As the bulls clawed back to reopen a recovery window, Solana crossed its 20 EMA but pulled back from its 25 EMA. Its 4-hour RSI still needed to close above the midline to confirm a strong reversal.

Moreover, Bitcoin Cash and EOS’ RSI crossed the equilibrium. But they needed to inject more volumes to display a bullish comeback possibility.

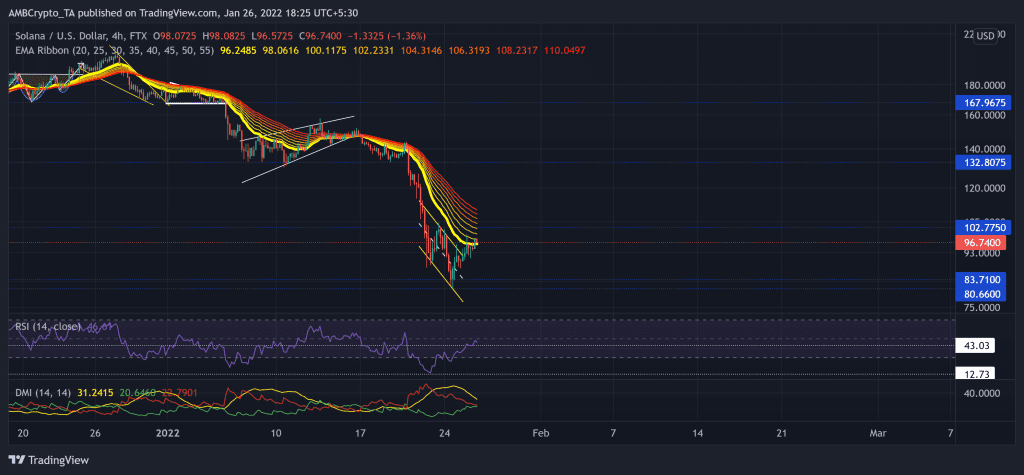

Solana (SOL)

Losing the $167-mark was menacing for SOL bulls while the bears kept exerting sustained pressure. On top of it, the 21 January sell-off led to alt to lose the $132-level as it registered a 43.79% loss.

Thus, it fell below all its EMA ribbons and marched toward its five-month low on 24 January. Since then, the alt saw an over 19% recovery that found resistance at the 25 EMA.

At press time, the alt traded at $96.74. After plunging to its record low, the RSI upturned from the oversold territory. It surged by over 30 points to cross the 43-mark level. But it still faced a strong barrier at the half-line. Also, the gap between the +DI and -DI has significantly improved, SOL broke out of the down-channel. It still needed to see a bullish crossover for further recovery.

Bitcoin Cash (BCH)

as the sellers initiated two major sell-offs since 5 January, bulls lost their vigor, and with it, the $419-mark. They upheld this mark for over a year before a 39.33% retracement (from 5 January). As a result, it hit its 13-month low on 24 January. Now, the immediate testing grounds for the bulls stood at the $302-level.

At press time, BCH was trading at $301.4. The RSI was northbound after recovering from the oversold region. After crossing the vital 43-mark, it tested the half-line at the time of writing. A sustained close above 50 will help challenge the $302 barrier.

Also, the CMF closed above the zero line, hinting at increased money volumes. However, the Volume Oscillator took a downturn during the last few hours. This reading pointed at a rather weak bull move so far.

EOS

Since facing resistance at the $2.9-level, the alt has aggressively declined. The down-channel (white) breakout was short-lived with the broader fallout as EOS marked a 30.41% decline and touched its 22-month low on 24 January. Also, the immediate testing point for the bulls continued to stand at the $2.28-mark

At press time, EOS traded at $2.28. The RSI undeniable showed improvement signs but seemed to stall near the half-line. Now, it flashed slightly neutral tendencies. Further, the AO asserted a position of decreasing bearish influence. However, like BCH, the Volume Oscillator plunged during the recent gains, revealing a weak bullish motion.