It’s no secret that crypto users love to race and compare speeds, but an evaluation of this kind is actually much harder than it sounds. To that end, an investigation by GM and Haseeb Qureshi from Dragonfly Capital delved into the question of whether Solana could take on an Ethereum Virtual Machine [EVM] compatible chain in a speed race.

Quickly shooting down transaction-per-second rates, the two researchers instead decided to look at the speed of Automated Market Makers [AMMs]. To refresh your memory, AMMs are what make it possible for decentralized exchanges to function on their own, and complete DeFi tasks.

Godspeed to you

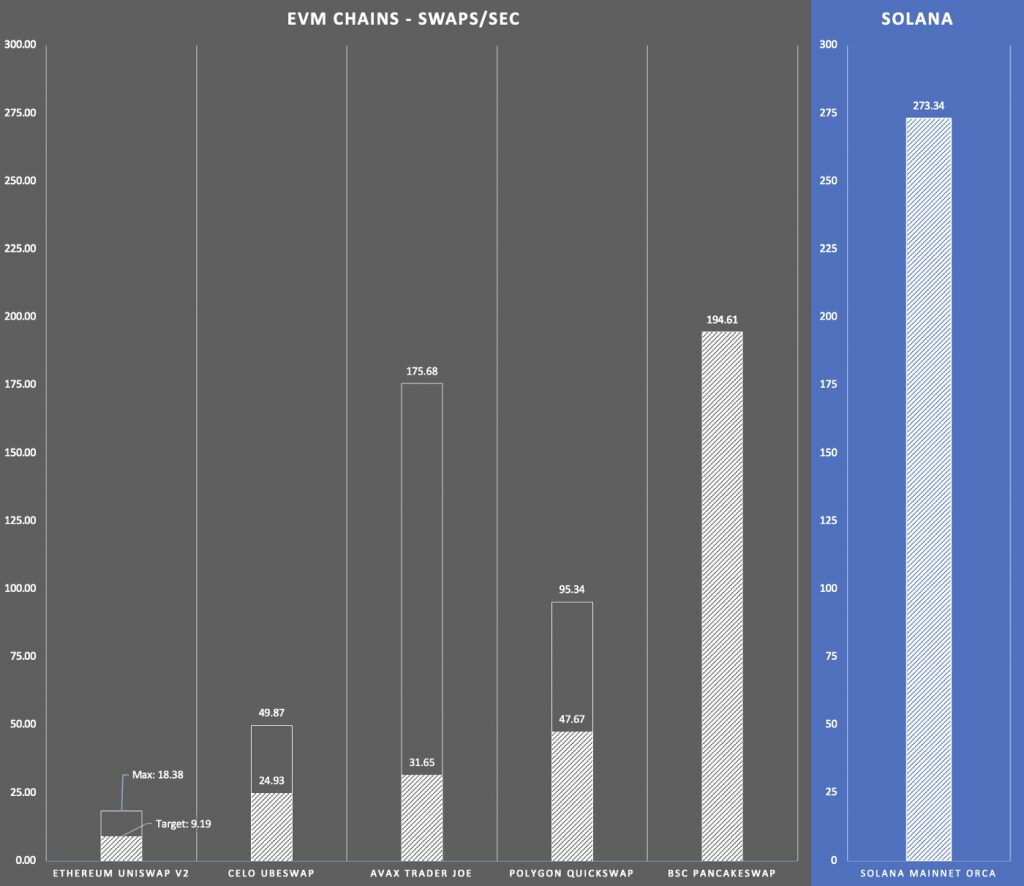

Comparing Ethereum’s Uniswap V2, Celo’s Ubeswap, Avalanche’s Trader Joe, Polygon’s Quickswap, BSC’s PancakeSwap, and Solana’s Orca, the two researchers concluded that the winner was indeed Solana. However, note that the test took place on the Solana devnet, which is faster than the mainnet.

The final figures were 273.34 Orca trades per second, with 13 seconds to finality.

Source: GM on Medium.com

That said, there are some caveats. Removing Solana’s consensus messages from the transaction count, the report stated,

“Subtracting those, you’re left with ~600 TPS, of which most of those are Serum trades which are very cheap. So long as enough other contracts are being touched, Solana can also achieve higher performance in production.”

Meanwhile, Ethereum’s Uniswap V2 achieved 9.19 trades per second on average, and a maximum of 18.38 trades per second.

Fast and Furious: crypto drift

Readers might have strong reactions to the above figures, but Qureshi advised caution as there is a myriad of ways to measure speed amongst blockchains. What’s more, AMMs are ideally getting faster.

13/ 3. Note that the spread in performance between chains is less than advertised. DYOR.

4. If you want to get really high performance, you have to abandon the EVM.

— Haseeb Qureshi (@hosseeb) March 1, 2022

But before crowning Solana as the champion, it’s important for users to question if speed is the endgame. After all, the network is also notorious for its congestion issues. What’s more, the same could be hurting Solana’s adoption rate, even if only slightly. Studying unique daily active signers, the OurNetwork newsletter reported,

“Unique signers peaked at 299k in late January, but tapered off a bit to 232k after the network’s most recent bout with degraded performance.”

A pricey few days

At press time, Ether was changing hands at $2,903.67. This was after falling by 3.64% in the past day while rallying by 23.02% in the past week. In the meantime, Solana’s SOL was keeping investors on tenterhooks at $99.97, having dropped by 5.55% in the past 24 hours, while rising by 23.23% in the last week.