The Solana(SOL) price provided a strong rally during the weekdays, registering a 29% gain from $105. However, the bullish momentum showcased weakness during the weekend as the price struggled to sustain above the $135 mark. So, where will the weekly candle close this time?

Key points

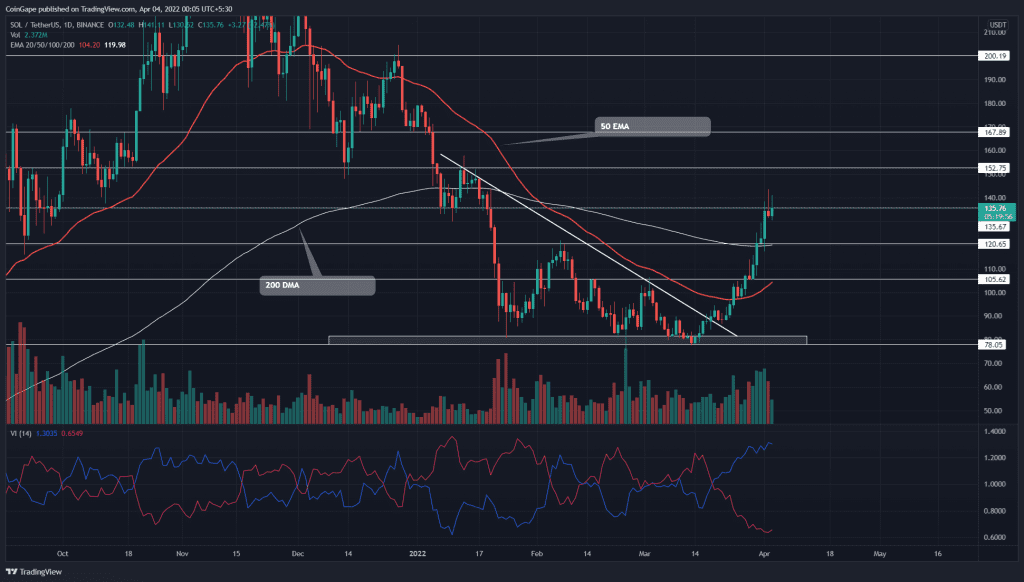

- The SOL chart shows higher price rejection candles at $135 resistance

- The 24-hour trading volume in the Solana coin is $2.57 Billion, indicating a 12.03% gain

Source-Tradingview

The descending triangle pattern governed the first three months of 2022. This bearish pattern usually boosts the selling momentum after a breakdown from the bottom support line. However, amid the recovery sentiment in the crypto market and the bullish divergence in RSI, the SOL price triggered a bullish breakout from this pattern.

The SOL buyers breached the price pattern’s descending trendline on March 18th. As a result, the post-retest rally sliced through the $120 mark, indicating a 55% gain within just two weeks. The parabolic rally reached a high of $144.5, its highest in the last two months.

However, the aggressive sellers prevented a candle closing above the $135 resistance, and a higher price rejection candle suggests the price may trigger a minor correction.

Today, the coin is 2.14% up and reattempts to pierce the overhead resistance($135). However, the high-tail rejection attached to this candle encourages a bearish reversal, which could descend 10.5% to $120.

Technical indicator

Vortex Indicator: The widespread gap between the VI+ and VI- slope highlights an overall bullish tendency.

The SOL price trading above crucial EMAs(20, 50, 100, and 200) suggests that the buyers have a better advantage over the sellers. Moreover, the 200-day EMA moving near the $120 support could strengthen the buyers’ defense at his level.

- Resistance level- $135, $152

- Support levels- $120, $105