While Bitcoin dipped by over 10% in the first week of January, it wasn’t the only crypto that had it bad in the new year. In fact, the star performer of 2021, Solana seemed to be having a pretty tough time too.

The larger market’s momentum pulled Solana’s price down the charts. In fact, the #5 ranked altcoin tested the lower $140-mark on 8 January.

Degrading performance?

Over the last week, the Solana network suffered a drawdown with respect to its network performance. This, after a spike in high, compute transactions which reduced its capacity. The network saw failed transactions as developers worked on the same. Notably, the larger social sentiment for the alt seemed to drown.

After the network was hit by a spike in high compute transactions, its capacity of usually around 50,000 transactions per sec (TPS) was severely affected. That, alongside the larger market drop, drove Solana’s price to a freefall. Curiously, the altcoin registered close to 40% losses over the last month.

While Solana saw an almost independent rally throughout August-September, the coin’s sensitivity to the market rose over time. Notably, SOL’s price saw a pullback each time BTC faced a drawdown.

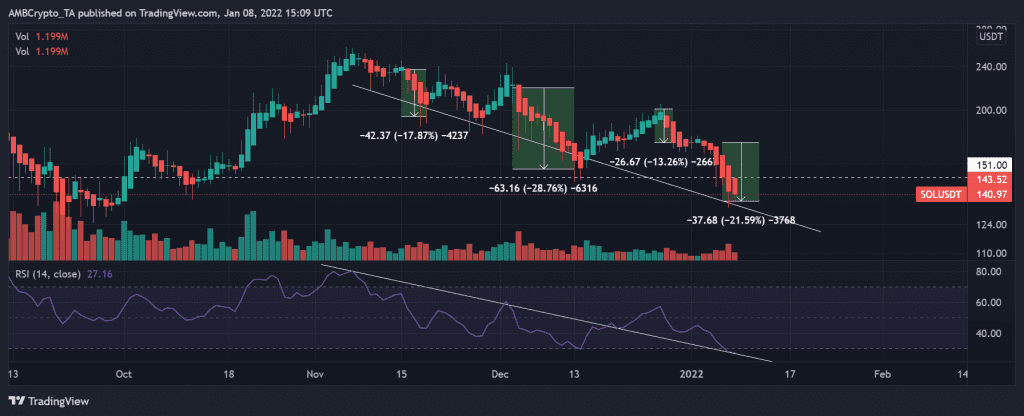

First, on 15 November, Solana’s price dropped by 17%. Then, the 4 December flash crash pulled its price down by almost 28%. Interestingly, again SOL fell by 13% and 21% in December end and the first week of January, respectively.

Thus, after hitting an all-time high of $258 on 7 November, SOL made lower lows and lower highs as its price fell by over 45% from its ATH. And, its price and RSI seem to be on a long-term downtrend since the aforementioned ATH.

So, what’s next?

With the price around the lower $140-level, is this just a dip-buying opportunity or is the altcoin ready to bleed? Well, SOL’s price dip triggered a negative crowd sentiment for SOL. This simply means that the market hasn’t been too big on the alt.

However, post the recent dip, a considerable increase in on-chain volume was recorded. This coincided with the reversal in short-term RSI. A recovery in SOL’s weighted social sentiment, which was at all-time low levels, could indicate further recovery in the near term.

Furthermore, as per data from Coinalyze, on the Futures and perpetual market, SOL’s Open Interest increased by almost 2-3%. At press time, the price seemed to be making a recovery as SOL oscillated around $144.81. Following its 3.25% daily gains, an entry in SOL could make sense.

However, a Sharpe ratio recovery would still be needed as the same for SOL flashed a reading of -3.49, at the time of writing.

Interestingly, for now, SOL seems to offer a good risk-reward ratio with less downside risk and higher potential ROI in the long term.