining operator that will share revenue with the building owner.

The mining heat provides hot water for showers, sinks, dishwashers and washing machines. In the winter, the miners work overtime to provide heating for the apartments. During the peak days of summer, a newly installed rooftop PV system feeds excess power back to the miners to keep them running at low cost. The building participates in local grid demand response programs and shuts down mining as needed to respond to peak conditions and acquire extra revenue.

As a result, the owner has additional capital that can be invested back into the building to improve maintenance, enhance the property value and improve the experience for building tenants, all while reducing carbon emissions. This same approach could be scaled and implemented across commercial and residential portfolios, presenting a triple win for bitcoin, buildings and the environment.

This is a guest post by Dan Luddy . Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.