Despite the negative crypto market sentiment, Solana trading volume in the first quarter of 2022 was more than sixteen times that of the first quarter of 2021.

Solana continues to recover amid a bearish crypto market in 2022 after reaching new price milestones in November 2021.

According to Be[In]Crypto Research, investor interest in the native asset of the Solana ecosystem soared in the first quarter of 2022.

The trading volume recorded for Solana during the first quarter of the year was around $201.16 billion.

This was a 1,587.96% increase in the trading volume recorded between January and March 2021 of approximately $11.91 billion.

What caused the spike in Solana trading volume?

The increased support by some of the biggest exchanges after March 2021 in addition to the improvement of the Solana ecosystem can be credited for the increased demand for SOL by millions of investors.

Support of big-name exchanges

As of April 2022, there are around 61 exchanges that have listed SOL for trading. This statistic cannot be compared to the relatively smaller number of exchanges that supported the asset in the first three months of 2021.

Multi-asset exchange eToro added support for Solana in October 2021. Others such as Coinbase Pro listed the coin for trading in May 2021. With millions of active traders on such platforms, liquidity from different exchanges contributed to the spike in trading volume in the first quarter of 2022.

Improvements in the ecosystem

In 2022, Solana has surpassed Flow, Avalanche, Polygon, WAX, and Binance Smart Chain to become the second-largest blockchain by NFT sales volume.

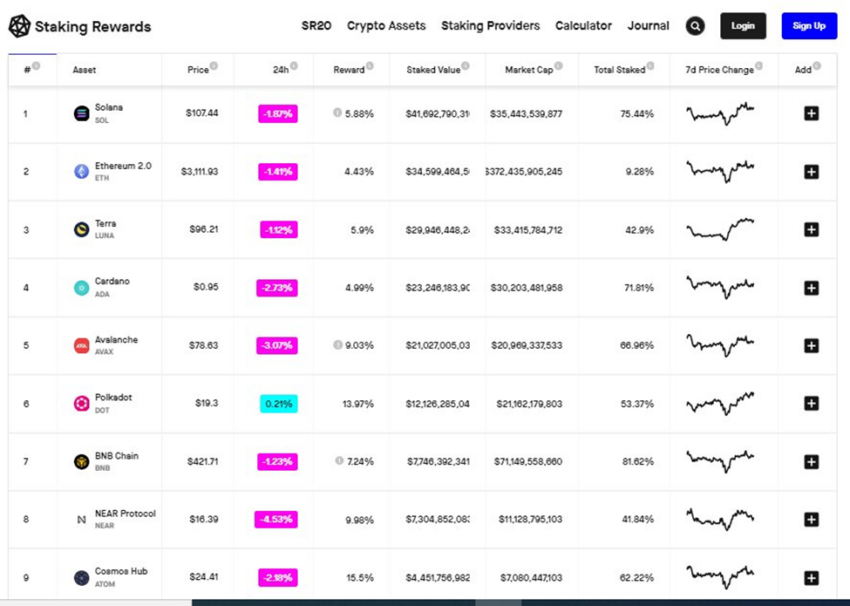

In addition to this, Solana is the most staked cryptocurrency in the market with a staked value of more than $40 billion.

Such milestones give SOL mileage in a saturated market of more than 18,000 projects.

The resultant effect has been the flow of liquidity from investors into the native asset of the entire blockchain, SOL.

To give you a mathematical understanding of events, In January 2021, the trading volume of Solana was $1.99 billion with a single-day high in the region of $206 million. In January 2022, the trading volume of Solana was around $64 billion and had a single-day high of approximately $4.66 billion.

In February 2021, the trading volume of SOL was around $4.84 billion with a single-day high of $574 million. In February 2022, the trading volume of SOL was in the region of $66.21 billion and had a single-day high of approximately $5.25 billion.

In March 2021, the trading volume of Solana was approximately $5.07 billion with a single-day high of around $426 million. In March 2022, the trading volume of Solana was in the region of $70.61 billion and had a single-day high of $4.11 billion.

Price reaction

Solana opened on Jan. 1, 2022, with a trading price of $170.31, reached a quarterly high of $179.43 on Jan. 2, and closed the first quarter of the year at $122.66.

Overall, there was a 17% decrease between Solana’s opening and closing price in Q1 2022 due to a bearish trend in the market.

For the sake of comparison, Solana opened on Jan. 1, 2021, with a trading price of $1.51, reached a quarterly high of $20.87 on March 31, and closed the first quarter of 2021 at $19.23. Overall, there was a 1,173% increase between the opening and closing price of Q1 2021.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.