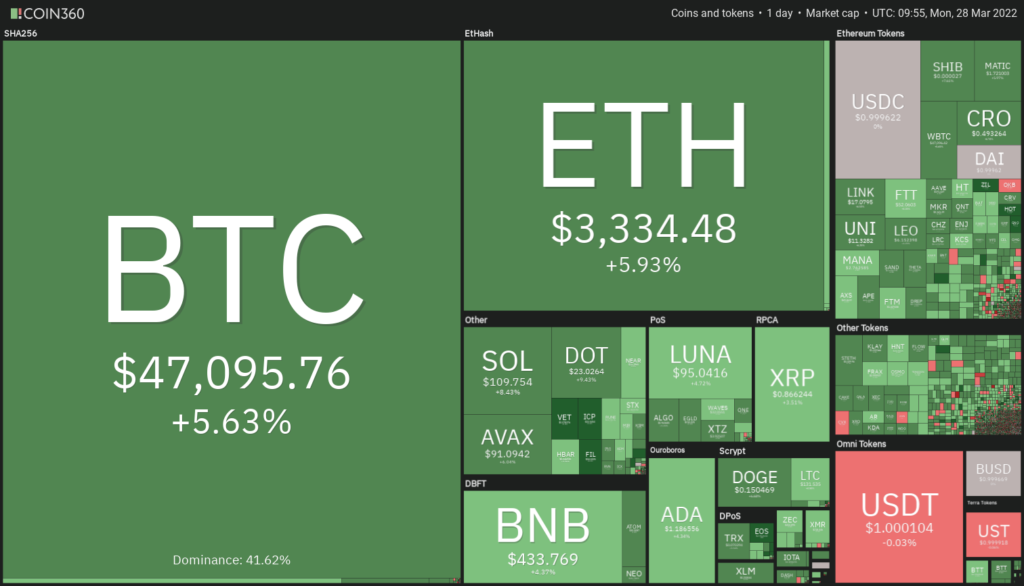

On Sunday, the crypto market saw notable gains, with assets ranked in the top 10 by market cap posting over 5% gains. Bitcoin remarkably went over $47k for the first time in 3 months.

The State Of The Markets

Sunday saw a lot of bullish momentum come into the markets, with the 10 foremost crypto assets by market capitalization seeing gains of over 5%. The market showed that it was picking up from where it left off last week.

With an over 5% surge, Bitcoin finally shattered the $44,500 price ceiling, and it didn’t stop there; it also retook the $47k price level. The move meant that BTC had recouped all its losses in 2022 and broken a 3-month price resistance. BTC is currently trading just above the $47k price point. It presently sits at $47,067, up by 5% in the last 24 hours and 14.3% in the last 7 days.

On the other hand, Ethereum also moved by over 5% as it continues to outperform BTC marginally. Pundits have attributed this to the fact that the network is on the brink of the “Merge” phase, where it would move from Proof-of-Work to Proof-of-Stake. The asset is currently trading at around $3,331.42, with its price up 5.23% in the last 24 hours and 15% in the last 7 days.

BTC and ETH, as earlier stated, are not the only gainers. Solana, Avalanche, and Polkadot have also shown bullish momentum. Notably, Solana leads the pack in terms of gains up 7.98% in the last 24 hours, trading at about $108.93 as it sets its sights on the $120 price point.

Cardano also continues its good form in the last couple of weeks, moving 5.08% higher in the last 24 hours and an impressive 32.99% in the last 7 days. It is also worth mentioning that Polkadot (DOT) ranked 11th by market cap, has put up an interesting show as the asset has soared by 9.93% in the last 24 hours and 20.78% in the last 7 days. The crypto market trading volume is up an impressive 68.06% in the last 24 hours as the total crypto market valuation sits at $2.12 trillion.

Market Drivers

2022 has so far not gone as expected or predicted by many pundits. The crypto markets have come under pressure for the most part for the last 3 months. Factors like Fed policies and uncertain crypto regulations left investors skeptical of taking on risk-on assets, crypto included.

However, in the last couple of weeks, the crisis in Europe appears to have heightened the demand for digital assets, which have so far played a significant role in supporting Ukraine’s war effort through donations. Add to that the fact that Russia is planning to accept Bitcoin for its exports.

Development around assets like ETH, ADA, LUNA, and AVAX is also speeding up. It is still worth noting that several regulatory clouds still hang over the nascent market.