Solana (SOL) became one of the worst performers among the top cryptocurrencies on Feb. 3 as traders assessed its links with the second-biggest hack to date.

$325M worth of wETH gone

SOL price dropped by 5.50% to below $96.50 as Wormhole, a bridge between Solana and Ethereum blockchains, reportedly lost $325 million worth of Wrapped Ethereum (wETH) due to a technical vulnerability.

Prior to the hack on Wednesday, SOL was trading as high as $112.

Solana security hole needs fixing asap?

Seems their consensus proceeds with only 33% of the nodes

Hard math proofs show you need 66%+ for safety. No ifs no buts

Possibilities: 1) is insecure, 2) is centralized, or 3) they’ve broken Computer Science (unlikely) pic.twitter.com/yqfW3QnfeK

— dom.icp ∞ (@dominic_w) February 3, 2022

In detail, hackers tricked a series of Solana’s smart contracts into signing illicit transactions digitally posing as “guardians,” reported blockchain researcher Kelvin Fichter on Feb. 2, the night after the hack. He wrote:

“The attacker made it look like the guardians had signed off on a 120K deposit into Wormhole on Solana, even though they hadn’t. All the attacker needed to do now was to make their “play” money real by withdrawing it back to Ethereum.”

And one withdrawal of 80k ETH + 10k ETH later (everything in the bridge on Ethereum), everything was gone.

— smartcontracts (@kelvinfichter) February 3, 2022

Wormhole said that it would add Ethereum’s native token Ether (ETH) “over the next hours” to back wETH on the Solana network on a 1:1 basis. However, the project did not clarify the source of the funds that would be used to buy ETH tokens.

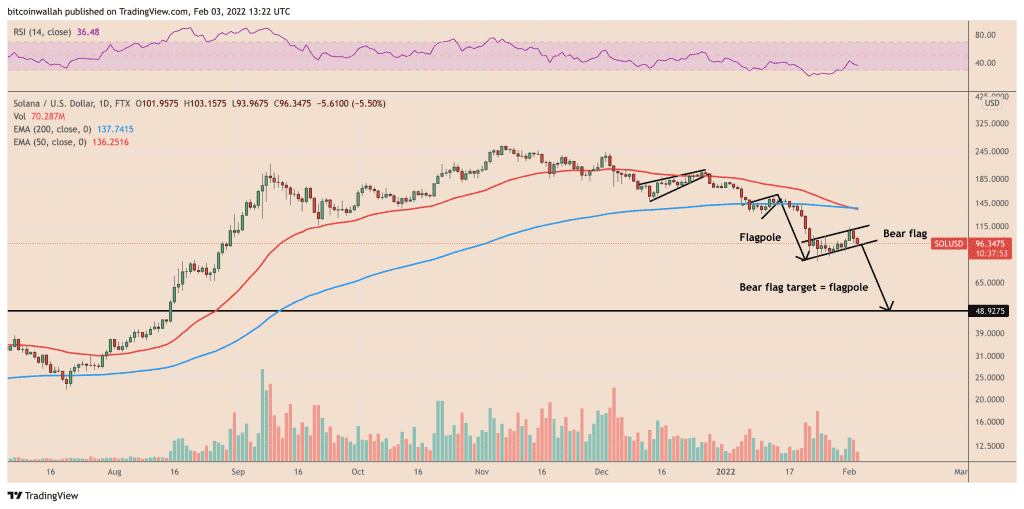

Bear flag triggered

The selloff in the Solana market across the last 24 hours came closer to triggering a bearish continuation setup that may send the SOL price down by another 50%.

Dubbed “bear flag,” the pattern emerges when the price consolidates sideways/higher after a strong downside move, called “flagpole.” In a perfect world, the price eventually breaks below the consolidation range and falls by as much as the flagpole’s length.

So far, SOL/USD has been forming the same bear flag pattern, as shown in the chart below.

The downside target put forth by Solana’s bear flag sits near $50, almost halfway down where the SOL price has been trading on Feb. 3.

Related: Report crowns Solana for using least energy per transaction, but there’s a catch

Last year, Solana sprinted into the top-ten cryptocurrencies by market cap with SOL rising by more than 11,000% as investors bet on the growth of decentralized finance (DeFi) and nonfungible token (NFT) sectors.

However, entering 2022, the SOL price has fallen sharply, wiping almost half Solana’s market capitalization amid a broader crypto market decline — that also battered Bitcoin (BTC), Ether and other top-ranking digital assets.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.