Solana total value locked (TVL) continued to plunge in the third week of May due to bearish trends in the market that have seen declining interest in decentralized finance (DeFi).

Solana has been one of the best-performing crypto projects in the last 18 months. According to Be[In]Crypto Research, Solana has lost 60% in total value locked since the first day of 2022.

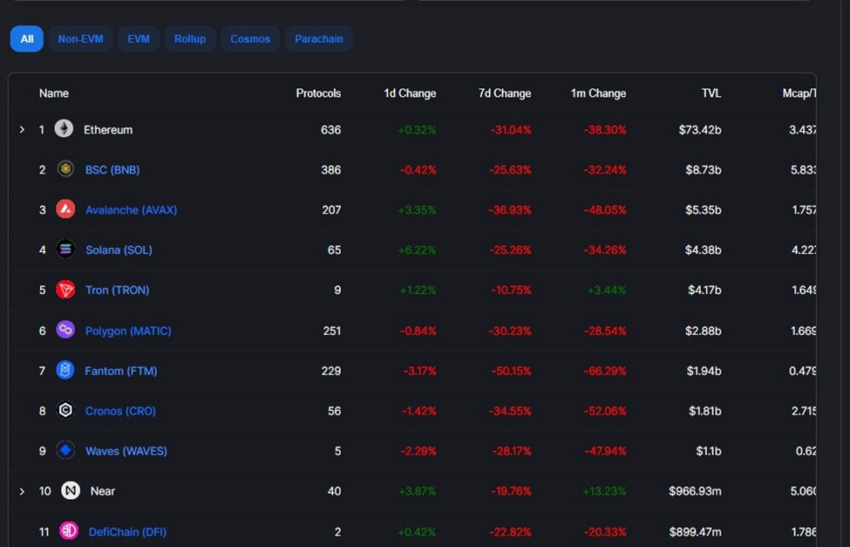

On Jan 1, Solana had a TVL of approximately $11.22 billion, falling to around $4.38 billion on May 15.

Solana is a decentralized blockchain that enables the building of user-friendly applications that are highly scalable. As the fastest growing ecosystem in the crypto finance space, Solana has thousands of projects under Web3, non-fungible tokens (NFTs), and DeFi.

Why the decline in TVL?

Solana TVL sunk to new high lows this week due to decentralized applications (dApps) in its ecosystem plunging to new lows.

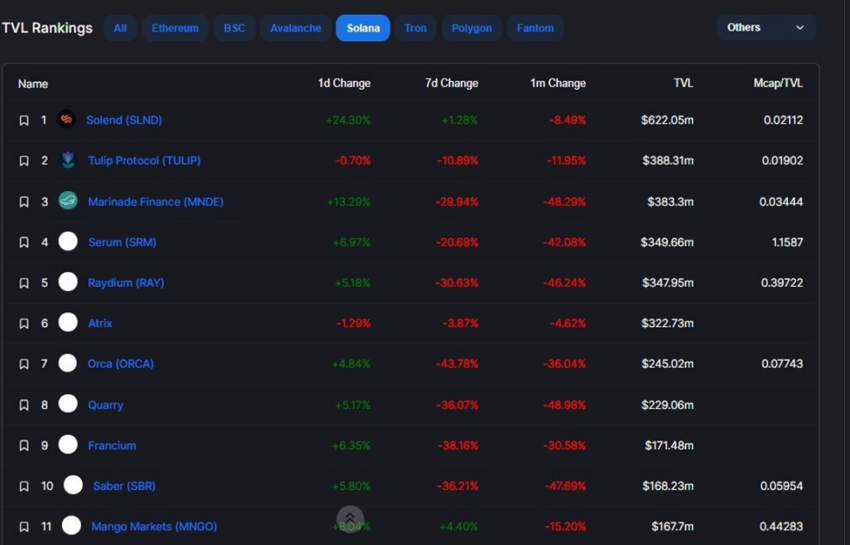

Decentralized lending and borrowing platform Solend, for example, has fallen by more than 8% in the last month, while yield aggregation platform Tulip has also shed more than 11% of its TVL within the same timeframe.

Staking platform Marinade Finance and decentralized exchange (DEX) protocol Serum, have lost more than 48% and 42%, respectively, of their total values locked.

Other dApps that have contributed to the decline in total value locked include, but are not limited to Raydium, Atrix, Orca, Quarry, Francium, Saber, and Mango Markets.

Despite plummeting by more than $6 billion, Solana has maintained its position as the fourth blockchain with the most value locked.

Solana still holds the lion’s share in value locked over TRON, Polygon, Fantom, Cronos, Waves, Near, DefiChain, Osmosis, Harmony, and Cardano.

Solana has been named by Meta Platforms as one of the blockchains whose non-fungible tokens (NFTs) will be integrated with the social media platform, Instagram. Other platforms named for this integration are Polygon and Ethereum.

SOL opened the year with a trading price of $170.31, reached a yearly high of $179.43 on Jan. 2, and closed on May 15 at $55.38. Overall, this equates to a 67% decrease in the price of SOL since the start of the year.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.