One altcoin that has been affected a lot following the FTX and Alameda collapse is Solana (SOL). Along with the FTX tokens, Solana’s native crypto SOL has come under intense selling pressure. The SOL price is trading 20% down in the last 24 hours at a price of $21.06 as of press time.

Ever since the Alameda crisis surfaced last week, the SOL price has tanked by a staggering 50% in the last five days. Over the last 24 hours, there have been nearly $0 million in SOL long liquidations as per data on Coinalyze.

But why is the Alameda contagion spreading to Solana (SOL)? As per reports, Sam Bankman-Fried has acquired $1.2 billion worth of SOL tokens via Alameda. Industry reports suggest that Alameda has been selling its SOL holdings and buying FTT to contain the fall of the FTX token price.

Furthermore, with the recent development of FTX’s buyout by Binance, CZ controls 10% of the tokens. Thus, investors might think that they would be better off supporting the BNB chain instead of Solana.

Sam Bankman-Fried was one of the major supporters of Solana. But with his companies under deep water, it remains doubtful on how long would this support continue to extend.

Trending Stories

Solana Whale Liquidation

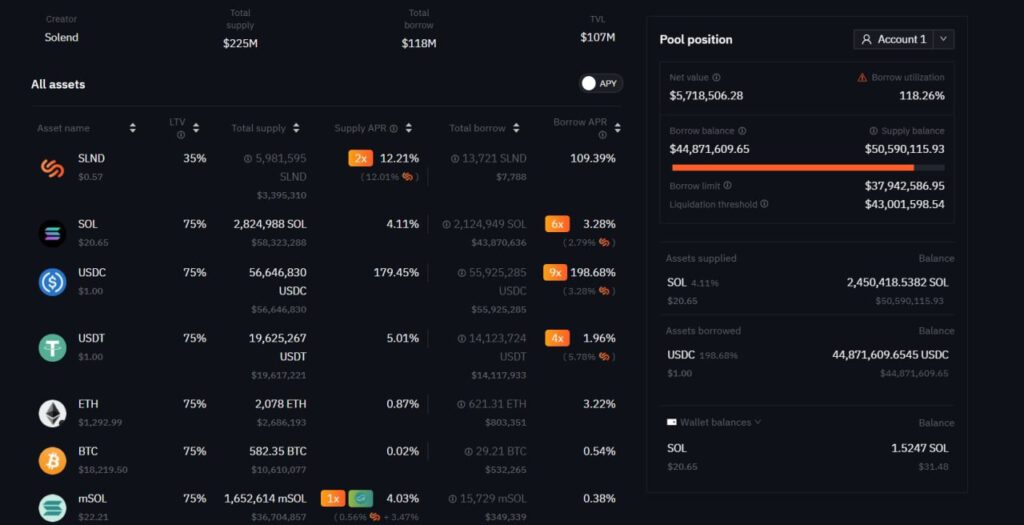

As per on-chain data, there has been a major liquidation by a Solana whale which is driving the SOL price lower. Citing data from Solend.fi, Chinese crypto journalist Colin Wu explains:

Solana Whale (3oSE9CtGMQeAdtkm2U3ENhEpkFMfvrckJMA8QwVsuRbE) is in liquidation and currently has 2,450,418.5 SOL (worth over $51 million) in collateral and 44,871,609.6 USDC in debt. However, Solana is currently facing congestion due to the update of the oracle.

It is not certain how far this contagion can spread and how much more SOL will be sold in the open market. Earlier this year, investors experienced a similar liquidation situation with LUNA. If panic across retail and institutional investors kick-in, there could be a further downfall in Solana as well as the broader crypto space. Currently,SOL is trading at 90% discount year-to-date.